How to Use Simple and Compound Interest Worksheets to Maximize Your Savings

Saving money is essential to achieving financial independence and stability. Using simple and compound interest worksheets can help maximize your savings by making it easier to identify ways to optimize your financial strategies.

Simple interest is calculated based on the principle amount, the interest rate, and the length of the loan or savings account. To calculate the simple interest, you must multiply the principal amount by the interest rate and then multiply the result by the length of time. For example, if you have a principal of $1,000 and an interest rate of 5%, the simple interest would be $50 ($1,000 x 0.05 x 1 year).

Compound interest, on the other hand, is calculated based on the principal amount, the interest rate, and the number of times the interest is compounded. Compounding is when the interest earned on an investment or loan is added to the principal amount, creating a higher principal amount for the next interest calculation. For example, if you have a principal of $1,000 and an interest rate of 5% compounded monthly, the compound interest would be $51.28 ($1,000 x 0.05 x 12 months).

[toc]

Using simple and compound interest worksheets can help you maximize your savings by identifying ways to further optimize your financial strategies. You can use the worksheets to compare the results of different scenarios, such as different interest rates or compounding periods, to determine which will be most beneficial to you. Additionally, you can use the worksheets to plan out your investments or savings account to ensure that you’re taking advantage of the best interest rates and compounding periods available.

Overall, using simple and compound interest worksheets can help you maximize your savings by making it easier to identify ways to optimize your financial strategies. By using the worksheets to compare different scenarios and plan out your investments, you can ensure that you’re taking advantage of the best interest rates and compounding periods available.

Understanding the Difference Between Simple and Compound Interest: A Guide for Beginners

Understanding the difference between simple and compound interest is an important step for anyone beginning to learn about personal finance. It can be difficult to understand the difference between the two, as they both involve interest rates and compounding periods.

Simple interest is the amount of interest that is calculated on the initial principal amount of a loan or investment. The interest rate is usually fixed, and the interest is earned over the length of the loan or investment period. Simple interest is calculated by multiplying the principal amount by the interest rate and the time period of the loan or investment.

Compound interest is the amount of interest that is calculated on the principal plus any interest that has already been earned. It is different from simple interest in that the interest rate is not fixed and can fluctuate over the life of the loan or investment. Compound interest is calculated by adding the principal amount plus any interest already earned and then multiplying that total by the interest rate and the time period of the loan or investment.

The main difference between simple and compound interest is that compound interest earns interest on both the principal and any interest that has already been earned. This means that the interest rate on compound interest is higher than the interest rate on simple interest.

Understanding the difference between simple and compound interest is an important step in being able to make informed decisions about personal finance. Knowing which type of interest rate is best for an individual’s financial situation can help them make the most of their money.

Exploring the Benefits of Investing with Simple and Compound Interest Worksheets

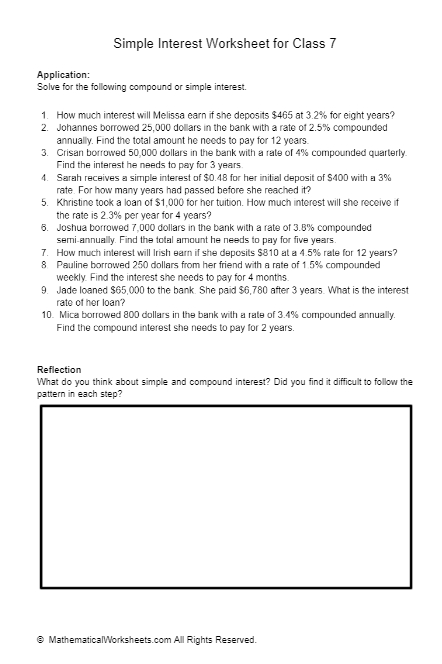

Investing is a great way to grow your wealth over time and build financial security. One of the most important decisions you can make when investing is to choose the right type of interest, whether it is simple or compound. Understanding the difference between these two types of interest can be confusing, but using a simple and compound interest worksheet can help you make the right decision.

