The Basics of Calculating Sales Tax Worksheets: What You Need to Know

Sales tax is an important part of running a business, and ensuring that you are able to accurately calculate it is essential. Calculating sales tax can be a complex process, and it is important to understand the basics of the process so that you can accurately calculate the tax owed. This guide will provide an overview of the basics of calculating sales tax, including the formulae to use, the types of taxes and how to use worksheets to help you track your calculations.

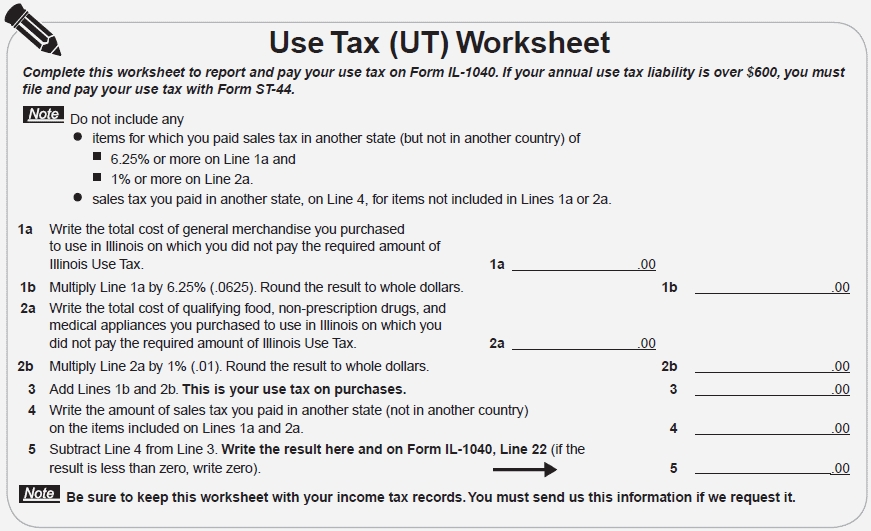

The first step of calculating sales tax is to understand the appropriate tax rate for the area that you are located in. Tax rates can vary from state to state, and even from county to county, so it is important to make sure that you are using the correct rate for your area. The rate should be listed on your local or state government website.

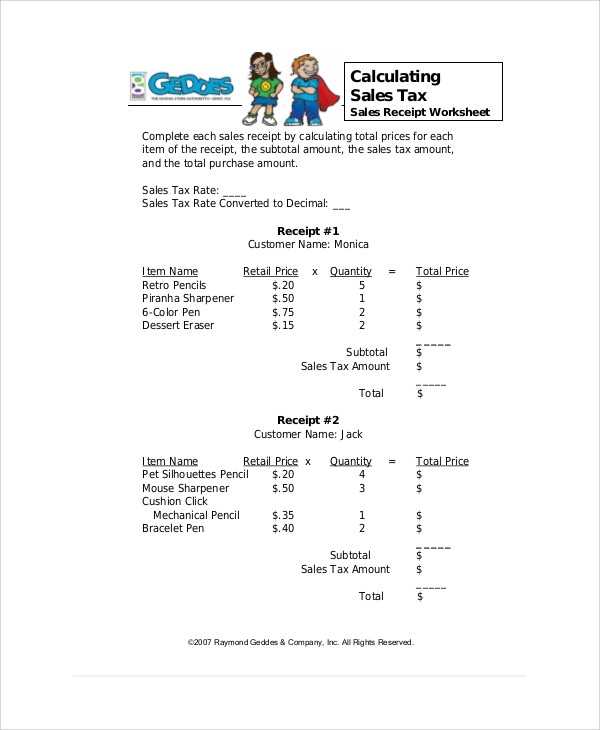

Once you have determined the rate, you will need to use the appropriate formula to calculate the amount of sales tax due. Generally, the formula used is total sales multiplied by the rate, with the result being the amount of tax due. In some cases, additional calculations may be necessary, such as when sales tax is charged on items that are taxed at different rates.

[toc]

In addition to the base rate, other taxes may apply to your sales, such as taxes on shipping, handling fees, and other fees. It is important to understand the rules for these taxes, as they can have a major impact on the total amount of tax that you are responsible for.

