How to Use the Fed Up Worksheet Answer Key to Create a Financial Plan

Creating a financial plan is essential for anyone looking to achieve financial stability and achieve their long-term goals. The Fed Up Worksheet Answer Key is an invaluable resource for anyone looking to create a comprehensive financial plan. This answer key provides a comprehensive overview of the key elements of a financial plan and outlines the necessary steps to develop an effective plan.

The first step in using the answer key as a guide for creating a financial plan is to take stock of your current financial situation. This includes identifying any sources of income, any debts and liabilities, and any assets you currently possess. This information will help you determine your net worth and provide a base from which to work.

Once you have identified your current financial situation, you can begin to use the answer key to develop a budget. This includes setting a realistic income goal, determining how much you can afford to save each month, and creating a budget to ensure that you do not overspend. Additionally, you should create a list of expenses and prioritize them according to importance. This will help you to ensure that you are living within your means and managing your finances effectively.

[toc]

Once you have identified your budget, you can begin to use the answer key to create a savings plan. This includes setting up a retirement account, an emergency fund, and any other savings accounts that may be beneficial. Additionally, it is important to set goals for these accounts to ensure that you are saving enough money to meet your long-term goals.

Finally, the answer key can be used to identify any potential investments you may be interested in. This includes stocks, bonds, mutual funds, and other investments. It is important to research the markets and understand the risks associated with each investment before making any commitments. Additionally, you should consult with a financial advisor to ensure that you are making educated decisions.

Using the Fed Up Worksheet Answer Key as a guide, you can create a comprehensive financial plan that will help you achieve financial stability and reach your long-term goals. By taking stock of your current financial situation, budgeting, setting up a savings plan, and identifying potential investments, you can ensure that you are able to take control of your finances and achieve your financial goals.

Exploring the Benefits of the Fed Up Worksheet Answer Key

The Fed Up Worksheet Answer Key is an indispensable tool for individuals who are looking to better manage their finances. This comprehensive guide provides a clear and concise explanation of the different aspects of personal finance, from budgeting and saving to managing debt and investments.

The worksheet is divided into several sections, each focusing on a specific aspect of personal finance. This allows for a more organized approach to learning and understanding the concepts. Additionally, the worksheet provides helpful tips and advice for those who are just starting out in the world of finances.

The first section of the answer key provides an overview of the budgeting process. This includes an explanation of the different types of expenses, income sources, and investments. Additionally, the worksheet offers guidance on the best ways to save money and how to make an effective budget.

The second section of the answer key focuses on debt management. This includes an explanation of the different types of debt, such as credit cards, mortgages, and student loans. Additionally, the worksheet provides advice on how to effectively manage debt and how to create a plan for paying it off.

The third section of the answer key focuses on investments. This includes an explanation of different investment options, such as stocks, bonds, mutual funds, and real estate. Additionally, the worksheet provides advice on how to analyze different investments and how to create a plan for investing.

The fourth section of the answer key provides an overview of retirement planning. This includes an explanation of the different types of retirement accounts, such as 401(k)s, IRAs, and Roth IRAs. Additionally, the worksheet provides tips and advice on how to create a retirement plan that is tailored to one’s individual needs.

The Fed Up Worksheet Answer Key is an invaluable tool for those who are looking to better manage their finances. This comprehensive guide provides a clear and concise explanation of the different aspects of personal finance, from budgeting and saving to managing debt and investments. By using this resource, individuals will be able to maximize their financial success and gain a better understanding of the various aspects of personal finance.

