The Basics of Reconciling a Bank Statement Worksheet

Reconciling a bank statement is an essential part of managing finances and keeping accurate records. This worksheet can help to guide you through the process of reconciling a bank statement, making it easier and faster to get done.

1. Gather the necessary information. Before beginning the process of reconciling a bank statement, you will need to gather the necessary information. This includes the bank statement, a copy of the check register, and any other relevant documents.

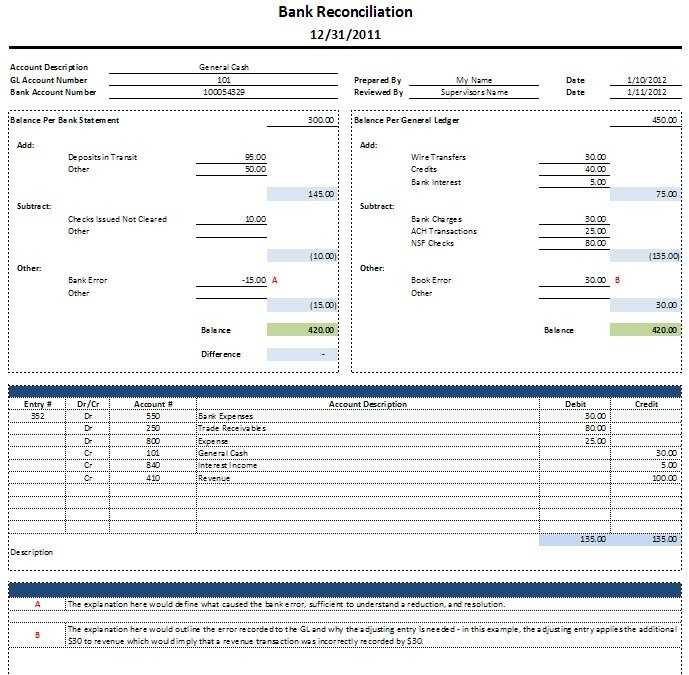

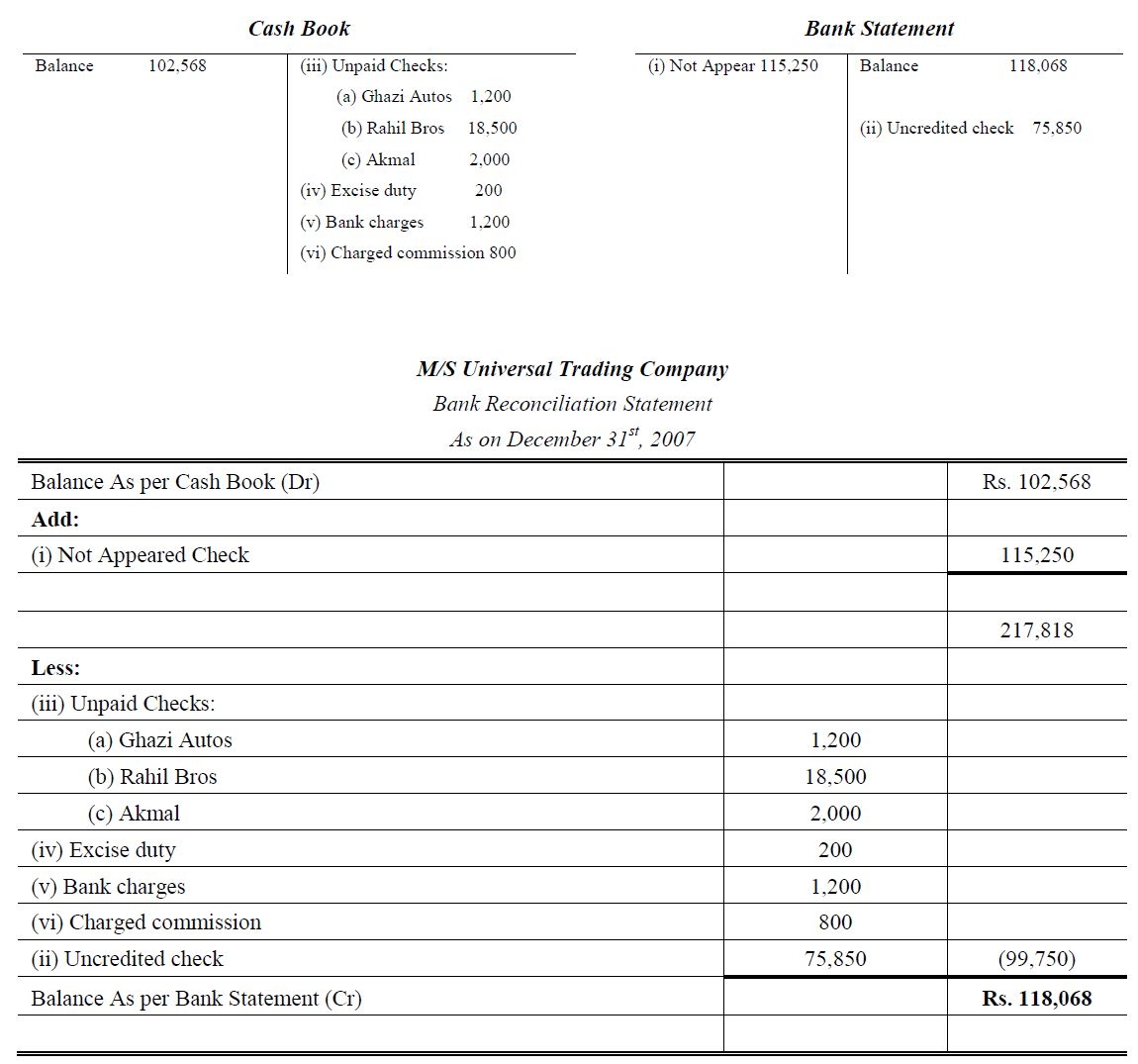

2. Compare the balances. Compare the ending balance on the statement to the balance on the check register. If the two balances don’t match, then you will need to look at the transactions on the statement and in the check register to determine why the balances are different.

[toc]

3. Identify any discrepancies. If there are any discrepancies between the two documents, make a note of them and investigate further. These discrepancies could be caused by a mistake on the bank’s part, incorrect information or transactions that have not been recorded correctly.

4. Correct any mistakes. If any mistakes have been made, make sure to correct them. This could involve contacting the bank or entering the correct information into the check register.

5. Reconcile the accounts. Once any mistakes have been corrected, the accounts should be reconciled. This involves checking that all transactions have been recorded correctly and that the ending balances match.