A simple interest worksheet is designed to help you calculate the amount of money you will earn on an investment through a single payment. This type of interest is calculated as a percentage of the initial principal or the amount invested. As the principal is not changed, the interest earned will remain the same over time.

A compound interest worksheet is designed to help you calculate the amount of money you will earn on an investment through multiple payments. This type of interest is calculated as a percentage of the initial principal plus any interest earned on the previous payment. As the principal grows, the amount of interest earned will increase over time.

Both types of interest worksheets are useful tools for understanding the potential benefits of investing. By using one of these worksheets, you can determine how much money you can expect to earn over a certain period of time and compare the potential returns of different investments.

Investing with simple and compound interest is an important part of financial planning and can help you build a secure future. Using a simple and compound interest worksheet can help you make the best decision for your investment goals. With this tool, you can easily compare the potential returns of different investments and make the most of your money.

Tips for Creating an Accurate Simple and Compound Interest Worksheet

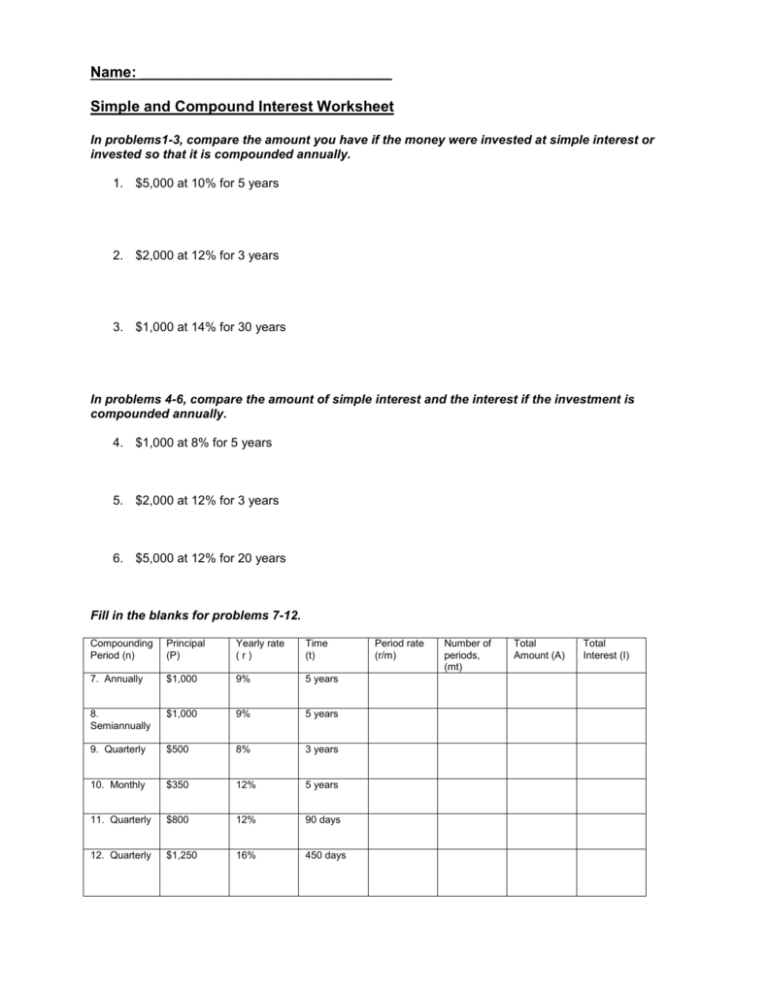

1. Begin by familiarizing yourself with the concept of simple and compound interest. Understand the differences between the two and how they are calculated.

2. Gather all the necessary information that will be needed to calculate interest, such as the initial sum, the rate of interest, the time period, and any other variables that may affect the calculations.

3. Calculate the simple and compound interest on paper before entering them into the worksheet. This will allow you to double-check your work and ensure accuracy.

4. Create a detailed and organized worksheet with clearly labeled columns and rows. Make sure to include all of the necessary information from step two and include a section for the calculated interest.

5. Enter the data into the worksheet accurately. If using a spreadsheet, use formulas to automatically calculate interest for you.

