How a Wants Vs Needs Worksheet Can Help You Prioritize Your Spending

A wants vs needs worksheet can be a helpful tool in managing your finances. By clearly delineating the difference between what you want and what you need, you can prioritize your spending to ensure that your basic needs are met first.

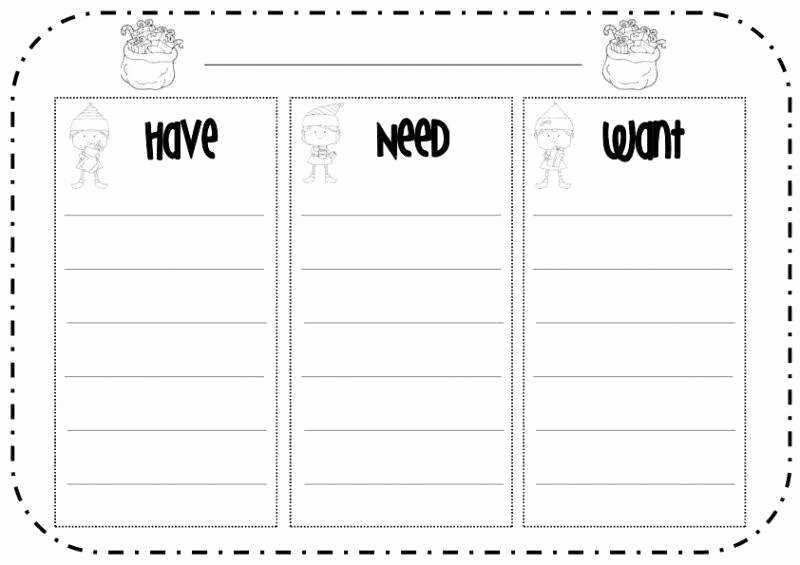

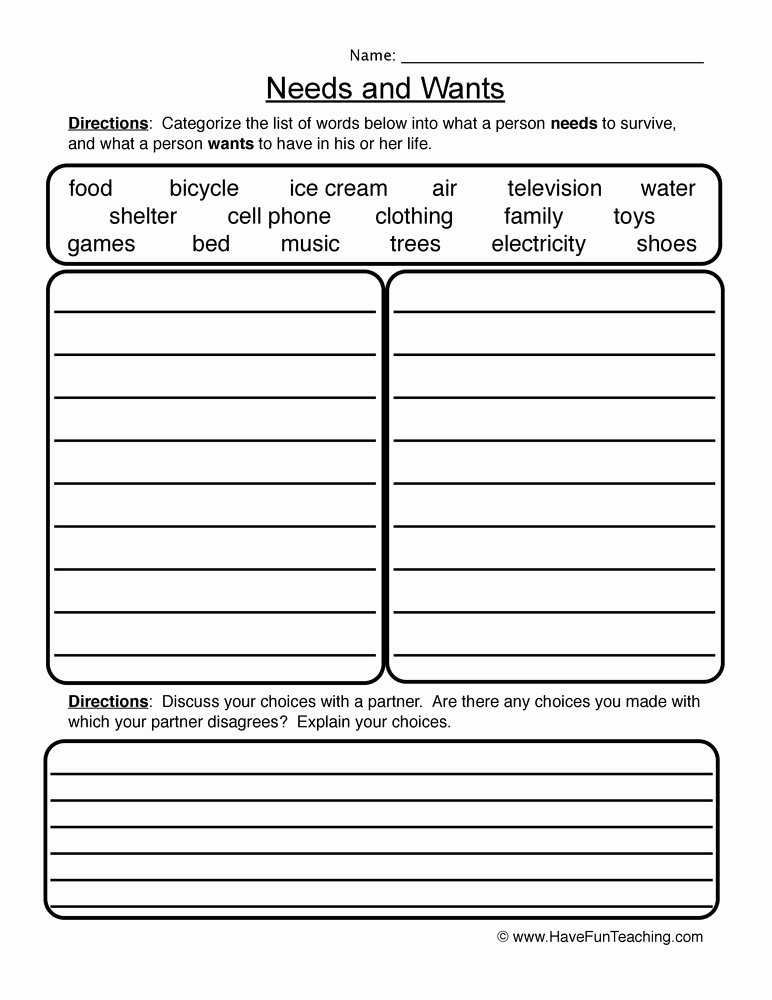

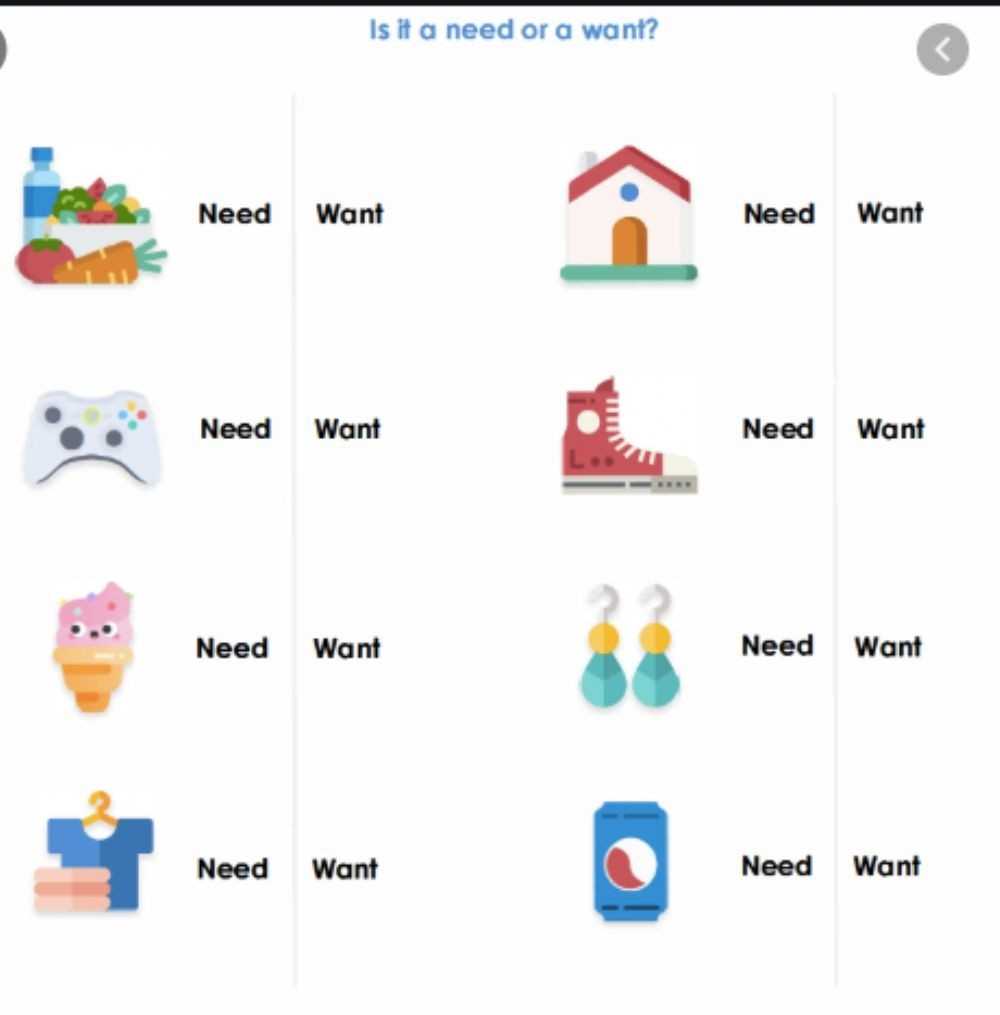

A wants vs needs worksheet is typically a simple spreadsheet that divides spending into two main categories: needs and wants. Needs are items or services that are essential for your well-being and day-to-day living. These may include rent, food, utilities, transportation, health care, and other basic necessities. Wants, on the other hand, are items or services that you would like to have, but are not essential to your survival. Examples of wants include a new car, a vacation, or an expensive watch.

By using a wants vs needs worksheet, you can easily distinguish between the two types of spending, making it easier to manage your finances. It can also help you identify areas where you can save or cut back on spending. For example, if you are spending a large amount of money on wants, you may be able to redirect those funds to more important needs.

