How to Use a Home Daycare Tax Worksheet to Maximize Your Tax Savings

Using a home daycare tax worksheet can help maximize tax savings and ensure that you are taking full advantage of all tax deductions available to you. A home daycare tax worksheet is designed to help you calculate your potential tax savings based on the expenses you incurred throughout the year related to running your home daycare business.

To use a home daycare tax worksheet, first gather all of your daycare business records and receipts. These records should include any costs you incurred while running your daycare, such as supplies, equipment, advertising, and professional fees. Once you have all of your records, you can begin to fill out the home daycare tax worksheet.

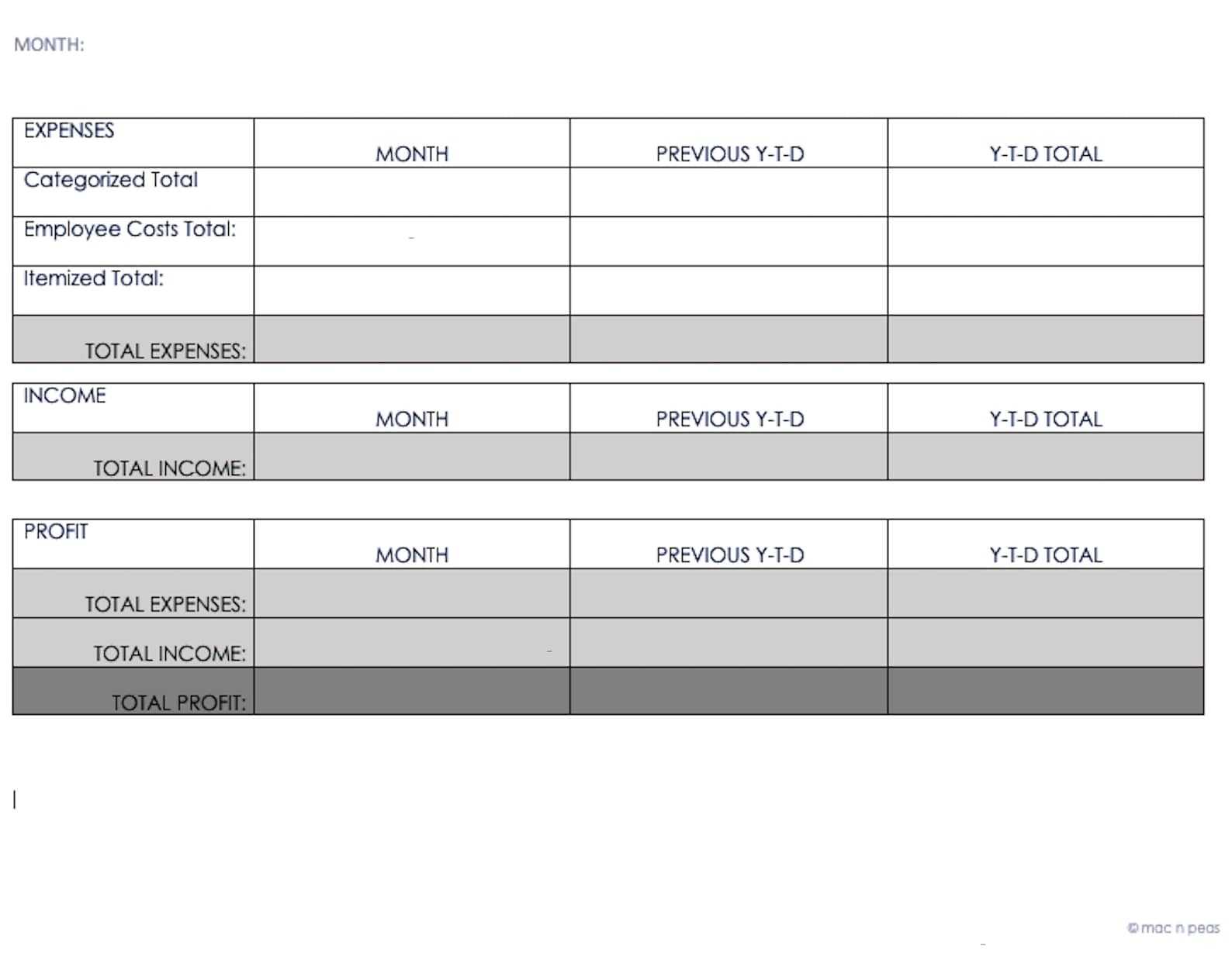

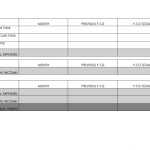

The home daycare tax worksheet should include columns for different categories of expenses. For example, it should have columns for supplies, advertising, salaries, and other expenses. Once you enter all of your expenses into the home daycare tax worksheet, you can begin to calculate your potential tax savings.

[toc]

To calculate your tax savings, you will need to subtract the total of all of your expenses from your total income. This will give you your total taxable income, which is the amount of income you will be taxed on. From there, you can use the tax worksheet to determine your total tax savings.

Using a home daycare tax worksheet can help you maximize your tax savings by ensuring you are taking full advantage of all tax deductions available to you. You can also use it to plan ahead for future tax years to ensure you are taking full advantage of available deductions and credits. With the right home daycare tax worksheet, you can maximize your tax savings and ensure you are staying compliant with IRS regulations.