Developing a Personal Budget with the Fed Up Worksheet Answer Key

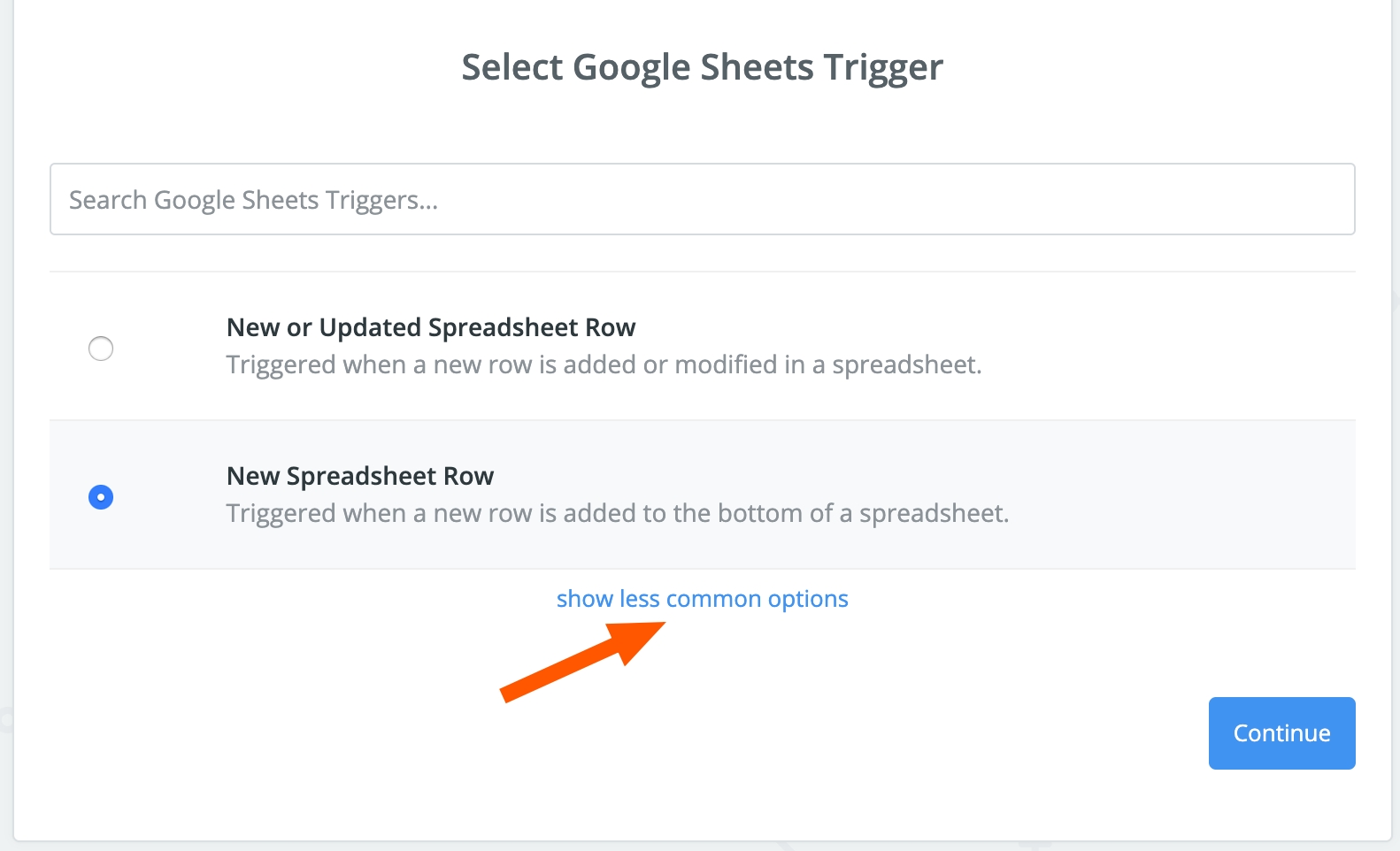

Creating a personal budget is an important step to achieving financial stability. The Federal Reserve Bank of Minneapolis has created a worksheet to help individuals develop a budget. The worksheet, “Fed Up: Take Control of Your Finances” provides an answer key that can help guide individuals through the process of constructing a personal budget.

The answer key for the Fed Up worksheet begins by asking for the amount of income earned each month. This includes all sources of income, such as full-time employment, part-time jobs, freelance work, and any other form of compensation. After entering this information, users are prompted to list their expenses. This includes fixed costs, such as rent, utilities, and car payments, as well as variable costs, such as groceries and fuel.

The next step of the answer key is to assign a percentage of income to each expense category. This will help individuals determine the amount of income they should allocate to each area. For instance, housing expenses should be no more than 30% of a person’s income. This step ensures that individuals are not overspending in any one area.

The last step of the Fed Up answer key is to create a spending plan. This plan outlines how much of an individual’s income should be set aside for saving and investing. It also helps individuals keep track of their spending and ensure that they are not overspending in any one area.

By utilizing the answer key for the Fed Up worksheet, individuals can create a budget that meets their needs and helps them achieve financial stability. Developing a budget is an important step to managing personal finances and the answer key provided by the Federal Reserve Bank of Minneapolis makes this process easier.

Strategies for Overcoming Financial Struggles with the Fed Up Worksheet Answer Key

1. Develop a budget: Developing a budget is the most important step in tackling financial struggles. By tracking your income and expenses, you can have a better understanding of your financial situation and make adjustments to ensure you are spending within your means.

2. Make savings a priority: Establishing a savings plan is key to overcoming financial struggles. Aim to save a predetermined percentage of your income each month and keep this amount separate from your spending money.

3. Pay down debt: Paying down debt is essential to overcoming financial struggles. Start by paying off the debt with the highest interest rate first, and then work your way down.

4. Look for ways to reduce expenses: Reducing expenses can free up additional funds for savings, debt repayment, and other financial goals. Look for ways to reduce your spending, such as cutting back on eating out and taking on a side hustle to earn extra income.

5. Seek help: If your financial struggles persist, it may be helpful to seek help from a financial professional. A financial planner can provide guidance and advice to help you create a plan of action to achieve your financial goals.

Conclusion

The Fed Up Worksheet Answer Key provides a comprehensive guide to help students understand the causes of the financial crisis and the government’s response to it. By studying the answers to the worksheet, students can gain insight into the federal government’s actions during the crisis and learn how their decisions affected the economy. This is an important lesson for students to learn and understand, as it can help them make informed decisions in their own financial lives.

[addtoany]