How to Create a Personal Saving and Investing Plan

Creating a personal saving and investing plan is an important step to achieving financial security. It is a way to ensure that your hard-earned money is being managed effectively. A personal saving and investing plan should be tailored to your individual financial situation and goals. The following steps will assist you in developing a comprehensive plan that meets your individual needs.

1. Establish Financial Goals: The first step in creating a saving and investing plan is to determine your financial goals. Consider your short-term and long-term goals. Be realistic and set a timeline for when you would like to meet each goal.

2. Assess Your Financial Situation: Once you have established your financial goals, you should assess your current financial situation. Take into account your current income, expenses, and assets. Calculate your net worth, which is the total value of your assets minus your liabilities. Also, consider any potential sources of income that are not included in your current financial status.

[toc]

3. Create a Budget: Creating a budget is essential for managing your money and reaching your financial goals. You should consider your current expenses and determine if there are areas where you can cut back. This will help you free up money that can be used to save and invest.

4. Set Up an Emergency Fund: Establishing an emergency fund is an important part of a saving and investing plan. It is important to have money set aside in case of an unexpected financial emergency. Generally, it is recommended to have an emergency fund that is equivalent to three to six months of your living expenses.

5. Invest: Once you have created a budget and an emergency fund, you can begin to invest. Investing allows you to take advantage of compound interest, which is the ability of your investments to earn interest on both the principal amount and on the interest that has previously been earned. Consider your risk tolerance and return expectations when determining which investments are best for you.

Creating a personal saving and investing plan is an important part of managing your finances and achieving your financial goals. Consider your individual financial situation and goals when developing your plan. Take the time to establish a budget, an emergency fund, and invest in order to reach your desired outcome. With a comprehensive and tailored saving and investing plan, you can ensure that your money is being managed effectively and efficiently.

Why Everyone Should Have a Saving and Investing Worksheet

Having a savings and investing worksheet is an invaluable tool for anyone looking to ensure their financial wellbeing in the long term. A well-crafted worksheet can serve as a blueprint for developing and maintaining a healthy financial portfolio. It provides a tangible representation of one’s income, expenses, liabilities, assets, and investments, and can be used to track progress and make adjustments along the way.

The benefits of having a savings and investing worksheet are numerous. For starters, it can help individuals establish and stick to their budget, as it can clearly delineate their income and expenses, as well as track their progress. Additionally, it can help them become better informed about their financial situation, as they can gain a better understanding of their assets, liabilities, and investments. Moreover, having a worksheet can help individuals plan for the future. They can use it to develop a comprehensive financial plan that takes into account their current and future needs and goals, and chart a path to success.

In addition to the practical benefits, having a savings and investing worksheet can also provide individuals with peace of mind. Knowing that their finances are in order can help alleviate financial anxiety and provide them with a greater sense of security.

Overall, having a savings and investing worksheet is an invaluable tool for anyone looking to ensure their financial wellbeing in the long term. It can provide individuals with a better understanding and control over their finances, and help them develop a comprehensive financial plan for the future. With its numerous benefits, it is clear to see why everyone should have a savings and investing worksheet.

How to Maximize Returns on Your Savings and Investments

Maximizing returns on savings and investments is a key factor for anyone looking to build and maintain financial security. With the right strategies, you can make the most out of your savings and investments, allowing you to enjoy financial freedom.

First and foremost, it is essential to create a financial plan that outlines your long-term and short-term goals. With an understanding of your financial objectives, you can develop an effective strategy tailored to your individual needs. Additionally, consider creating an emergency fund to ensure that you have easy access to funds in the event of an unexpected financial setback.

When it comes to investments, it is important to diversify your portfolio. This means investing across a range of asset classes, such as stocks, bonds, and mutual funds. Additionally, you should consider investing in a variety of industries, sectors, and countries. This will help to reduce risk and maximize returns on your investments.

It is also important to understand the fees associated with your investments. Many investments come with fees that can take a big bite out of your returns. Be sure to read the fine print and understand what you are signing up for before committing to any investments.

Finally, you should stay up-to-date on the latest news and trends in the markets. Keeping abreast of current news and developments will allow you to make informed decisions about your investments and to act swiftly when opportunities arise.

By following these tips, you can maximize returns on your savings and investments, helping you to achieve your financial goals. With the right strategy and a disciplined approach, you can enjoy financial freedom for years to come.