6. Include a section for the total amount of simple and compound interest that has been calculated.

7. Double-check your work and proofread the worksheet to make sure all of the data is accurate and you have included all the necessary information.

8. If possible, have someone else review your work and provide feedback.

9. Save and store the worksheet securely for future reference.

Common Mistakes to Avoid when Calculating Simple and Compound Interest

Calculating simple and compound interest can be a complicated process, so it is important to be aware of the common mistakes that can be made to ensure accuracy.

One of the most common mistakes is not accounting for the frequency of the compounding period. When calculating compound interest, the interest rate must be adjusted to reflect the frequency of the compounding period. If the frequency is not adjusted, the calculation will be inaccurate.

Another mistake to avoid is not converting the interest rate to a decimal. When calculating simple or compound interest, the interest rate must be expressed in decimal form. If the interest rate remains as a percentage, the calculation will be incorrect.

It is also important to be aware of the order of operations when calculating simple or compound interest. The order of operations must be followed precisely to ensure accuracy. If the order is not followed, the calculation will be incorrect.

Finally, it is important to double-check all calculations to ensure accuracy. If any of the information is incorrect, the entire calculation will be incorrect. Therefore, it is important to double-check the interest rate, compounding period, and order of operations to ensure accuracy.

By being aware of these common mistakes, you can ensure accuracy when calculating simple or compound interest.

Analyzing the Impact of Time on Returns with Simple and Compound Interest Worksheets

Time is a crucial factor when it comes to returns from investments. Understanding how time affects returns is essential for any investor. This article will explain the concept of simple and compound interest and how it impacts returns over time.

Simple interest is the most basic form of interest calculation. It is calculated by taking the principle amount, multiplying it by the interest rate, and multiplying the result by the number of time periods. For example, a principle of $100 with a 5% interest rate over the course of five years would yield a total return of $125.

Compound interest, on the other hand, is slightly more complex. It is calculated by taking the principle amount and multiplying it by one plus the interest rate, then multiplying that result by itself for each time period. For example, a principle of $100 with a 5% interest rate over the course of five years would yield a total return of $162.50.

The difference between simple and compound interest is that compound interest takes into account the interest earned on the previous periods’ interest. This is why compound interest yields a higher return over time.

