How to Use a Balancing A Checkbook Worksheet to Track Your Finances

Balancing a checkbook worksheet is a great tool for tracking your finances and making sure you stay within your budget. This worksheet is designed to help you see where your money is going, and where you can make changes to save money. With a few simple steps, you can use the worksheet to track your finances and ensure that you are staying in control of your money.

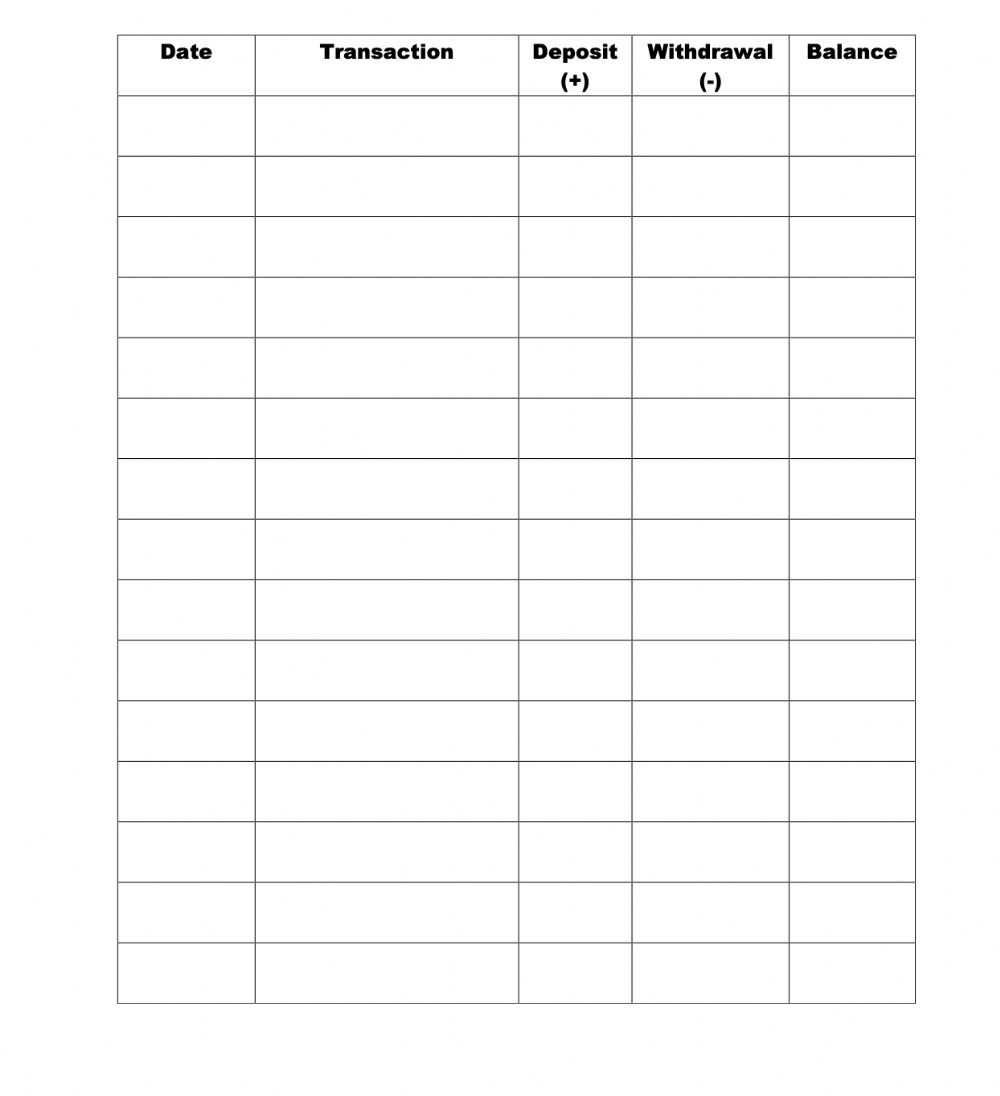

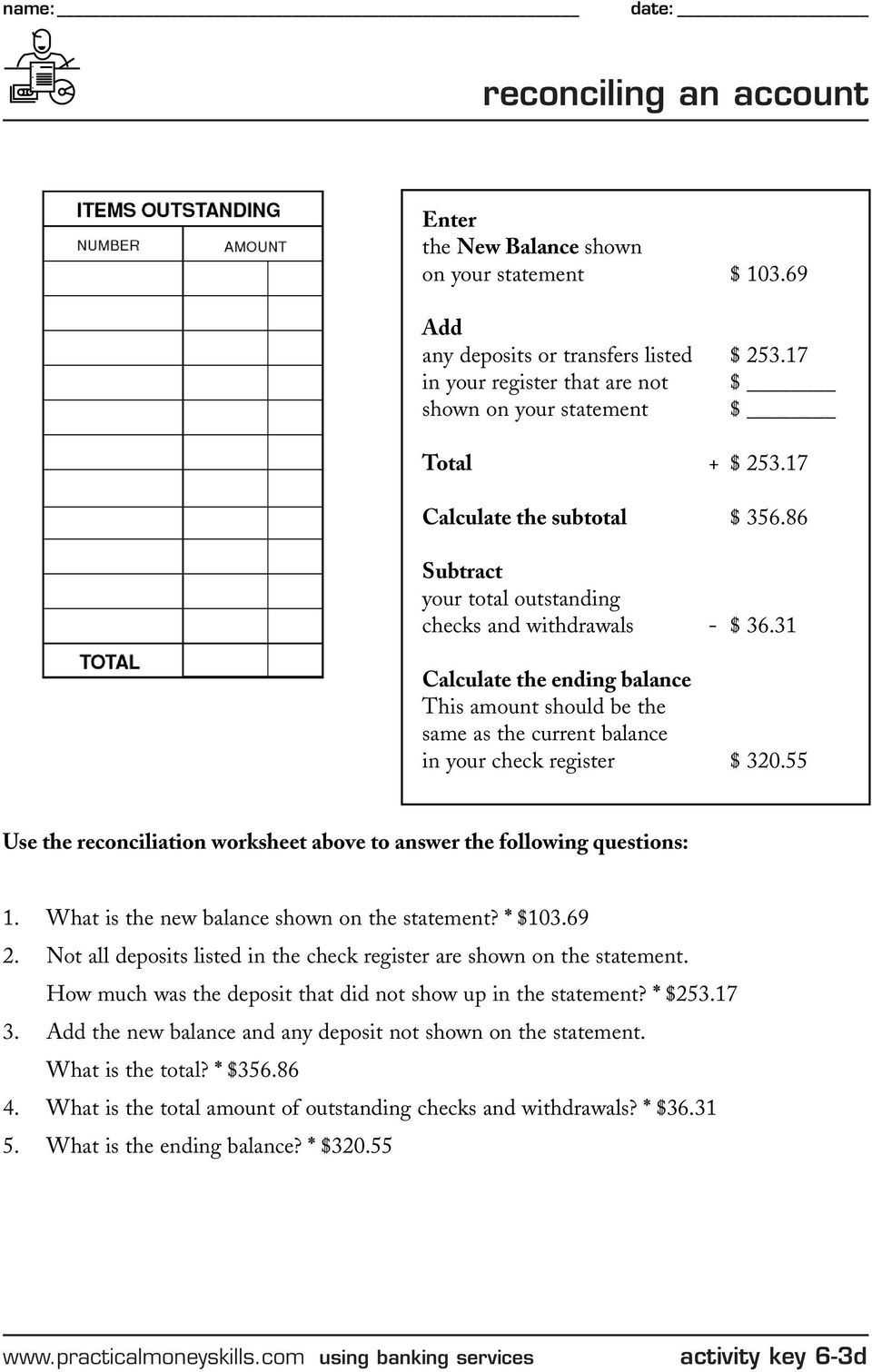

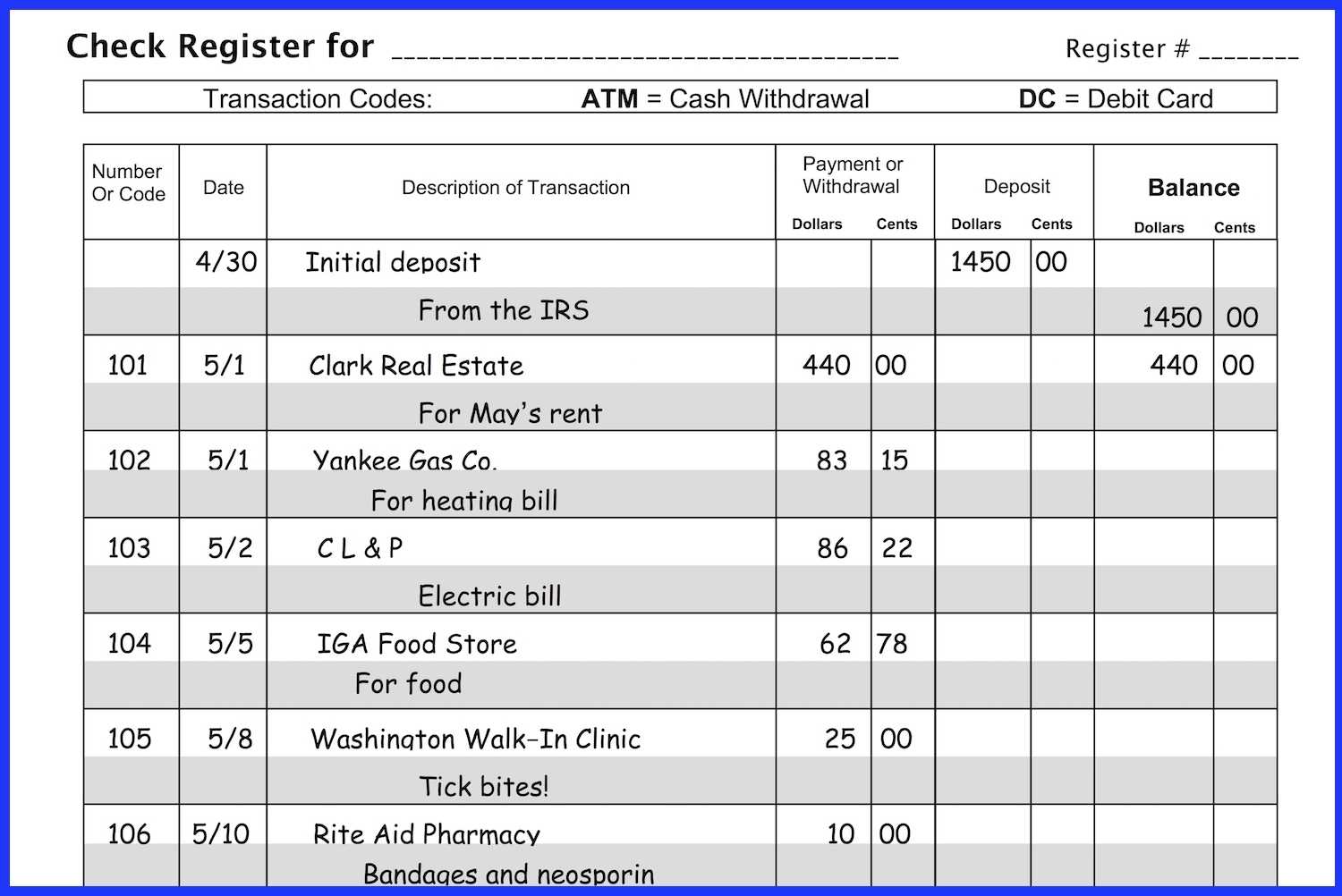

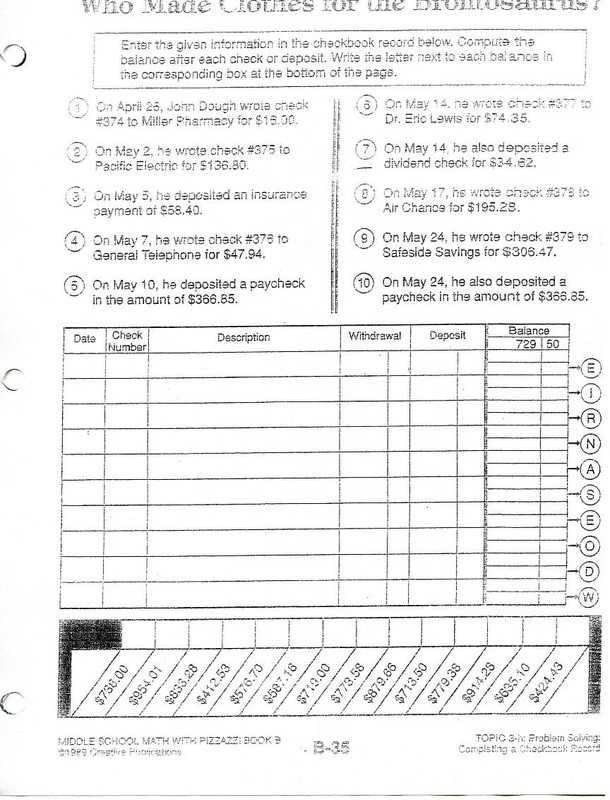

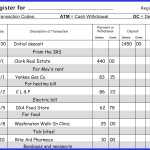

