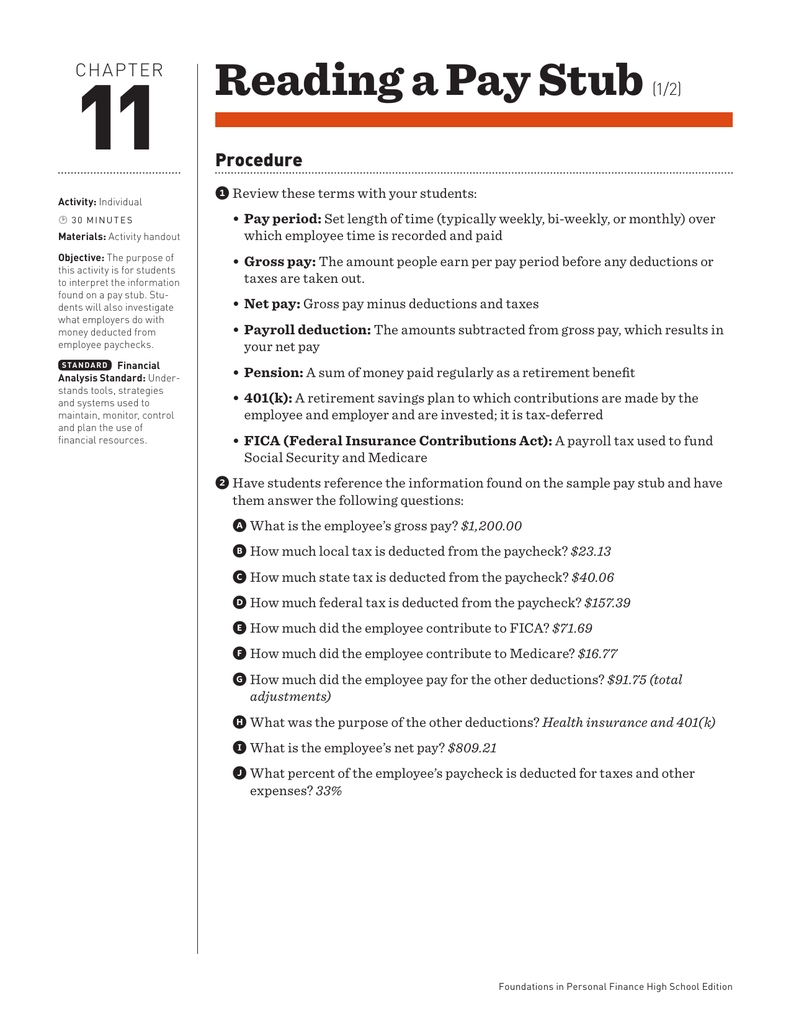

How to Read Your Pay Stub: A Step-by-Step Guide

A pay stub is a document that provides a record of an individual’s wages or salary and details the deductions made from their earnings. It is important to understand what is included on your pay stub so that you can ensure that your employer is accurately and properly calculating and withholding the appropriate taxes and other payments. The following is a step-by-step guide to help you understand how to read your pay stub.