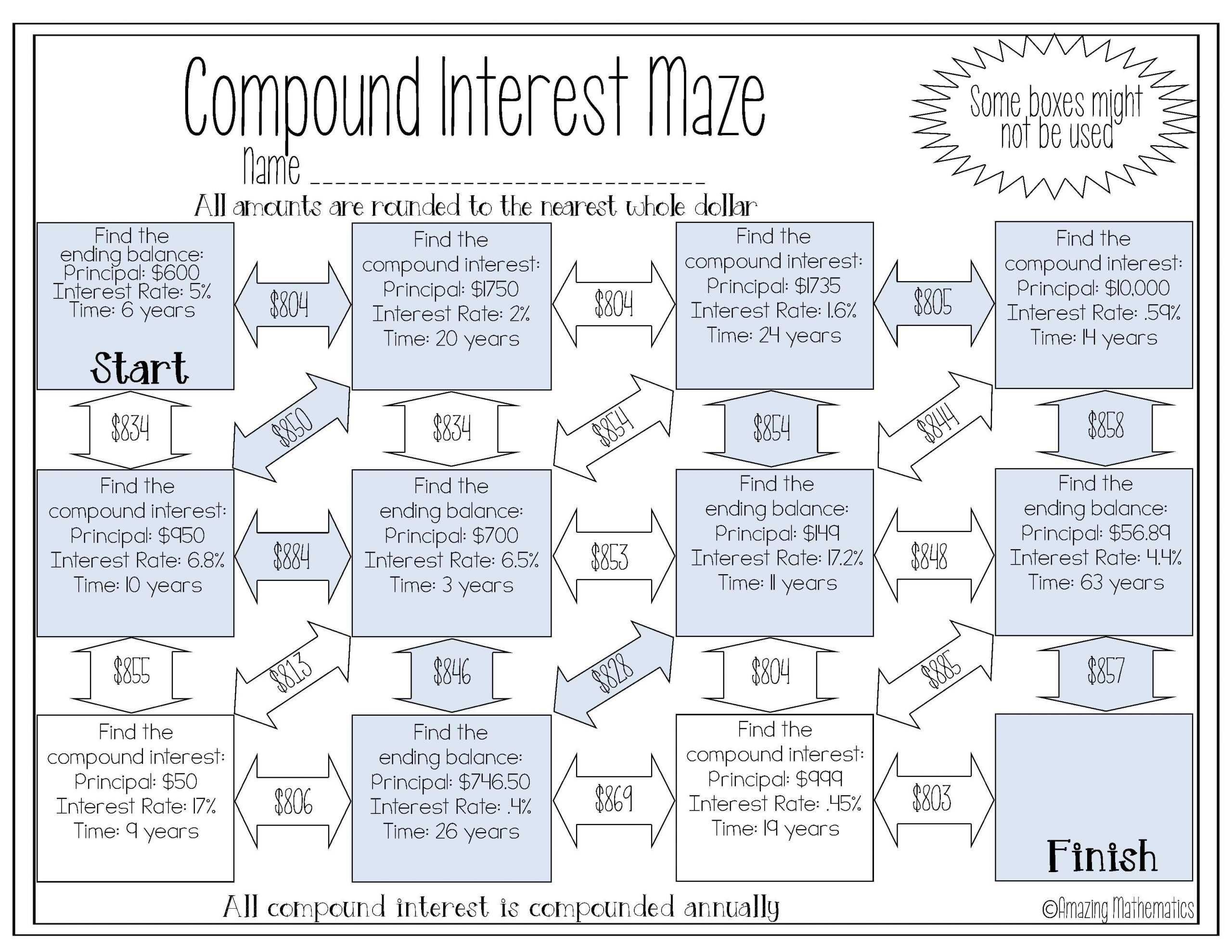

To illustrate this further, the following worksheets provide an example of how simple and compound interest can affect returns over different time periods. In each worksheet, the principle has been set at $100 and the interest rate at 5%.