Pros and Cons of Different Types of Investment Strategies

Investment strategies are the plans and methods used by investors to manage their investments. Different strategies have different advantages and disadvantages, and the right strategy for one investor may not be suitable for another. To help investors make an informed decision, here is a look at the pros and cons of different types of investment strategies.

Value Investing: Value investing is a strategy that emphasizes the purchase of stock in companies that are currently undervalued relative to their intrinsic worth. This strategy is often used by investors seeking to acquire undervalued stocks with the potential to appreciate significantly in the future. Pros of this strategy include potentially higher returns than those of the overall market, the potential for diversification, and the ability to buy stocks at low prices. Cons include the risk that the stock price may not reach its expected value, the risk that the investor may not have the expertise to identify stocks with value, and the potential for higher volatility than the overall market.

Growth Investing: Growth investing is a strategy that focuses on buying stocks in companies that are expected to experience high growth rates. This strategy is often used by investors seeking to capitalize on companies with higher than average earnings growth potential. Pros of this strategy include the potential for higher returns than the overall market, the potential for diversification, and the focus on stocks with higher growth rates. Cons include the risk that the company may not realize the expected growth rate, the risk that the investor may not have the expertise to identify stocks with growth potential, and the potential for higher volatility than the overall market.

Index Investing: Index investing is a strategy that involves buying and holding a portfolio of stocks that tracks a broad market index such as the S&P 500. This strategy is often used by investors seeking to capture the returns of the overall market. Pros of this strategy include lower volatility than other strategies, the potential for diversification, and the ability to track the market with minimal effort. Cons include the fact that index funds do not beat the market, the lack of potential for higher returns, and the lack of control over stock selection.

In conclusion, different types of investment strategies have different advantages and disadvantages. It is important for investors to do their research and decide which strategy is best suited for their individual goals and risk tolerance.

Tips for Choosing the Best Investment Options for Your Needs

1. Set realistic goals: Before investing, it is important to have a clear idea of what you want to accomplish with your money. Consider your current financial situation and set realistic goals that can be met with your available resources.

2. Research the investment options available: Before investing, it is important to understand the different investment options available and their associated risks. Research the various investment products and services available and make sure you understand the terms and conditions.

3. Consider your risk tolerance: Every investor has a different risk tolerance. Consider how much risk you are willing to take on when making your decision. It is important to be comfortable with the amount of risk you are taking on before investing.

4. Compare fees and services: Different investment products and services charge different fees. Compare the fees and services of different products and services to make sure you are getting the best value for your money.

5. Seek professional advice: Investing can be complicated and it is important to seek professional advice from a qualified financial advisor. A qualified financial advisor can provide valuable advice when it comes to selecting the best investment options for your needs.

6. Diversify your investments: Diversification is an important tool for minimizing risk. Consider diversifying your investments across different asset classes and asset types to reduce your risk and maximize returns.

7. Regularly review your investments: It is important to regularly review your investments to make sure they are meeting your goals and expectations. Make sure to review your investments at least once a year to make sure they are still suitable for your needs.