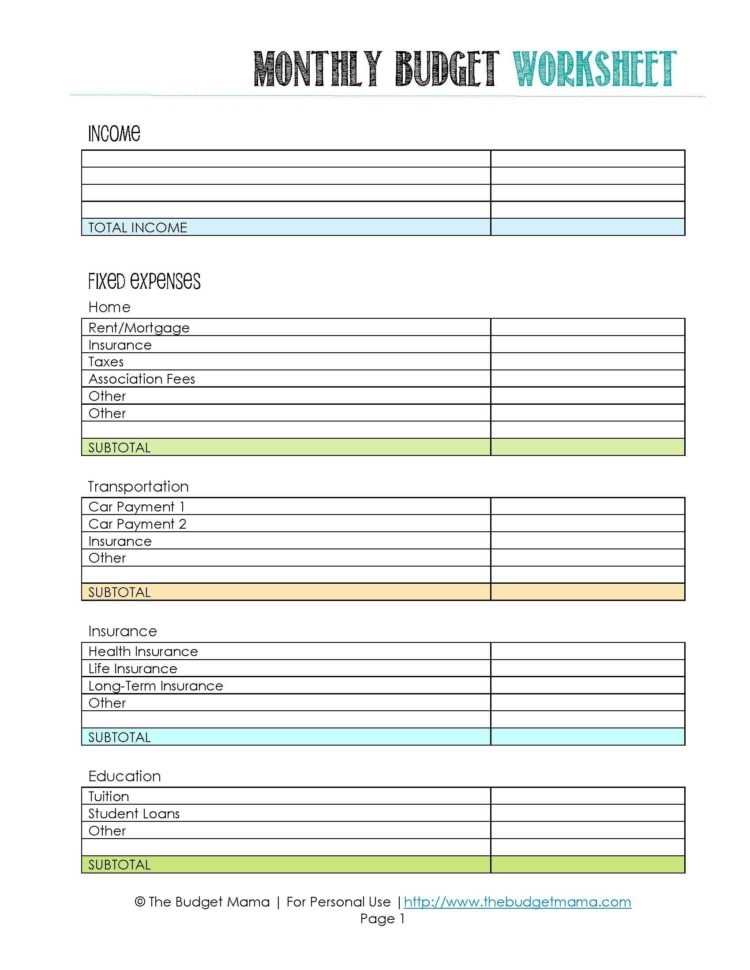

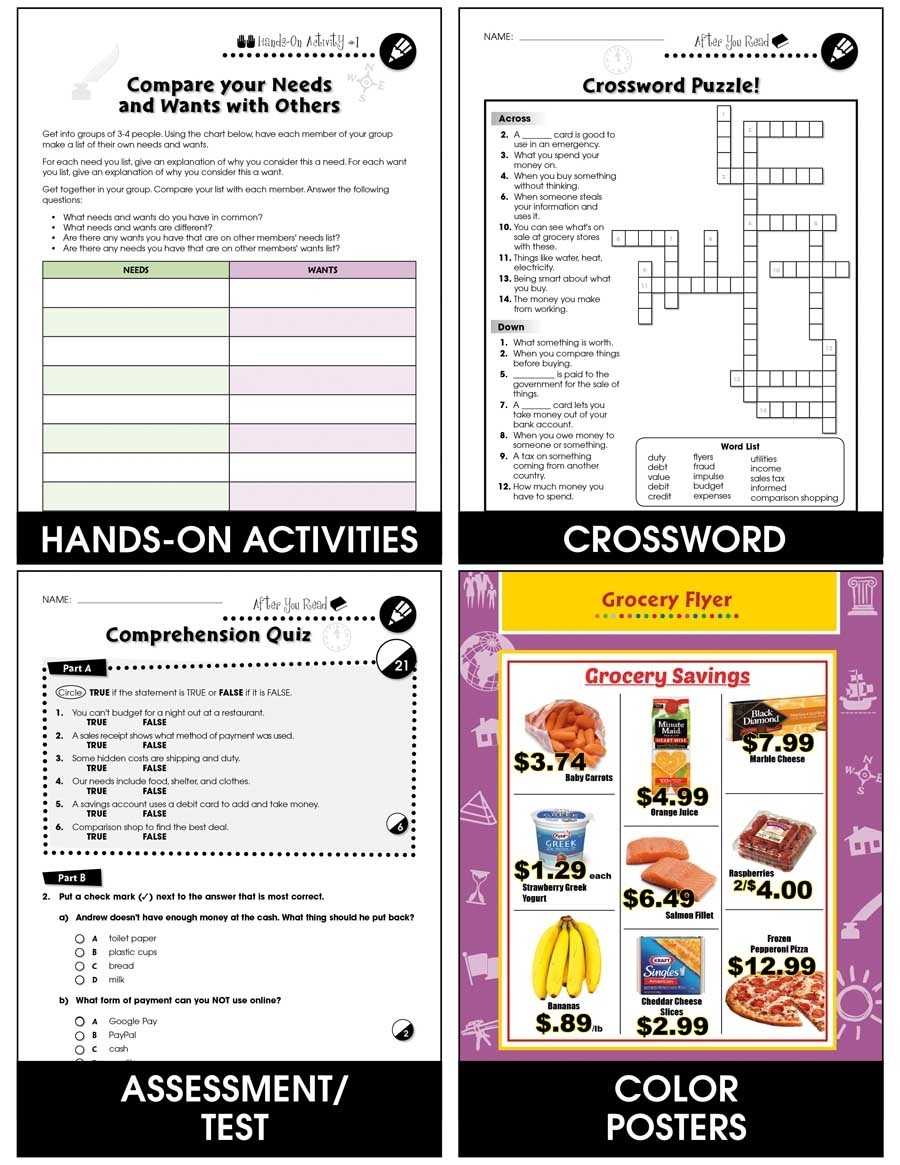

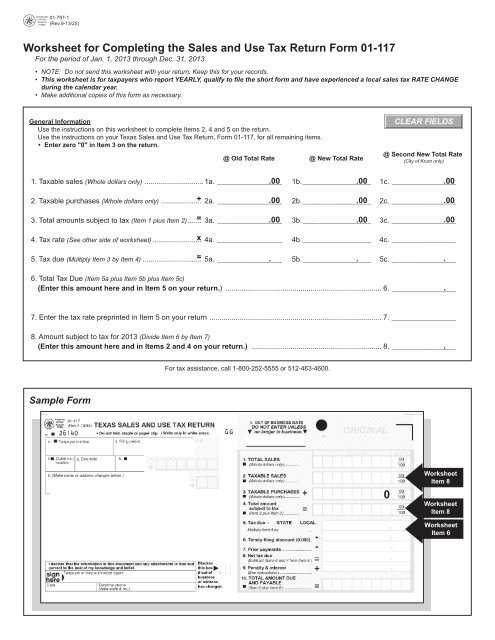

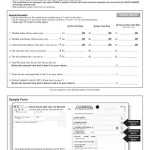

Finally, it is important to use worksheets to keep track of your calculations. Worksheets can help you make sure that your calculations are accurate, and they can also give you a better understanding of how the taxes are applied. Worksheets can also help you keep track of the amount of sales tax owed on each sale, so that you can avoid any unexpected surprises during tax time.

By understanding the basics of calculating sales tax, you can ensure that you are accurately calculating the amount of tax due and avoiding any potential problems. Utilizing worksheets can help to make sure that your calculations are accurate and that you are able to quickly and easily track your sales tax payments. With the right knowledge and understanding of the process, you can make sure that your business runs smoothly and efficiently.

How to Leverage Calculating Sales Tax Worksheets to Maximize Your Tax Savings

Calculating sales tax can be a tedious and time-consuming process for businesses, but when done correctly, it can be an effective way to maximize your tax savings. Sales tax worksheets provide a straightforward and simple way to accurately calculate sales tax, allowing you to save time and money.