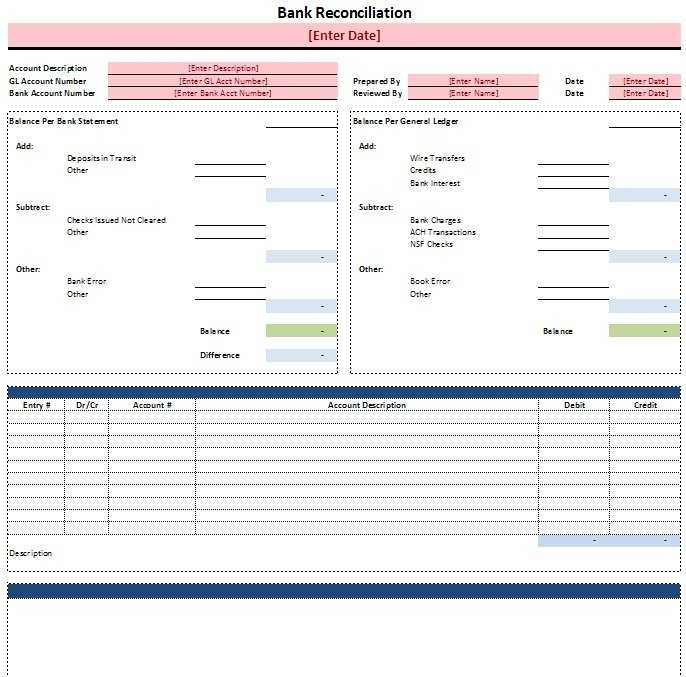

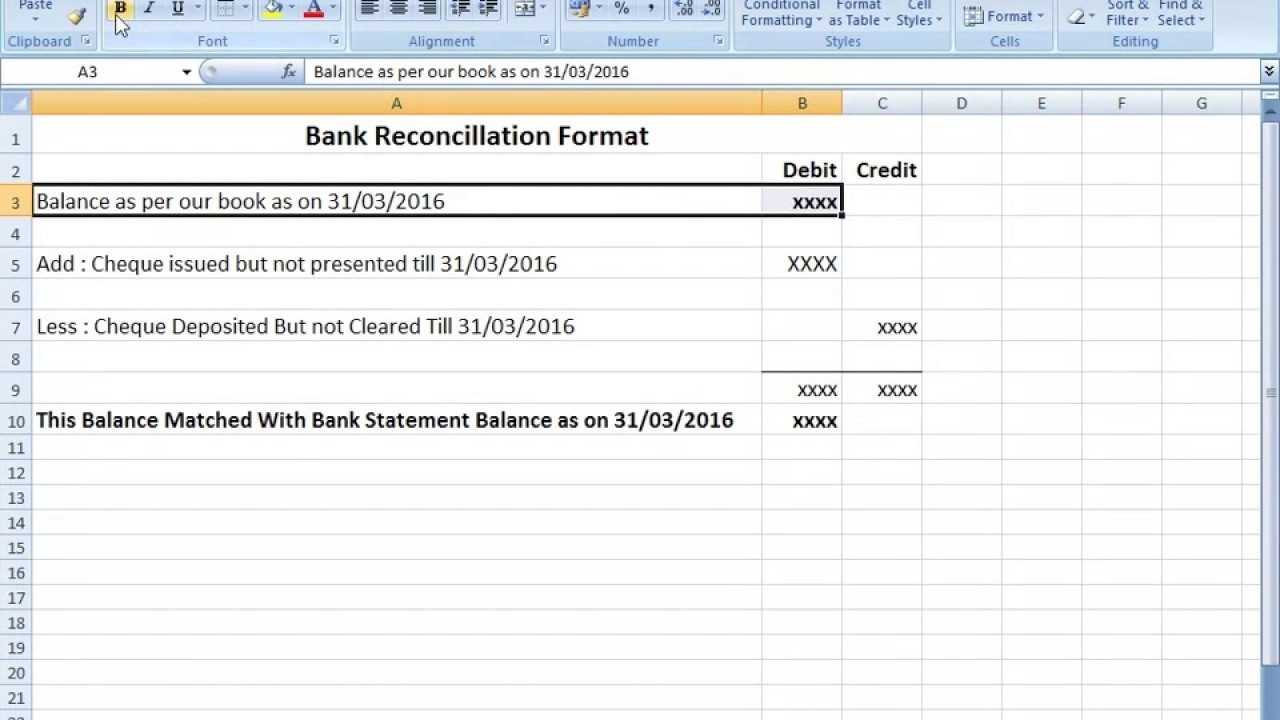

6. Prepare a reconciliation statement. Prepare a reconciliation statement that summarizes the process. This should include the beginning balance, all transactions, and the ending balance.

By following these steps and using this worksheet, you will be able to successfully reconcile a bank statement. This will help to ensure that all of your financial records are accurate and up-to-date.

Strategies for Effectively Reconciling Bank Statements

The reconciliation of bank statements is a critical part of the financial management process. It is important to ensure that the balance of the bank account is accurate and that all transactions are properly accounted for. Here are some strategies for effectively reconciling bank statements:

First, start by gathering all of the necessary information. This includes the bank statement, the checkbook, and any other documents related to the account. It is important to have all of the information in one place.

Second, compare the bank statement to the checkbook. Look for any discrepancies between the two and make any necessary adjustments. Take note of any deposits or withdrawals that have not been included in the checkbook.

Third, review the bank statement for any errors or mistakes. The bank may have made an error when entering transactions or there may be a duplicate entry that needs to be corrected.