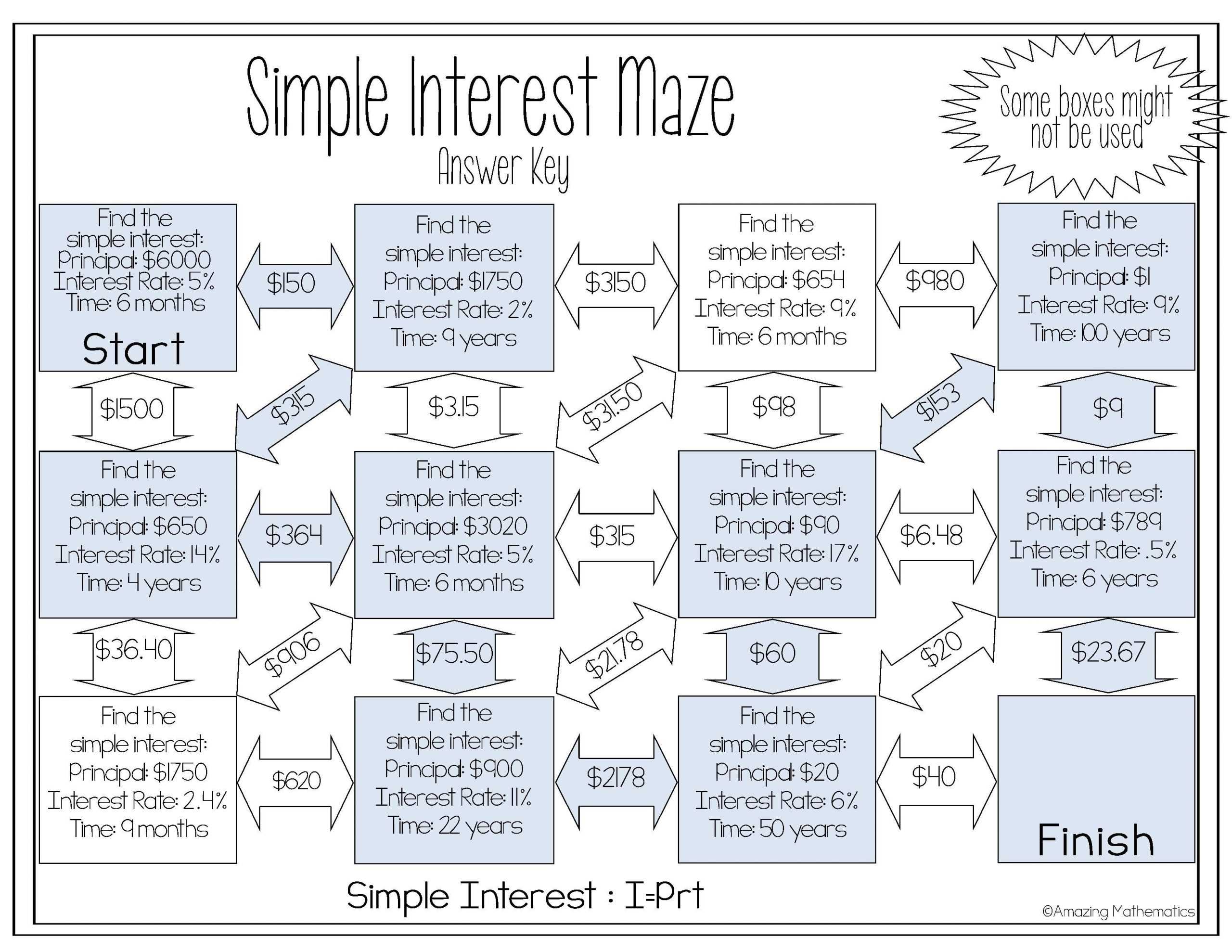

Simple Interest Worksheet

Time Period Total Return

1 year $105.00

2 years $110.00

3 years $115.00

4 years $120.00

5 years $125.00

Compound Interest Worksheet

Time Period Total Return

1 year $105.25

2 years $110.76

3 years $116.55

4 years $122.63

5 years $162.50

As can be seen from these worksheets, compound interest yields a greater return than simple interest over time. This is because the interest earned on the previous periods’ interest is taken into account.

Understanding the concept of simple and compound interest and how it impacts returns over time is essential for any investor. By utilizing these worksheets, investors can better understand the effect of time on returns with simple and compound interest and make more informed decisions about their investments.

Strategies for Maximizing Returns with Simple and Compound Interest Calculations

One of the most effective ways to maximize returns with simple and compound interest calculations is to make regular investments. By investing regularly, investors are able to take advantage of compounding effects and increase their returns over time. For example, by investing a fixed amount each month, investors can benefit from compounding interest and see their returns increase exponentially over time.

Another strategy that can be used to maximize returns with simple and compound interest calculations is to invest in assets with higher returns. Assets such as stocks and bonds can offer higher returns over time, and these returns can be compounded over time. This can result in substantial returns over time, making investing in assets with higher returns an attractive option for investors looking to maximize their returns.

Finally, investors should consider diversifying their investments. Diversification allows investors to spread their investments across a variety of different assets, reducing the risk of losses from any single asset. This can help protect investors from market volatility and reduce the overall risk of their investment portfolio.

By investing regularly, investing in assets with higher returns, and diversifying their investments, investors can maximize their returns with simple and compound interest calculations. By employing these strategies, investors can increase their returns over time and maximize their returns on their investments.

How to Interpret Simple and Compound Interest Worksheets for Financial Decision Making

Interpreting simple and compound interest worksheets is a vital component of financial decision-making. Although both types of interest can yield financial rewards, the type of interest chosen will depend on the specific situation. By being familiar with the different types of interest and how to interpret the worksheets, financial decision-making can be made more informed and effective.

Simple interest is calculated as a fixed rate on the principal amount. As such, the amount of interest earned is determined by the initial sum and the rate. To interpret a simple interest worksheet, the user needs to enter the principal amount and the rate of interest in the corresponding cells, and the worksheet will then calculate the amount of interest earned.

