How to Use a Personal Net Worth Worksheet to Track Your Finances

Tracking your finances is essential for financial success. A personal net worth worksheet is a great tool to help you stay on top of your finances. By using a personal net worth worksheet, you can easily keep track of your assets and liabilities, as well as your overall financial health.

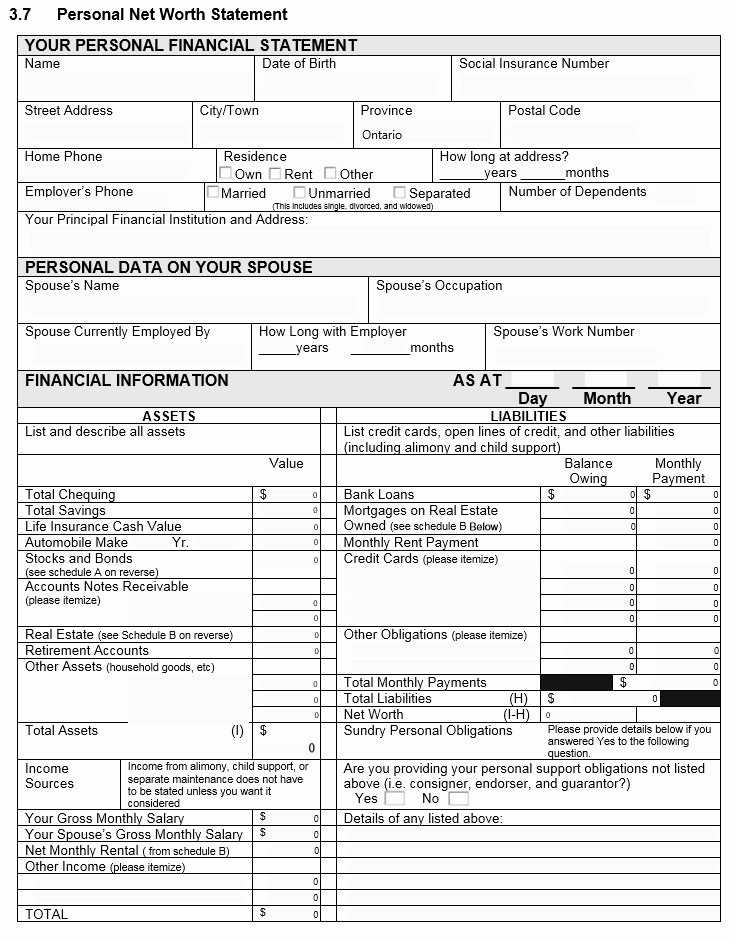

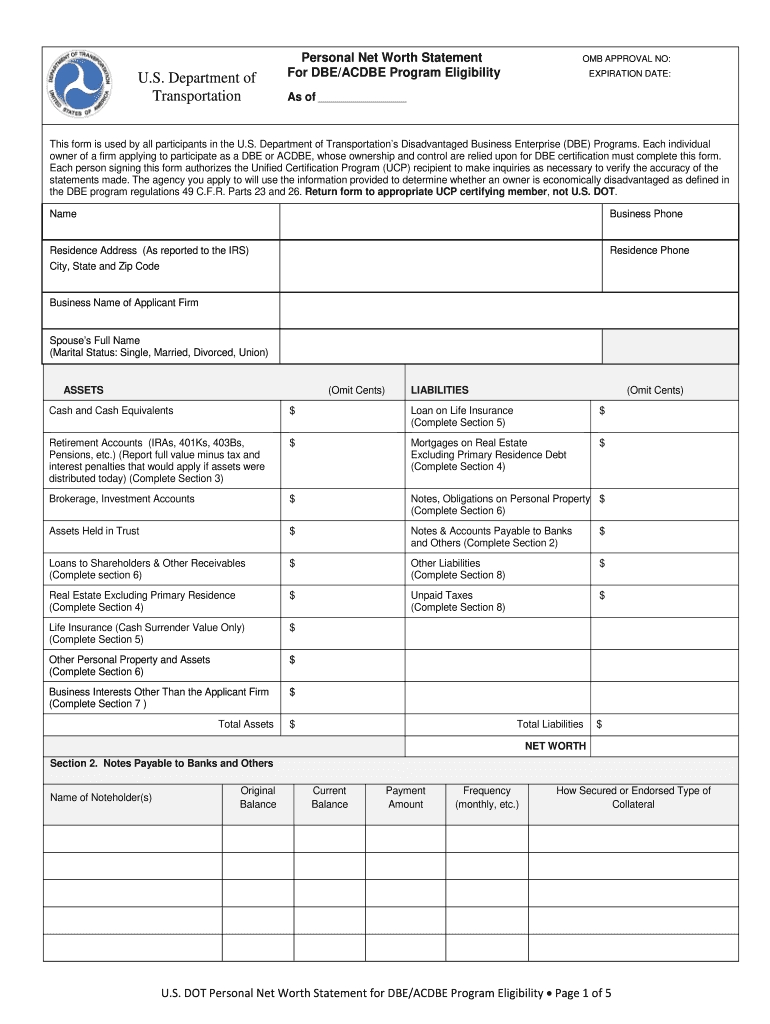

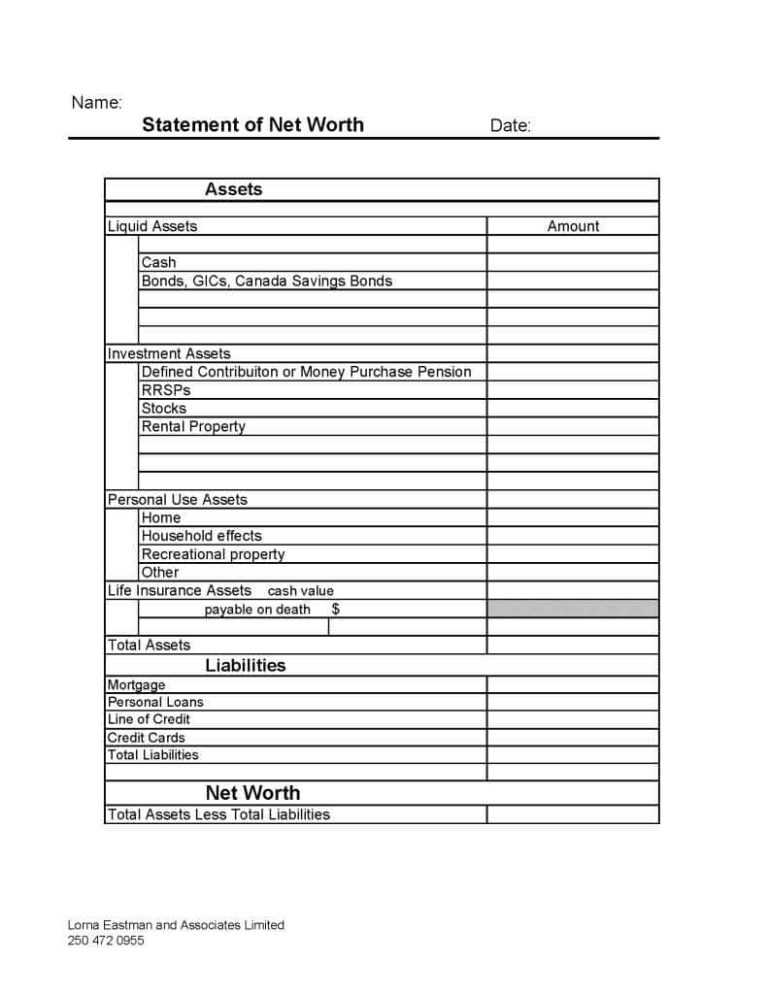