Fourth, verify all of the transactions. This includes deposits, withdrawals, and other transactions. Make sure that all of the transactions have been entered correctly and that the dollar amount is correct.

Finally, review the bank statement and checkbook for any unusual activity. Make sure that all of the transactions are legitimate and that there are no unauthorized transactions.

By following these strategies, it is possible to effectively reconcile bank statements and ensure that all of the account activity is accurately reflected in the financial records. Taking the time to review the bank statement and checkbook for any discrepancies can help ensure that the financial records are accurate and up-to-date.

Tips for Avoiding Common Reconciling Mistakes

1. Review Your Bank Statement Carefully: Before beginning the reconciliation process, it is important to review your bank statement carefully to identify any discrepancies. Pay close attention to the date, amount, and description of each transaction to make sure it matches your records.

2. Reconcile Frequently: Reconciling your accounts frequently can help you spot any discrepancies quickly and easily. It is best to reconcile your accounts at least once a month, but more often is even better.

3. Double-Check Your Math: Always double-check your math to make sure that all of your calculations are correct. A simple error in your calculations can lead to a reconciliation mistake.

4. Use the Same Methodology Every Time: It is important to always use the same methodology when reconciling your accounts. This includes using the same starting and ending balances, the same method of calculating interest, and the same method of calculating fees.

5. Document Your Process: Documenting your reconciliation process can help you spot any errors or discrepancies quickly and easily. Make sure to keep accurate records of your reconciliation process and any discrepancies that you find.

6. Always Investigate Discrepancies: Whenever you encounter any discrepancies, it is important to investigate them. This can help you identify the cause of the discrepancy and take the necessary steps to correct it.

7. Seek Professional Help When Necessary: If you encounter any discrepancies that you cannot resolve on your own, it is important to seek professional help. An experienced accountant or bookkeeper can help you identify and resolve any reconciliation mistakes.

How to Use Technology to Streamline Bank Statement Reconciliation

Bank statement reconciliation is an essential part of any accounting process, as it helps to ensure accuracy and identify any discrepancies between the balances of two sets of financial records. The process consists of comparing individual transactions from the bank’s records with an organization’s internal accounting records. This process can be time consuming and tedious, but technology can help to streamline the process.

Modern technologies such as automated data feeds can be used to quickly synchronize bank and internal records, allowing transactions to be compared in a fraction of the time. These feeds can pull data directly from the bank, eliminating the need to manually input data into the accounting system. Additionally, software programs can be used to automate the entire reconciliation process. Automated reconciliation software can quickly compare transactions and generate reports that highlight any discrepancies. This can save a significant amount of time, as manual reconciliation processes can take several hours of work.

In addition to automated reconciliation, document imaging software can also help to streamline the process. Images of individual transactions can be quickly captured and stored, allowing for faster and easier comparison. This type of software also allows for quick access to older records, making it easy to reference past information.

By using modern technology to streamline the bank statement reconciliation process, organizations can save time and effort while still being able to accurately assess their financial records. Automated reconciliation software, data feeds, and document imaging software are all powerful tools that can help to simplify the process and improve accuracy.

Conclusion

In conclusion, Reconciling a Bank Statement Worksheet is an important tool for business owners and accountants to use in order to make sure that their financial records are accurate. It helps to compare the bank statement with the company’s financial records and determine if there are any discrepancies or corrections that need to be made. Reconciling a bank statement worksheet is a great way to ensure that the company’s financial records are accurate and up-to-date.

[addtoany]

![50+ Bank Reconciliation Examples & Templates [100% Free] For Reconciling A Bank Statement Worksheet](https://worksheet1.wp-json.my.id/wp-content/uploads/2023/02/50-bank-reconciliation-examples-templates-100-free-for-reconciling-a-bank-statement-worksheet.jpg)

![50+ Bank Reconciliation Examples & Templates [100% Free] For Reconciling A Bank Statement Worksheet](https://worksheet1.wp-json.my.id/wp-content/uploads/2023/02/50-bank-reconciliation-examples-templates-100-free-for-reconciling-a-bank-statement-worksheet-150x150.jpg)