When using sales tax worksheets, the most important step is to determine the applicable sales tax rate for the items you are selling. This rate can vary widely from state to state, so it is important to consult your local sales tax authority first before proceeding. Once you have the appropriate rate, you can start filling out the worksheet.

The worksheet should include all relevant information, including the sales price, the applicable tax rate, and the taxable amount. You will also need to include any exemptions or deductions that may apply. For example, some items may be exempt from sales tax due to their status as a necessary item, such as food or medicine.

In addition to the sales tax worksheet, you may also need to complete additional forms or paperwork related to your sales tax. This will vary depending on your state and local laws, so it is important to consult your local sales tax authority to ensure you are in compliance with all applicable regulations.

Once you have completed the necessary paperwork, you can start calculating sales tax. To do this, you will need to add up the sales price of each item, multiply it by the applicable tax rate, and subtract any applicable deductions or exemptions. The result is the total sales tax due.

Using sales tax worksheets can help you save time and money when it comes to calculating sales tax, allowing you to focus on other aspects of your business. By consulting with your local sales tax authority, you can ensure you are accurately calculating sales tax and maximizing your tax savings.

Creative Strategies for Optimizing Your Calculating Sales Tax Worksheet

1. Take advantage of resources: Utilizing online tools such as calculators, worksheets, and tax tables can make calculating sales tax easier and more accurate. These tools can help streamline the process, saving you time and reducing the likelihood of errors.

2. Utilize technology: Investing in software that automates the process of calculating sales tax can help to save time and ensure accuracy. Such programs can automatically calculate the appropriate amount of sales tax and simplify the process of record keeping.

3. Understand the process: The process of calculating sales tax can be complex, so it is important to have a good understanding of the regulations and laws that pertain to sales in your area. Taking the time to research the relevant information can help ensure that the calculations are accurate.

4. Create a checklist: Making a list of the information needed to complete the process can help ensure that all the necessary information is included and that nothing is forgotten. This can make the process more efficient and reduce the likelihood of errors.

5. Double check: Once the calculations are complete, it is important to double check the results to ensure accuracy. Taking the time to review the figures can help to avoid costly mistakes.

6. Stay organized: Keeping accurate and up-to-date records of sales and taxes can help streamline the process when calculating sales tax. Ensuring that documents are stored in a secure, organized manner can help to save time and reduce the likelihood of mistakes.

How to Utilize Calculating Sales Tax Worksheets to Streamline Your Processes

Calculating sales tax is an essential part of running a successful business. Keeping track of the amount of sales tax that is due can be a cumbersome process, especially in states with multiple tax rates. Utilizing a sales tax worksheet can streamline the process, making it easier to ensure that all taxes are collected correctly.

The first step in utilizing a sales tax worksheet is to determine the tax rate for each jurisdiction in which the business operates. This information can be found on the Department of Revenue website in each state. Once the appropriate rates have been determined, they should be entered into the worksheet. This ensures that the correct amount of sales tax is being collected for each jurisdiction.

The next step is to input all sales receipts into the worksheet. For each transaction, the total amount of the sale and the amount of tax that was collected should be included. This information should be recorded in the applicable columns.

Once all the sales have been entered into the worksheet, the total amount of sales tax due should be calculated. This can be done by adding all the sales tax amounts for each jurisdiction, and then subtracting the total amount of sales tax collected. The difference will represent the total amount of sales tax due.

Finally, the information from the worksheet should be submitted to the appropriate state or local taxing authority. This can be done electronically or by paper, depending on the regulations of the jurisdiction. Submitting taxes on time is essential in order to avoid penalties and ensure compliance with the law.

Using a sales tax worksheet is an effective way to streamline the process of calculating and submitting sales taxes. By taking the time to enter all sales and tax information into the worksheet, businesses can ensure that all taxes are accurately calculated and paid on time.

Conclusion

The Calculating Sales Tax Worksheet is an invaluable tool for businesses to use when calculating their sales tax and other related taxes. It allows businesses to accurately calculate their taxes and ensure they are paying the right amount. It is also very easy to use, making it a great choice for any business owner. With the help of this worksheet, businesses can save time and money while ensuring they are compliant with all tax laws.

[addtoany]