The Benefits of Keeping Detailed Records with a Home Daycare Tax Worksheet

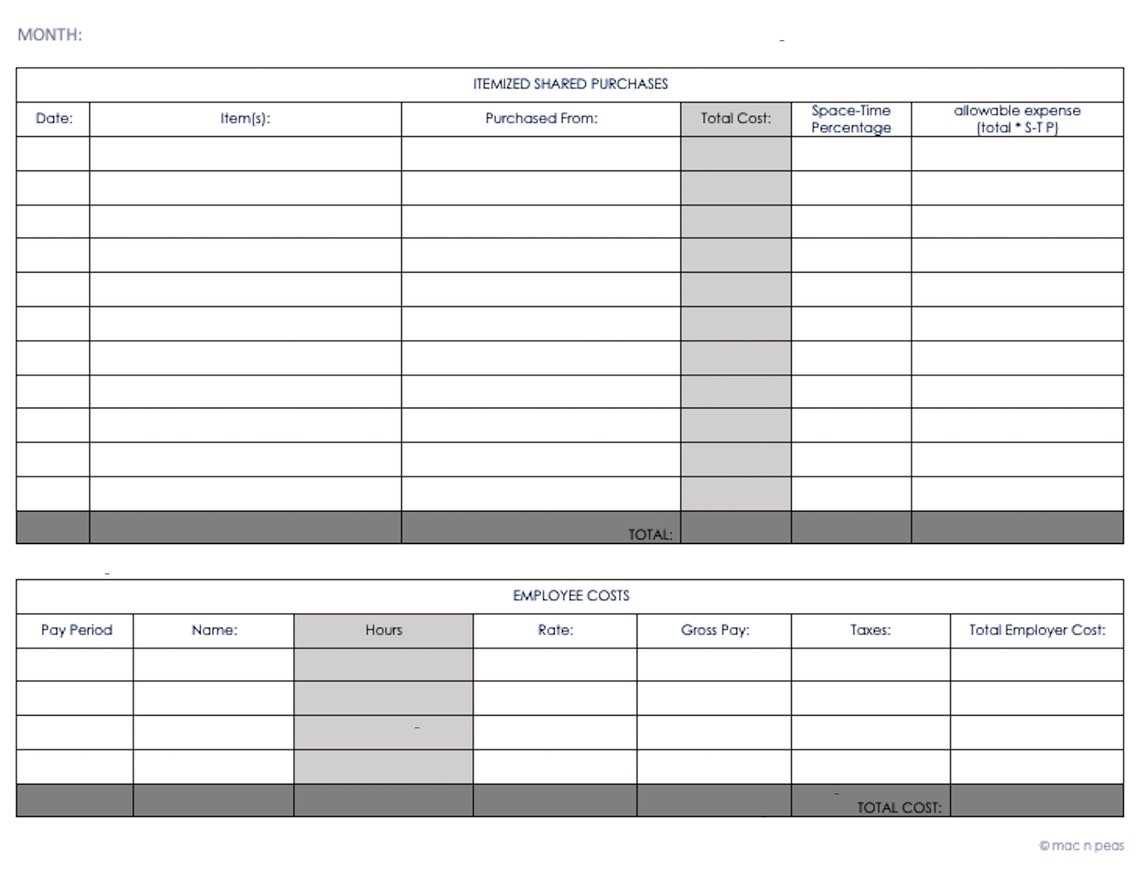

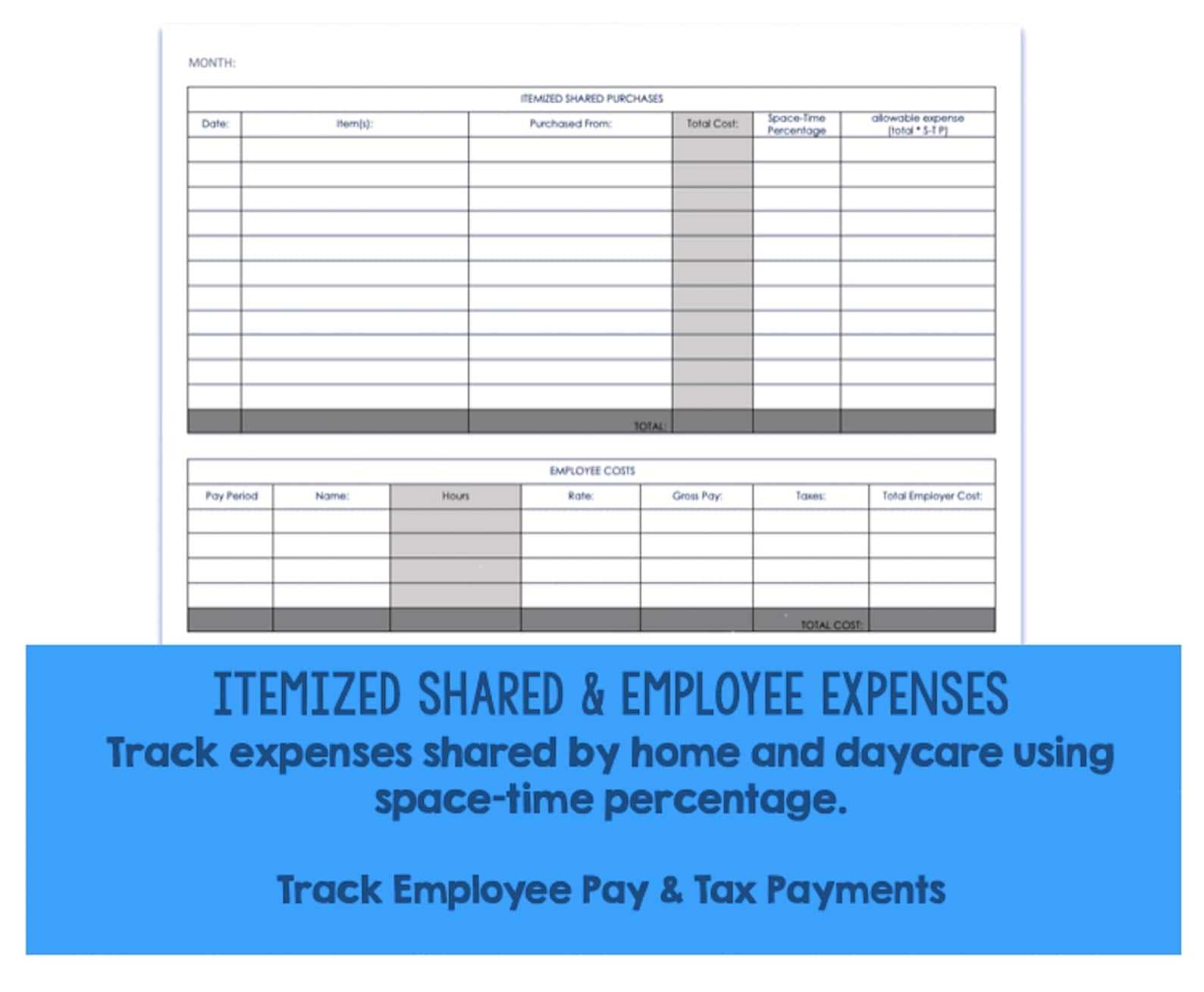

Keeping detailed records with a home daycare tax worksheet is an important step for daycare providers to ensure accurate reporting of their business income and expenses. It is also beneficial for the daycare provider to track the amount of time spent on each activity, such as childcare and administrative tasks, which can be used to calculate the percentage of time spent on each activity.

A home daycare tax worksheet helps to ensure that all income and expenses are recorded accurately and on time, which can be a key factor in filing taxes and avoiding costly penalties. It is also beneficial for tracking the cost of items purchased and the amount of time spent on each activity. The details of each individual transaction can be tracked in the worksheet, which can be used to determine the total cost of each activity.

This information can then be used to calculate the percentage of time spent on each activity, which can be used as a guide for allocating time appropriately. By tracking the time spent on each activity, the daycare provider can ensure they are meeting their obligations and providing the best service to their clients.