Understanding Compound Interest and Its Benefits on Your Savings and Investments

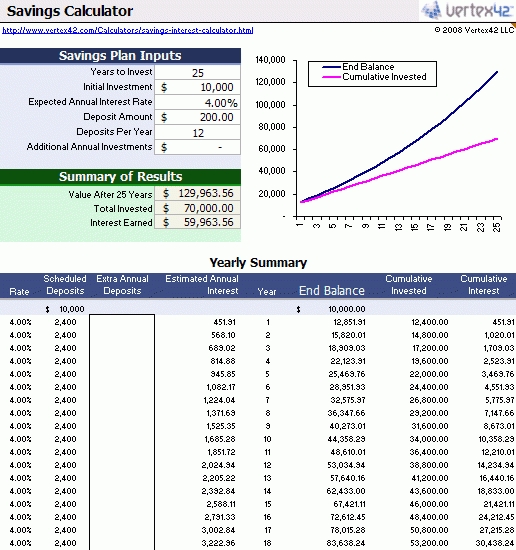

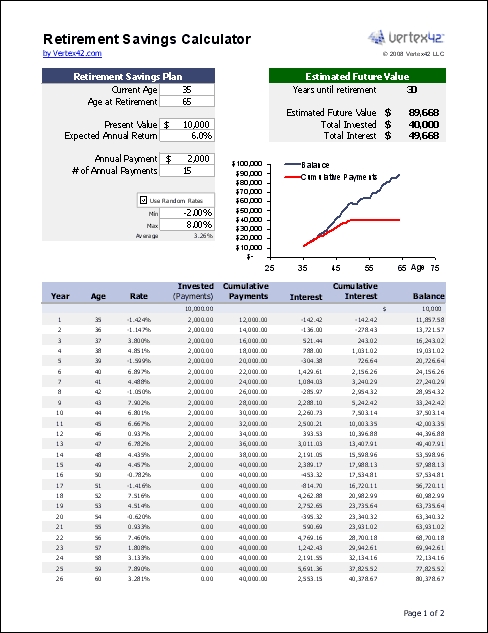

Compound interest is a powerful and beneficial financial tool that can help individuals grow their savings and investments over time. Compound interest is the interest earned on the principal amount plus the previously earned interest. This means that the more time passes, the more interest is accumulated over the principal amount and any interest previously earned, resulting in a significantly larger amount than the original principal.

Compound interest is most beneficial when left to accumulate over a long period of time. This is because the interest earned is continually compounded, meaning the interest is then added to the principle amount and the process starts again. This type of interest is an important contributor to wealth accumulation over time as it means that more money is being added to your account more quickly. Compound interest can be earned on various types of investments, such as savings accounts, certificates of deposit, and investment accounts.

Compound interest is also beneficial because it can help you to reach financial goals and objectives faster. For example, if you have a goal of saving a certain amount of money for retirement, you can use compound interest to help you reach that goal faster. The interest earned will compound over time and the amount will grow more quickly than if you invested in a simple interest account.

Finally, compound interest is beneficial because it can help you to achieve greater returns on investments. By allowing investments to accumulate over time, you can achieve a greater return than if you had invested in a simpler interest account. This makes compound interest an attractive option for those looking to maximize their returns on investments.

Compound interest can be a powerful tool for those looking to grow their savings and investments. It is important to understand, however, the risks associated with investing in any type of account and to ensure you are comfortable with the level of risk before investing.

How to Research and Analyze Investment Opportunities

Researching and analyzing investment opportunities is a critical step in the investment process. It requires careful consideration of the potential risks and rewards associated with the investment, as well as a thorough understanding of the industry, organization, and financials of the company in question.

The first step in researching an investment opportunity is to identify the type of investment. This can range from stocks and bonds to mutual funds, real estate, and other investments. Once the type of investment is chosen, it is important to research the company’s history, financials, and competitive landscape. This should include information such as the company’s past performance, current management team, and competitive advantages.

The next step is to analyze the investment opportunity to determine the potential risks and rewards associated with it. This should include a thorough understanding of the company’s financials, including its balance sheet, income statement, and cash flow statement. Additionally, an analysis of the industry and competitive landscape should be conducted to determine the company’s current and future prospects.

It is also important to consider any regulatory or political risks associated with the investment. It is important to understand the regulations that may impact the company and the risks associated with any changes in the regulatory environment. Additionally, any political risks should be taken into account, as these can have a major impact on an investment’s potential returns.

Finally, it is important to consider the investment’s expected return. This should include an analysis of the company’s past performance, current environment, and potential for future growth. Additionally, it is important to consider the company’s current dividend yield and the potential for future dividends.

By researching and analyzing investment opportunities, investors can make informed decisions about their investments. This process should include a thorough understanding of the company’s financials, industry, and competitive landscape, as well as a careful consideration of the potential risks and rewards associated with the investment. By conducting a comprehensive analysis, investors can gain a better understanding of the potential risks and rewards associated with an investment, allowing them to make informed decisions about their investments.

Evaluating Risk and Return on Your Savings and Investments

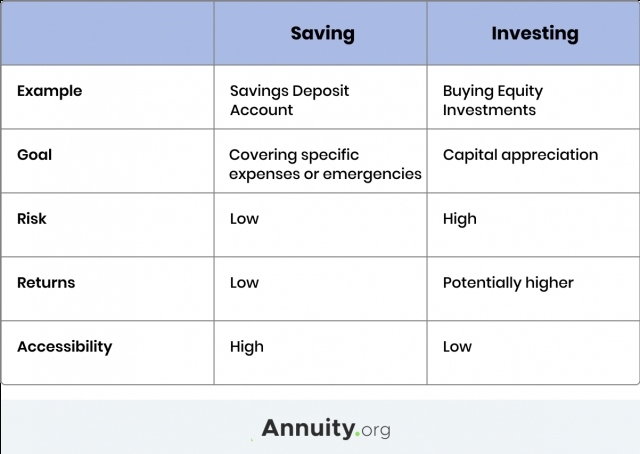

Risk and return are two of the most important factors to consider when making decisions about your savings and investments. Risk and return are inextricably linked, as the higher the risk you take, the higher the potential return you may receive. However, it is important to understand that there is no guarantee of return and that risks can be substantial.

