How to Use a Needs vs Wants Worksheet to Help Create a Financial Plan

Creating a financial plan is an important step in ensuring financial security and stability. A needs vs wants worksheet can help you prioritize your spending and create a plan that meets your financial goals. Here’s how to use a needs vs wants worksheet to create a financial plan:

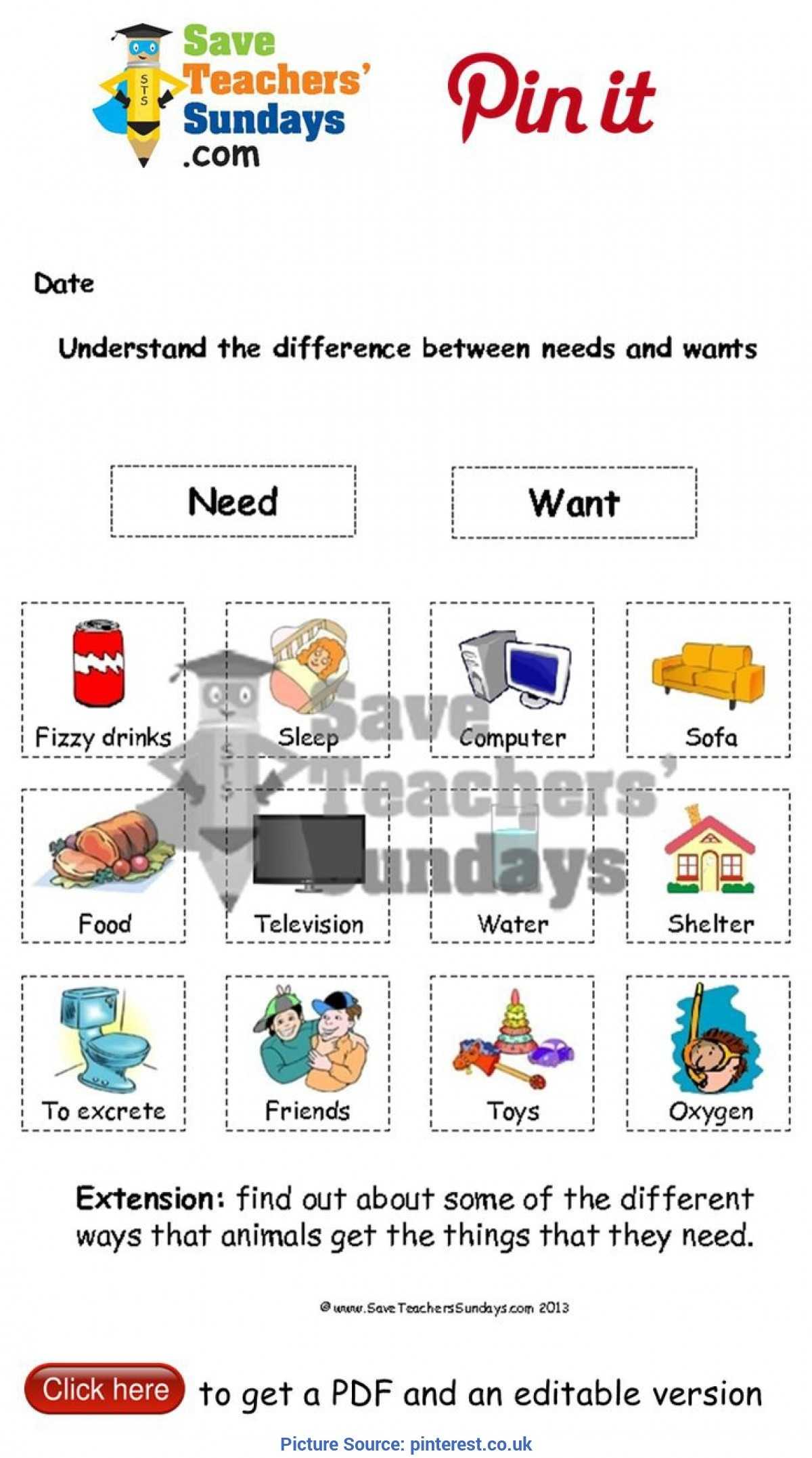

1. Identify your needs and wants. Start by making two columns on your worksheet – “Needs” and “Wants”. Make a list of the items you need to pay for every month, such as rent, food, and utilities. Then make a list of the things you want to spend money on, such as entertainment, vacations, and luxury items.