The first step to using a balancing a checkbook worksheet is to record all of your transactions. This includes any deposits, withdrawals, or transfers. When you record your transactions, make sure to include the date, amount, and any other information that is necessary. This information will be used to help you balance your checkbook.

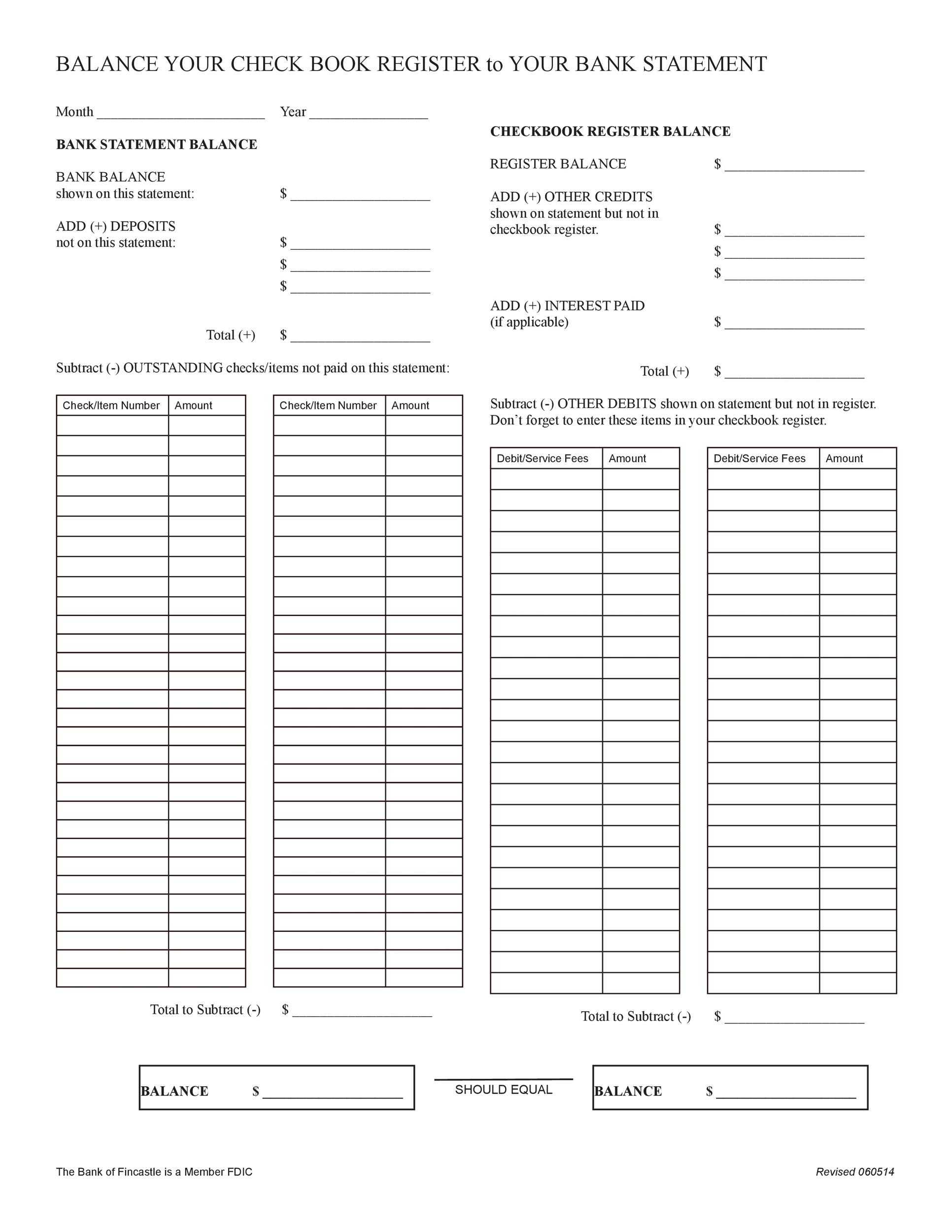

Once you have recorded all of your transactions, the next step is to total up the amount of each transaction. This will give you an overview of your financial activity. If you notice any discrepancies or discrepancies between your records and the total amounts, make sure to adjust the amount accordingly.