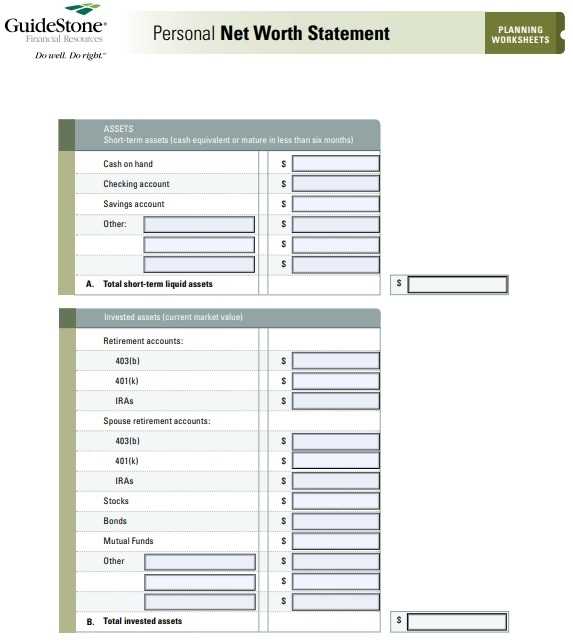

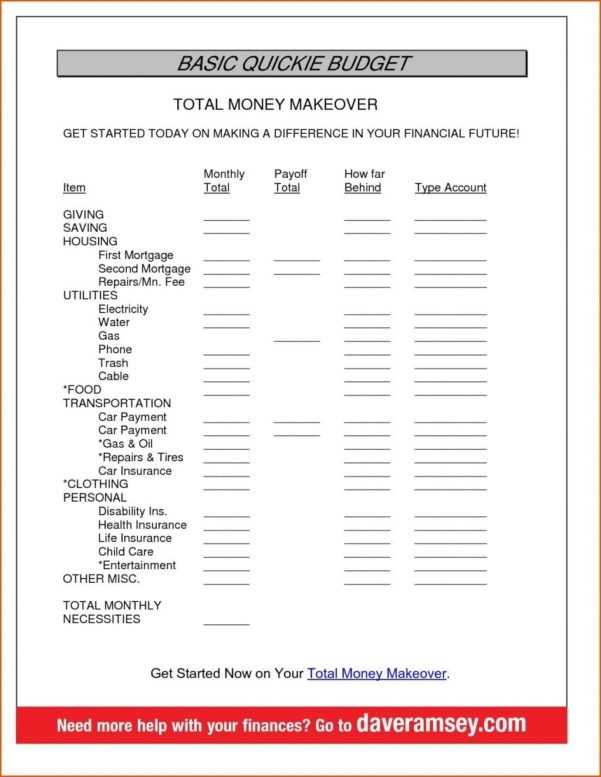

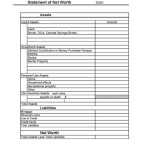

The first step in using a personal net worth worksheet is to gather all of the necessary information. This includes all of your assets, such as bank accounts, investments, and real estate, as well as all of your liabilities, such as credit card debt, student loans, and car loans. Once you have gathered all of this information, you can begin to fill out the worksheet.