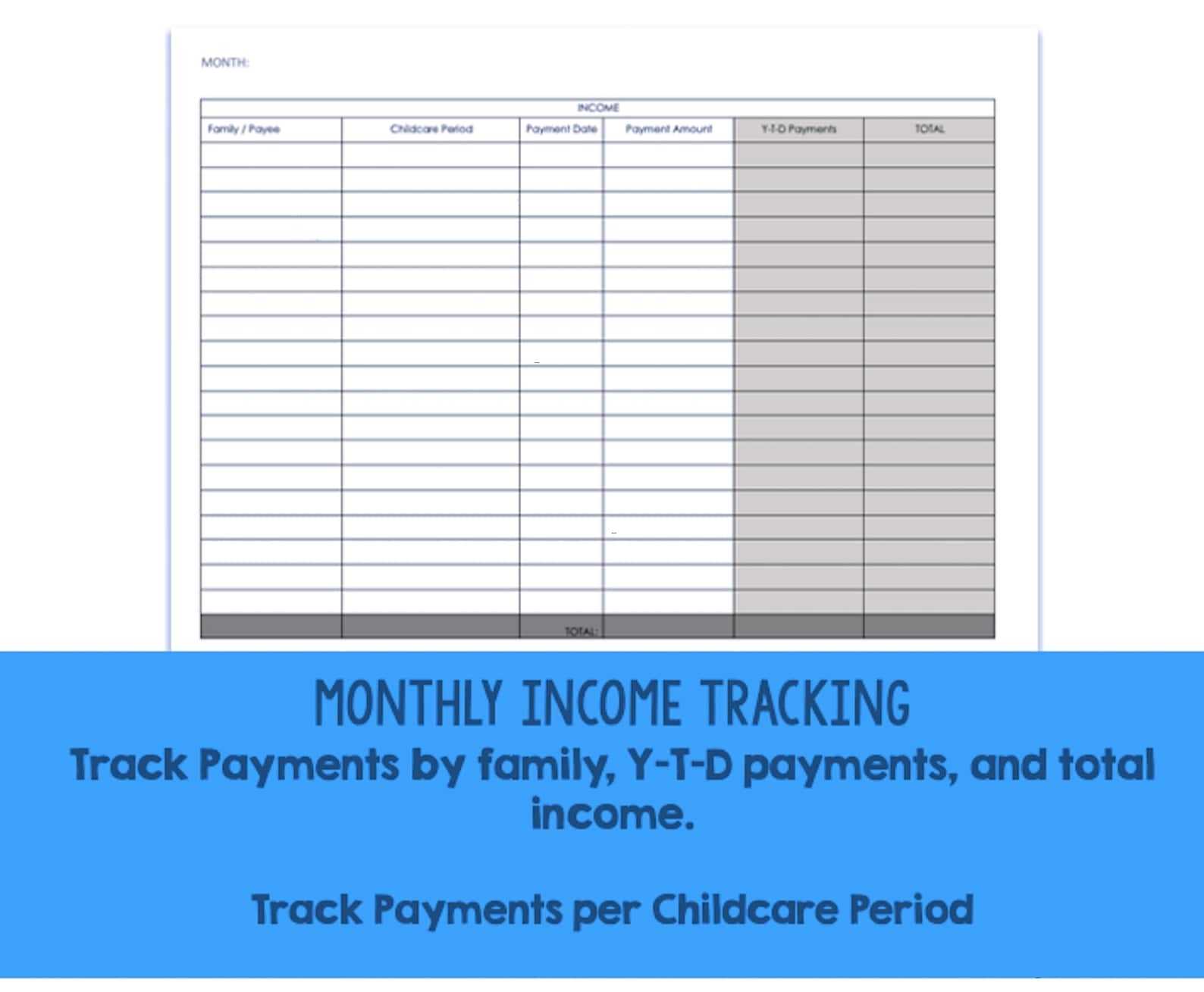

A home daycare tax worksheet can also be used to track the total amount of income earned per month. This information can be used to calculate the total amount of tax owed for the month and to estimate the amount of income tax refunds that may be due.

Finally, a home daycare tax worksheet can also be used to keep track of the cost of each activity. This information can help the daycare provider determine how much to charge for each activity and to determine whether or not they are providing a profitable service. By tracking all expenses, the daycare provider can determine whether or not they are making a profit.

Keeping detailed records with a home daycare tax worksheet can be an invaluable tool for daycare providers. The information can be used to ensure accurate reporting of income, expenses, and profits, as well as for tracking the cost of each activity. This can help the daycare provider to ensure their business is running efficiently and to ensure they are providing the best service to their clients.

How to Create an Effective Home Daycare Tax Worksheet for Your Business

Creating an effective home daycare tax worksheet is essential for any business and can help to ensure that you are accurately tracking and reporting your income and expenses. A quality tax worksheet should include all of the necessary information that you need to accurately and efficiently complete your tax returns.

To create an effective home daycare tax worksheet, the following steps should be taken:

1. Identify your daycare’s income sources. It is important to accurately record all of the sources of income for your daycare, such as fees charged for services, grants, and reimbursements. Make sure to include any other income sources that may be applicable to your business.

2. Record all of your daycare expenses. All of the expenses associated with running your daycare should be listed on the worksheet. This includes anything from supplies to utilities. Make sure to include any payments that you make to other businesses as well.

3. Calculate the total amount of income and expenses. After you have listed all of your income and expenses, you should add them up to determine your net profit or loss.

4. Include any applicable deductions. Any applicable business deductions should be included on the tax worksheet so that you are able to take advantage of them when filing your taxes.

5. Review your information and make any necessary changes. Once you have completed your worksheet, you should review the information to make sure that you have accurately recorded all of your income and expenses. Make any changes that are necessary and ensure that all of the information is correct before filing your taxes.

By following these steps, you should be able to create an effective home daycare tax worksheet for your business. This will help to ensure that your taxes are accurately and efficiently completed, allowing you to maximize your deductions and minimize your tax liability.

Conclusion

Overall, the Home Daycare Tax Worksheet is an important tool for individuals who are running or considering running a home daycare. It can help them determine their tax deductions, expenses, and income, as well as provide important information about their financial situation. By taking the time to fill out the Home Daycare Tax Worksheet, individuals can ensure that they are on the right track when it comes to managing their finances and running a successful home daycare business.

[addtoany]