Compound interest, on the other hand, is calculated as a fixed rate on the principal amount, but it is also calculated on the accumulated interest. Using a compound interest worksheet, the user must first enter the principal amount, the rate of interest, and the frequency of compounding. The frequency of compounding is the number of times per year that interest will be added to the initial sum. Once these three components are entered, the worksheet will then calculate the total amount of interest earned.

By interpreting simple and compound interest worksheets, an individual can make more informed financial decisions. The worksheets provide users with the information necessary to compare different types of interest and determine which type of interest will yield the highest amount of returns. Furthermore, users can also use the worksheets to assess the potential risks associated with certain investments. With a better understanding of the different types of interest and how to interpret their worksheets, financial decision-making can be made more effective and profitable.

Leveraging the Power of Compound Interest with Simple and Compound Interest Worksheets

Compound interest is one of the most powerful financial tools for building wealth over time. By leveraging the power of compounding, individuals can invest small amounts of money and watch it grow exponentially over time. To understand the power of compound interest, it is helpful to first understand the different types of interest and how they work.

Simple interest is an interest rate that is applied to only the principal amount of the loan. For example, if an individual borrows $1,000 at a simple interest rate of 5%, and pays the loan off over a period of five years, the total amount paid would be $1,250. This is because the interest is applied only once.

Compound interest, on the other hand, is an interest rate that is applied to the principal amount plus any accumulated interest. This means that interest is added to the principal each period, so the interest rate is applied to a larger and larger amount of money over time. For example, if an individual borrows $1,000 at a compound interest rate of 5% and pays the loan off over a period of five years, the total amount paid would be $1,276. This is because the interest is added to the principal each period, so the interest rate is applied to a larger and larger amount of money over time.

To better understand the power of compound interest, it is helpful to use simple and compound interest worksheets. These worksheets can be used to calculate the total amount of interest paid over a given period of time, as well as the total amount of money that would be paid if the loan was paid off early. Understanding these calculations can help individuals make smarter financial decisions and develop a plan for building wealth over time.

Compound interest has the potential to create great wealth over time, but it is important to remember that it requires a long-term commitment. By understanding the power of compound interest, individuals can leverage this powerful financial tool to reach their financial goals. A simple and compound interest worksheet can help individuals understand the power of compound interest and create a plan to maximize its potential.

Exploring the Advantages of Investing with Simple and Compound Interest Worksheets

Investing is a great way to ensure long-term financial security. Utilizing simple and compound interest worksheets can be an effective tool to help investors understand the advantages of investing and make informed decisions.

Simple interest worksheets allow investors to calculate how much money they will make from their investments over a specific period of time. This worksheet provides investors with an easy way to calculate how much they will earn each year in interest and how much they will owe in interest over the life of their investments.

Compound interest worksheets are also a great tool for investors. This type of worksheet allows investors to calculate how much their investments will be worth in the future after the compounding of interest over a number of years. Compound interest worksheets can also be used to compare the returns from different types of investments.

The advantages of using simple and compound interest worksheets to invest are numerous. First, investors can easily calculate the return on their investments over a specific period of time. This allows investors to plan for the future by seeing what their investments will be worth in the future.

Second, investors can compare different types of investments and make informed decisions. Compound interest worksheets can be used to compare the returns from different investments and determine which investment is the most profitable.

Finally, investors can track their investments over time. Simple and compound interest worksheets provide investors with an easy way to monitor the performance of their investments. This is especially helpful to investors who want to ensure their investments are performing optimally.

Overall, simple and compound interest worksheets are a great tool for investors to understand the advantages of investing. They can be used to calculate the return on investments, compare different investments, and track their investments over time. Therefore, these worksheets can be a great asset to any investor looking to maximize their returns and secure their financial future.

Conclusion

The Simple and Compound Interest Worksheet is an invaluable tool for anyone trying to understand the basics of interest and their implications on long-term finances. It can help you visualize how compound interest can exponentially grow your money over time, and it can also help you determine the best strategy to maximize your savings and investments. With the help of this worksheet, you can start planning your financial future and make sure you are setting yourself up for success.

[addtoany]