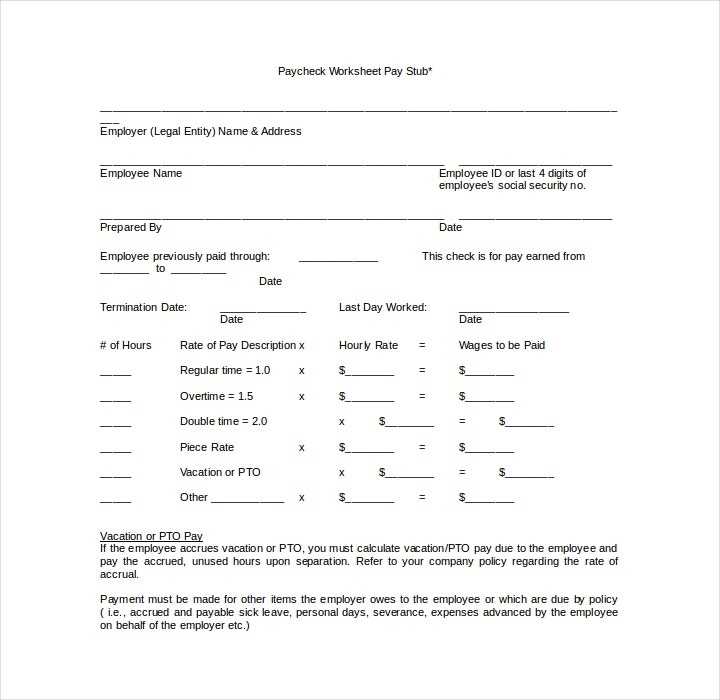

Step 1: Identify your pay period. Your pay stub will include the specific dates of the pay period that it covers. This is important to know as it indicates when you worked and when you will be paid.

Step 2: Locate your gross pay. This is the total amount of money you earned during the pay period before any deductions are taken out.

[toc]

Step 3: Look for deductions. Your pay stub will also include a list of deductions taken out of your gross pay. These deductions may include taxes, Social Security, Medicare, retirement contributions, health insurance premiums, and other deductions.

Step 4: Determine your net pay. After subtracting the deductions from your gross pay, you will see your net pay. This is the amount of money you will actually receive in your paycheck.

Step 5: Check for other information. Your pay stub may include other information such as the number of hours you worked and the rate of pay you received, as well as any additional payments or bonuses you may have earned.

By following this guide, you will be able to more easily understand your pay stub and ensure that you are being paid accurately.