2. Prioritize your needs and wants. Once you have your lists, it’s important to prioritize them. Start by noting which needs are most important, such as housing, food, and utilities. Then prioritize the wants. Consider how much money is available for each item and which items are the most important to you.

[toc]

3. Calculate your budget. After you have prioritized your needs and wants, it’s time to calculate your budget. Start by subtracting your needs from your income. Then add up the cost of the wants and subtract that from your income. The final number is your budget for the month.

4. Track your spending. Once you have a budget, it’s important to track your spending. Use your worksheet to note how much you have spent on each item and how much you have left in your budget. This will help you stay on track and ensure you don’t overspend.

Using a needs vs wants worksheet can help you create a financial plan that meets your needs and allows you to budget for your wants. By prioritizing your spending and tracking your progress, you can create a plan that will help you reach your financial goals.

Understanding Your Needs and Wants with a Needs Vs Wants Worksheet

A Needs Vs Wants Worksheet can be a helpful tool in understanding the difference between your needs and wants. By taking the time to identify and categorize your needs and wants, you can gain a better understanding of your priorities and determine where to allocate your resources.

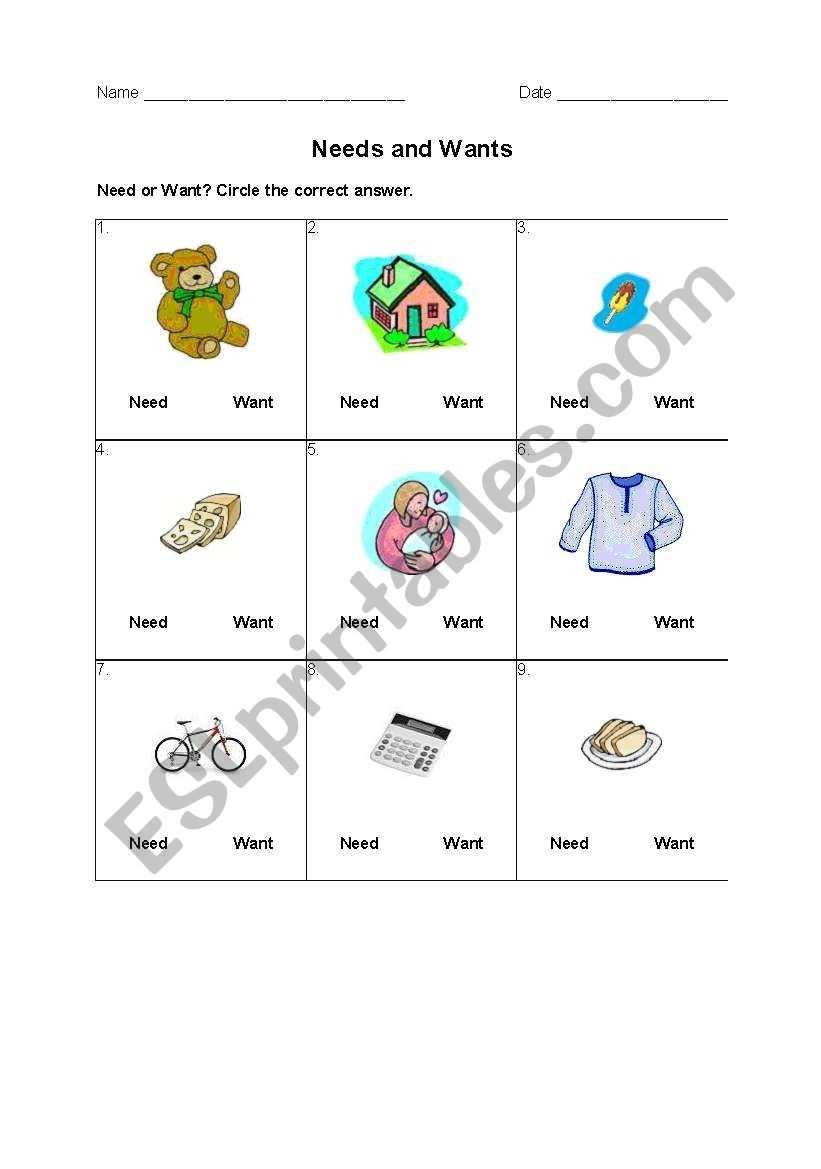

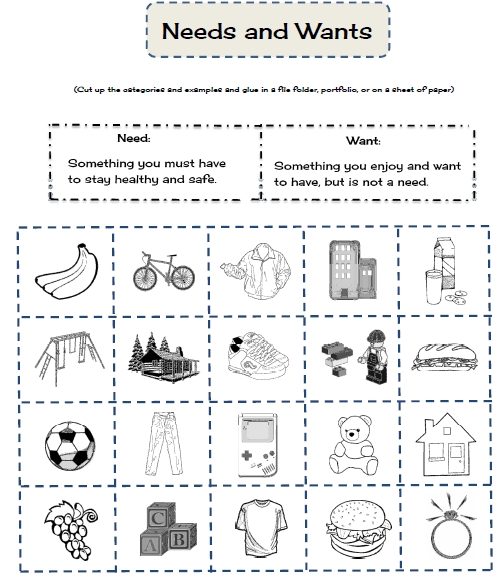

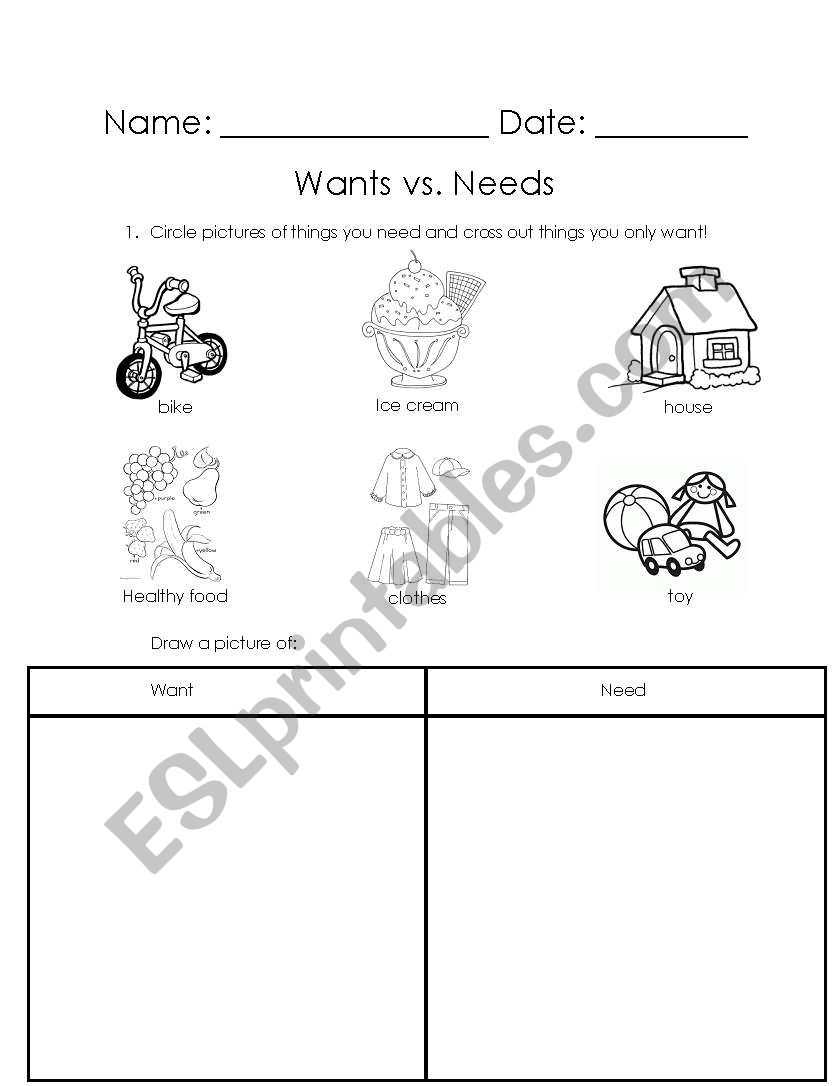

A Needs Vs Wants Worksheet typically consists of two columns—one column for needs and one column for wants. In the needs column, you would list items that are essential to your well-being or that fulfill basic life requirements. These could include items such as food, clothing, and shelter. In the wants column, you would list items that are not necessary for survival, but would improve your quality of life. This could include items such as a new car, a vacation, or a new wardrobe.

By completing a Needs Vs Wants Worksheet, you can get a better understanding of your priorities and financial goals. You can identify items that are essential to your well-being that should be given priority when allocating your resources. At the same time, you can also identify items that are not necessary for survival, but could pay off in the long run if you have the resources to invest in them.

By taking the time to complete a Needs Vs Wants Worksheet, you can make sure that you are spending your money on items that are important to you and that you can afford. This can help you stay on track towards achieving your financial goals and leading a comfortable and fulfilling life.

Exploring the Benefits of a Needs Vs Wants Worksheet for Financial Planning

Financial planning is a necessary part of life for individuals and families. A needs-vs-wants worksheet can be an invaluable tool for managing money and developing financial security. By using a needs-vs-wants worksheet, individuals can assess their current financial situation and develop a plan for their future.