When evaluating risk and return, it is important to understand the different types of investments and the associated risks and potential returns. Stocks, bonds, mutual funds, and exchange-traded funds are the most common types of investments. Each of these investments carries different levels of risk and potential return. Stocks typically carry a higher level of risk than bonds, as stock prices are more volatile. Bonds are a more conservative investment and generally provide a more consistent return. Mutual funds and exchange-traded funds offer a diversified portfolio of investments and can help reduce risk by spreading out investments across different asset classes.

The amount of risk you are willing to take is an important factor when evaluating risk and return. Generally, the higher the risk, the higher the potential return. However, it is important to remember that there is no guarantee of return and that the potential losses can be substantial. It is also important to remember that the amount of return on your investments is often determined by the amount of time you are willing to wait and the amount of money you are willing to invest.

When evaluating risk and return on your savings and investments, it is important to understand the different types of investments and their associated risks and potential returns. It is also important to consider the amount of risk you are willing to take and the amount of time you are willing to wait for potential returns. By understanding these factors, you can make more informed decisions about your savings and investments.

How to Harness the Power of Tax Advantages in Your Saving and Investing Plan

Saving and investing are important activities for creating financial stability and reaching long-term goals. It is possible to save and invest more effectively by taking advantage of the various tax advantages available. By understanding how to maximize your savings and investments with tax advantages, you can make the most of your money and secure your financial future.

Tax-deferred investments are one of the most popular ways to save and invest with tax advantages. These investments allow you to put money into accounts, such as 401(k)s, IRAs, and annuities, and defer taxes on the earnings until you withdraw the money. This means that you can invest more of your money, because you don’t have to pay taxes on the earnings in the present. Additionally, you may be able to deduct contributions to certain types of accounts from your taxable income, further reducing your tax bill.

Another method of saving and investing with tax advantages is through tax-free investments. These investments, such as municipal bonds, allow you to avoid paying taxes on the interest earned. This can be particularly beneficial for those in higher tax brackets, as the tax savings can be significant.

In addition to the aforementioned methods of saving and investing with tax advantages, there are other opportunities available. You may be able to take advantage of tax credits for certain investments, such as energy-efficient home improvements or educational expenses. Additionally, you may be able to take advantage of lower capital gains tax rates on certain investments.

By taking advantage of the various tax advantages available, you can maximize your savings and investments and secure your financial future. To get the most out of your investments and savings, it is important to understand the different tax advantages available, and how they can help you reach your financial goals.

Strategies for Rebalancing Your Portfolio for Maximum Returns

Rebalancing your portfolio is an important strategy for ensuring maximum returns on your investments. By regularly reviewing and adjusting your portfolio, you can ensure that it remains in line with your financial goals, representing the most effective use of your resources.

The first step in rebalancing your portfolio is to assess your current asset allocation. This involves taking into account the various asset classes you currently hold, such as stocks, bonds, and cash, as well as the percentages of each class in your portfolio. It is important to review your asset allocation to ensure that it reflects your risk tolerance, investment goals, and time horizon.

Once you have determined your current asset allocation, you must decide whether or not to make changes. If you determine that your asset allocation is no longer in line with your goals, you will need to rebalance your portfolio in order to bring it back in line. This can be done by selling off some of your existing investments and using the proceeds to purchase other investments that better align with your goals.

When rebalancing your portfolio, it is important to keep in mind your desired asset allocation. This will help you to determine when to buy and sell investments in order to maintain your desired allocation. Additionally, it is important to consider the tax implications of any changes you make to your portfolio. Tax-loss harvesting, for example, can be a useful tool for minimizing capital gains taxes on investments that have appreciated in value.

Finally, it is important to review your portfolio on a regular basis. This will allow you to make adjustments as necessary in order to ensure that your portfolio remains in line with your goals and objectives. By regularly rebalancing your portfolio, you can maximize your returns and ensure that your investments remain aligned with your financial goals.

Conclusion

The Saving and Investing Worksheet is a valuable tool for anyone looking to manage their financial future. It can help you identify where you stand financially, set goals and create a plan to reach them. With this worksheet, you can also compare your options and make sure you are making the most of your money. By following the advice provided in this worksheet, you can be sure to make smart financial decisions that will help you reach your goals.

[addtoany]