On the worksheet, you will need to list all of your assets and liabilities, as well as their current values. Once you have done this, you can calculate your net worth. This is done by subtracting your liabilities from your assets. The resulting figure is your net worth.

[toc]

It is important to update your personal net worth worksheet periodically. This will help you to keep track of changes in your financial situation over time. As your assets and liabilities change, your net worth will change as well. By tracking these changes, you will be able to make informed decisions about your finances and ensure that you are making the most of your money.

By using a personal net worth worksheet, you can easily keep track of your finances and ensure that you are on the path to financial success. By regularly updating the worksheet, you can monitor your financial progress and make decisions that will help you reach your financial goals.

How to Calculate Your Assets and Liabilities for a Personal Net Worth Worksheet

Your personal net worth worksheet is an important tool to help you understand your financial situation. It provides a snapshot of your total financial picture by adding up your assets and subtracting your liabilities. The result is your net worth, which is a measure of your financial health.

To calculate your personal net worth, you will need to list your assets and liabilities. Assets are items of value that you own, including property, investments, vehicles, and cash. Liabilities are any debts that you owe, such as credit card debt, student loans, and mortgages.

To begin, you will need to gather information about all of your assets and liabilities. Make a list of all of your assets, including the current market value. Include all items that can be converted to cash, such as investments, jewelry, and collectibles. For vehicles and property, include the fair market value.

Next, make a list of all of your liabilities, including the amount you owe and the interest rate. When calculating your liabilities, include any unpaid taxes or bills.

Once you have gathered the information about your assets and liabilities, add up the total value of your assets and subtract the total value of your liabilities. The result is your net worth. This number gives you a clear picture of your financial situation and can help you make better decisions about your finances in the future.

The Benefits of Creating a Personal Net Worth Worksheet

Creating a personal net worth worksheet can be a great way to gain a better understanding of one’s financial standing. This type of worksheet can be used to track assets and liabilities, and can even be updated as financial situations change over time.

One of the primary benefits of creating a personal net worth worksheet is that it allows individuals to gain a clearer picture of their overall financial situation. By having a detailed overview of all assets and liabilities, individuals can gain a better understanding of their exact financial worth. This can be extremely useful when making important financial decisions, such as investing or purchasing a home.

Additionally, creating a personal net worth worksheet can help individuals monitor their financial progress over time. By tracking their assets and liabilities over a period of time, individuals can easily identify any areas where their financial situation is improving, or areas where they may need to take action in order to improve their overall financial standing. This can be especially helpful for those who are attempting to save for retirement, or for any other long-term financial goals.

Finally, creating a personal net worth worksheet can provide individuals with a sense of control over their finances. By having a detailed overview of their financial situation, individuals can easily identify areas where they may need to make adjustments in order to improve their overall financial health. This can be an invaluable tool for those who are trying to establish their financial independence and take control of their financial future.

Overall, creating a personal net worth worksheet is an excellent way to gain a better understanding of one’s financial situation. With this type of worksheet, individuals can track their assets and liabilities, monitor their financial progress, and gain a sense of control over their financial future.

Tips for Keeping Your Personal Net Worth Worksheet Up-to-Date

1. Regularly review your financial accounts: Make sure to review your bank account, investment accounts, and any other financial accounts on a regular basis to ensure the accuracy of your personal net worth worksheet.

2. Track changes in the value of assets: Stay up-to-date on changes in the value of your assets, such as real estate, stocks, and bonds. This will help you accurately assess your net worth.

3. Monitor changes in liabilities: Take note of any changes in your liabilities, such as credit card debt, car loans, and mortgages. This will help you accurately calculate your net worth.

4. Adjust for changes in income: Keep track of changes in your income, such as salary increases or bonuses. This will help you accurately reflect your income on your personal net worth worksheet.

5. Update your worksheet frequently: Review your financial accounts and make adjustments to your worksheet on a regular basis. This will help you stay up-to-date on your net worth.

6. Schedule a yearly review: Schedule a yearly review of your net worth worksheet to ensure accuracy. During this review, you can make any necessary adjustments to your worksheet.

Conclusion

The use of a Personal Net Worth Worksheet is an important tool for achieving financial success. It provides an accurate snapshot of a person’s current financial situation, and helps them to make wise decisions about the future. By regularly updating the worksheet, individuals can keep track of their progress and make sure they are staying on track. By understanding their current financial situation, they can make better decisions that will lead to long-term financial success.

[addtoany]