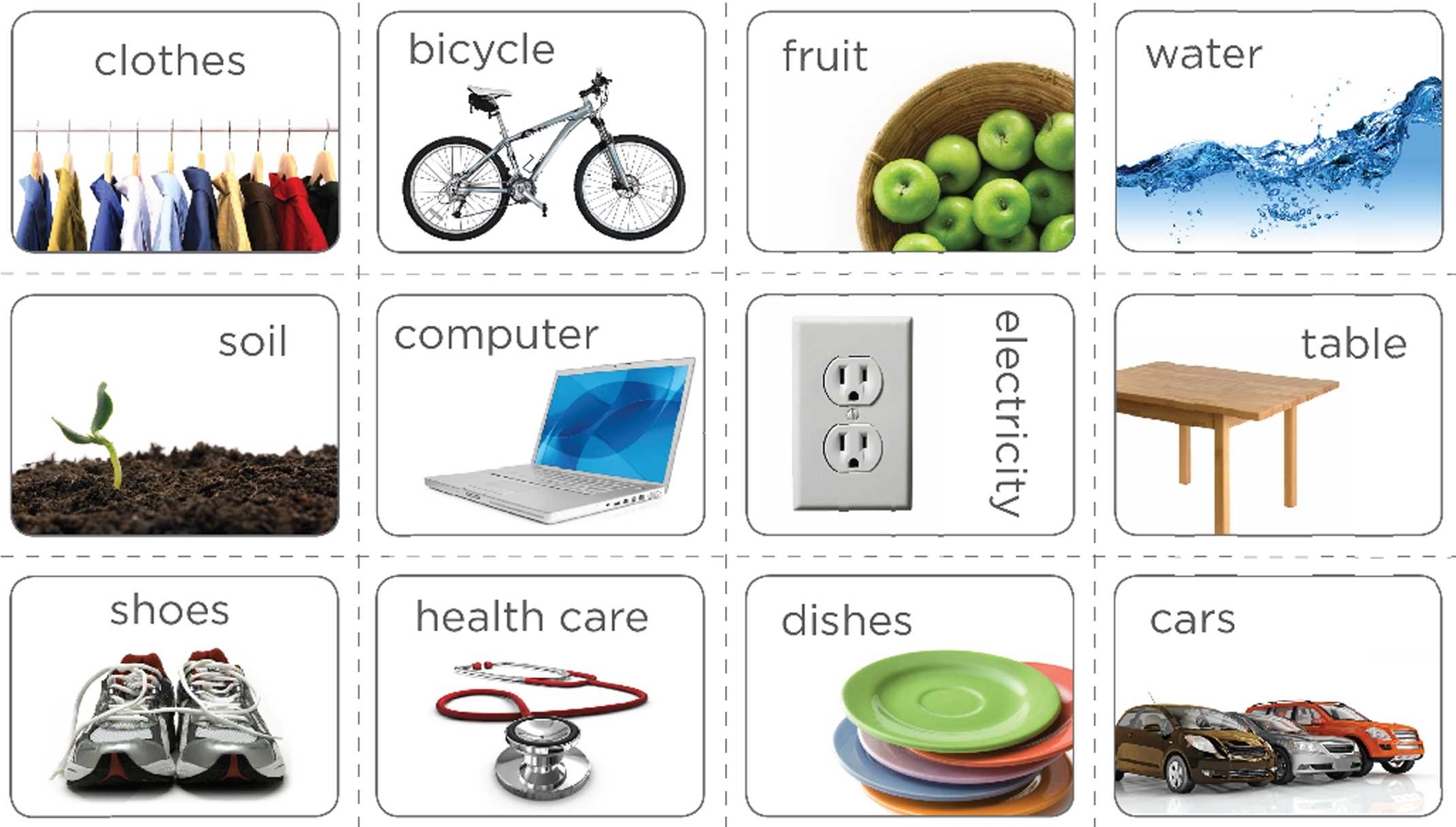

A needs-vs-wants worksheet is a tool that helps individuals to differentiate between needs and wants when it comes to financial planning. Needs are items or services that are essential to maintaining life and health, while wants are items or services that are desired but not essential. By identifying and prioritizing needs, individuals are better able to focus their financial resources on the essential items first.

The worksheet can be used to list out all the items a person needs, such as food, housing, healthcare, and transportation, as well as the items they want, such as vacations, new cars, and entertainment. By comparing the relative importance of the items, individuals can make better-informed decisions about how to allocate their financial resources.

The worksheet can also be used to help individuals develop a budget. By identifying the most important needs and wants, it can be easier to determine how much money should be allocated to each category. This can help individuals stay within their budget and avoid overspending on unnecessary items.

Using a needs-vs-wants worksheet can also help individuals plan for the future. By estimating the cost of needed items and determining the amount of money needed to cover them, individuals can begin to save for long-term goals like retirement or college. The worksheet can also be used to identify areas where individuals can cut back on spending in order to save more money.

A needs-vs-wants worksheet is a powerful tool that can help individuals and families manage their finances and plan for the future. By identifying and prioritizing needs and wants, individuals can make better decisions about how to allocate their financial resources. The worksheet can also be used to develop a budget and to plan for long-term goals like retirement or college. By using a needs-vs-wants worksheet, individuals and families can take control of their financial future and develop financial security.

Conclusion

The Needs Vs Wants Worksheet provides a useful tool for individuals to think through their current needs and wants, and to prioritize their budget accordingly. This worksheet encourages individuals to think about their financial priorities and how best to meet their needs and wants. It can also be used as a tool to understand what is needed and what is wanted, and how to best allocate resources to meet those needs and wants. Ultimately, the Needs Vs Wants Worksheet is an invaluable tool to help individuals make better financial decisions.

[addtoany]