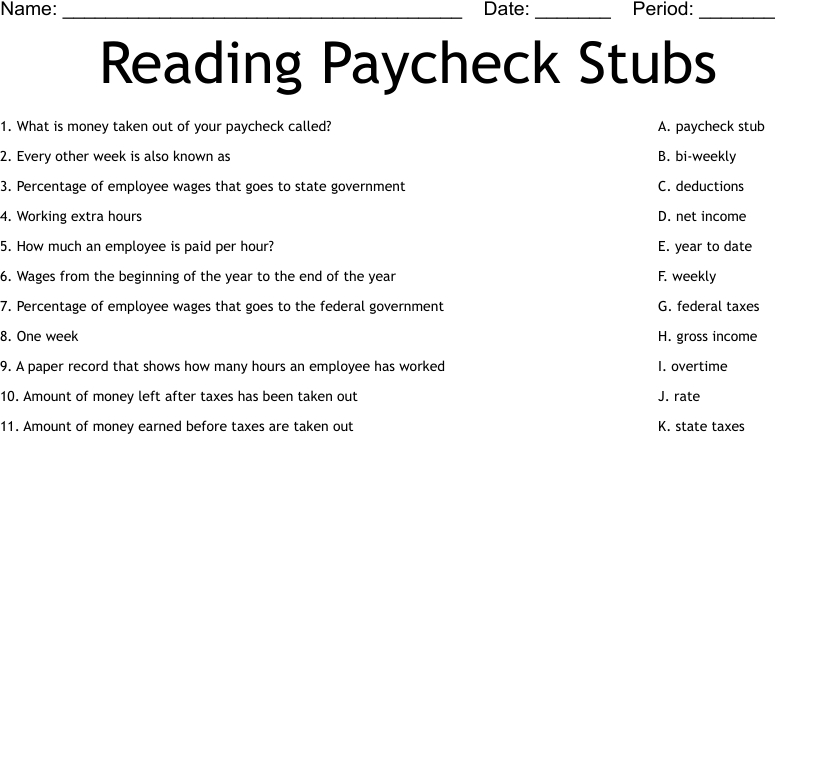

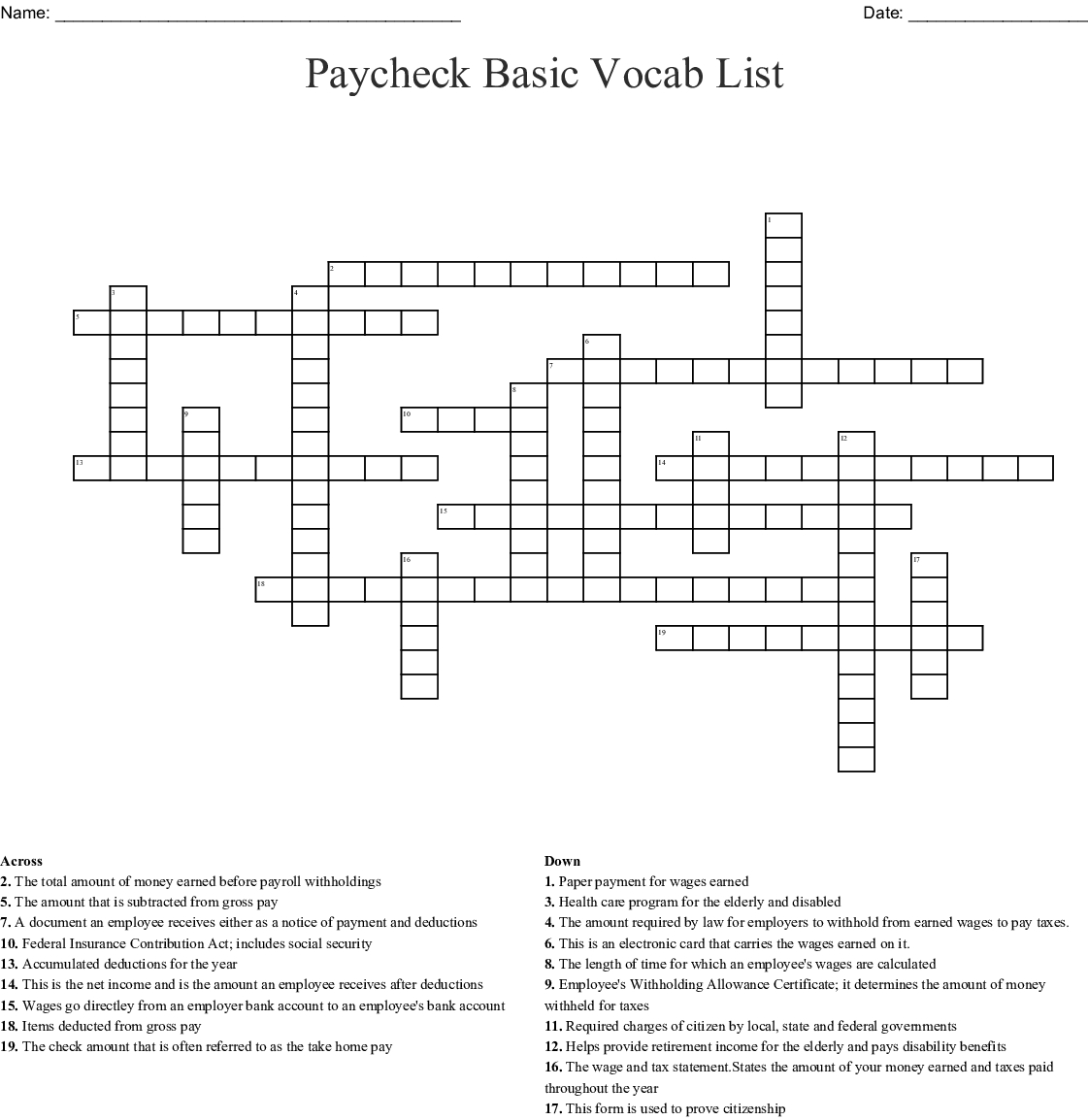

Deciphering Different Elements of a Pay Stub

A pay stub is a document that is issued by an employer to an employee detailing the employee’s wages for a given pay period. It usually contains several elements, which provide valuable information about the employee’s wages, taxes and other deductions.

The first element of a pay stub is the employee’s name and address. This is followed by the pay period dates, which indicate the start and end dates of the pay period. The total hours worked during the pay period is also listed.