[toc]

After you have totaled up all of your transactions, you can begin to use the checkbook worksheet to balance your checkbook. To do this, you will need to subtract the amount of each transaction from the total amount of each transaction. This will give you the balance that you need to enter into the worksheet.

Once you have entered the balance into the worksheet, you can compare it to your current balance. If there is a difference, make sure to adjust the balance accordingly. This will help you keep track of your finances and make sure that you are staying within your budget.

By using a balancing a checkbook worksheet, you can track your finances and make sure that you are staying within your budget. With a few simple steps, you can use the worksheet to track your finances and make sure that you are staying in control of your money.

The Benefits of Balancing a Checkbook Worksheet as Part of Your Money Management Strategy

Balancing a checkbook is an important part of creating and maintaining a sound money management strategy. Keeping accurate records of your spending and tracking your account balances can help you stay on top of your finances and help you avoid costly mistakes. A balancing worksheet is an effective tool for managing your finances and can help you stay on track with your budgeting.

One of the main benefits of using a balancing worksheet is that it helps you stay organized. By writing down all of your transactions, you can easily look back and review your spending patterns. This can help you identify potential issues or areas where you may be able to make adjustments to your budget. Additionally, it helps you keep your records up to date, so that you can quickly check your account balance if needed.

A balancing worksheet can also provide you with a better understanding of your spending habits. By including all of your transactions, you can easily identify any potential problem areas and make changes, if necessary. This can help you create a more accurate budget and ensure that you are not overspending.

A balancing worksheet can also help you determine how much money you need to save each month. By tracking your spending, you can determine how much money you need to set aside each month to meet your financial goals. This can help you stay on track with your budget and ensure that you are able to save as much as possible.

Finally, using a balancing worksheet as part of your money management strategy can help you identify areas where you may need to make changes. This can help you create a budget that is tailored to your individual needs, allowing you to make the most of your money and save for the future.

Balancing a checkbook is an important part of creating and maintaining a sound money management strategy. Using a balancing worksheet can help you stay organized, review your spending patterns, and determine how much money you need to save each month. With this effective tool, you can easily create a budget that fits your individual needs and ensures that you are able to meet your financial goals.

Tips for Keeping Your Balancing A Checkbook Worksheet Accurate and Up to Date

1. Track Your Transactions: Make sure to record all of your transactions in your checkbook register as soon as they occur. This way, you can keep track of all of your expenses and be sure that your account balance is accurate.

2. Update Regularly: You should update your checkbook register at least once a week. This will help you stay on top of any changes or discrepancies in your account balance.

3. Reconcile Your Account: Reconciling your account on a regular basis is an important part of keeping your checkbook register accurate. Make sure to check your bank statement each month and compare it to your checkbook register. This will help you identify any discrepancies and make sure your account balance is correct.

4. Review Your Entries: Periodically review your entries to ensure that everything is accurate. This will help you catch any errors or mistakes that you may have made when recording transactions.

5. Keep Track of Interest Payments: If you have any interest payments, make sure that you record these in your checkbook register. Interest payments can affect your account balance, so it’s important to keep track of them.

6. Get Professional Help: If you are having difficulty keeping your checkbook register accurate and up to date, consider getting some professional help. A qualified accountant or financial advisor can help you manage your finances and make sure your checkbook register is accurate.

Conclusion

Balancing a checkbook worksheet is a great tool for managing your finances. It can help you stay organized and ensure that your bank account is accurate and up to date. With a little practice and patience, you can easily learn how to balance your checkbook and take control of your money. With a balanced checkbook, you can save time and money by avoiding overdraft fees, managing your budget and tracking your spending.

[addtoany]