The gross wages are the total wages earned by the employee before any deductions are taken out. This includes the employee’s base salary, overtime pay, bonuses, and other compensation.

The deductions section of the pay stub lists all the deductions taken from the employee’s gross wages, such as taxes, health insurance, and retirement contributions. The net wages are the total wages earned by the employee after all deductions have been taken out.

The last element of a pay stub is the net pay, which is the amount of wages that the employee actually received after deductions are taken out. This is the amount that will be deposited into the employee’s bank account or used for cash payments.

A pay stub provides an employee with a comprehensive overview of their wages, deductions, and net pay for a given pay period. It is a valuable tool for both employers and employees to keep track of wages and deductions.

Understanding the Benefits of Reading a Pay Stub Worksheet

Reading a pay stub is a highly beneficial activity that can help you better understand your compensation and employment benefits. A pay stub is a document that summarizes your gross earnings, deductions, and net pay for a given pay period. By reading and understanding your pay stub, you can gain important insight into your financial security.

One of the primary benefits of understanding your pay stub is that it allows you to verify that you are receiving the correct amount of pay for the hours you have worked. Pay stubs typically list the hours you have worked, the hourly rate, and the total amount you have earned during the pay period. As such, you can use your pay stub to ensure that your employer is accurately calculating and paying you for the hours that you have worked.

Reading a pay stub also gives you a better understanding of the deductions that are taken from your paycheck. Pay stubs typically list deductions such as taxes, health and dental insurance, retirement savings, and other deductions. By understanding these deductions, you can gain insight into your financial situation and better plan for your future.

In addition, understanding your pay stub can help you identify potential errors or discrepancies. By reading and understanding your pay stub, you can identify any errors or discrepancies in the information. This can be especially important if you suspect that there may be an error in the amount of money you have been paid.

Finally, understanding your pay stub can help you make informed decisions about your financial future. By understanding the deductions and other details listed on your pay stub, you can make decisions regarding how to allocate and save your money in order to maximize your financial security.

In conclusion, reading and understanding your pay stub is a highly beneficial activity that can help you verify your pay, identify deductions, identify any errors or discrepancies, and make informed decisions about your financial future.

Tips for Using a Pay Stub Worksheet to Make Smart Financial Decisions

1. Analyze Your Income. Before you can begin to make smart financial decisions, it is important to analyze your income. A pay stub worksheet can provide a useful starting point for this process, as it allows you to track your income on a regular basis. This will help you keep track of any changes in your salary or bonuses, as well as any deductions or taxes that are taken out.

2. Set Financial Goals. Once you have an understanding of your income, you can begin to set financial goals. A pay stub worksheet can be a great way to help plan your budget and track your progress. You can also use the worksheet to set savings goals, such as putting a certain percentage of your income into a retirement account or emergency fund.

3. Track Expenses. Keeping track of your expenses is essential to making smart financial decisions. A pay stub worksheet can be an extremely useful tool for this purpose. By tracking your expenses, you can identify where your money is going and make adjustments to your spending habits accordingly.

4. Monitor Your Credit Score. It is important to regularly monitor your credit score, as this will give you an indication of your overall financial health. A pay stub worksheet can be used to track any changes in your credit score, which can be useful for spotting any problems.

5. Establish a Savings Plan. Having a savings plan in place is essential for making smart financial decisions. A pay stub worksheet can be used to establish a savings plan, as it allows you to track your progress and make sure you are putting away enough money each month.

Using a pay stub worksheet can be a great way to make smart financial decisions. By tracking your income, setting financial goals, tracking expenses, monitoring your credit score, and establishing a savings plan, you can ensure that you are making sound financial decisions and taking control of your financial future.

Conclusion

Reading a pay stub worksheet can be a useful tool in helping you understand the details of your pay. It can help you identify any discrepancies and ensure that you are being paid correctly. Furthermore, understanding your pay stub can help you make informed decisions about your finances. Knowing how to read a pay stub can be a valuable skill, and it can help you manage your finances more efficiently.

[addtoany]