[toc]

In addition, a wants vs needs worksheet can help you plan for the future. By tracking your spending, you can identify areas where you can save more, allowing you to build up a fund for future expenses.

Overall, a wants vs needs worksheet can be an invaluable tool in managing your finances. By helping you to prioritize your spending and plan for the future, it can help ensure that your basic needs are met and that you can save for the future.

How to Use a Wants Vs Needs Worksheet to Maximize Your Savings

A wants vs needs worksheet is an effective tool for budgeting and maximizing savings. By utilizing a worksheet, individuals can easily identify their wants and needs, prioritize their spending, and save money in the process.

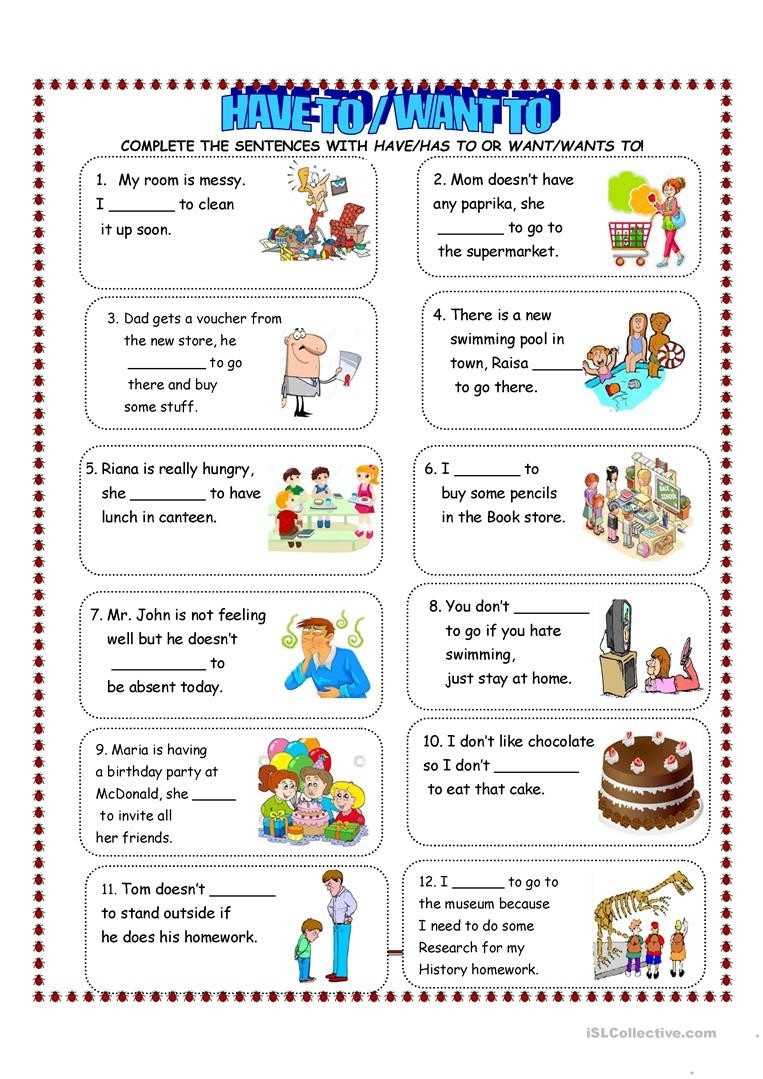

To begin, list all the items you want to purchase. This includes both necessities and luxuries such as groceries, clothing, electronics, vacations, and entertainment. Once the list is complete, separate items into two categories: “wants” and “needs.” Needs are items that are essential to everyday life, such as housing, transportation, food, clothing, and healthcare. Wants are items that are not essential and are more discretionary in nature, such as vacations, entertainment, and luxury items.

Now that the list is divided, it is time to prioritize your spending. Start by allocating funds for your needs first. This can help ensure that you are able to meet your basic financial obligations before considering purchases for items you want. After you have allocated funds for all of your needs, it is time to consider how much you can afford to spend on items you want.

Once you have determined how much you can spend on wants, it is time to start cutting back. Consider eliminating the least important items from your list, or reducing the amount of money you plan to spend on each item. You may even want to consider saving the money you would have spent on the item for a later date.

By utilizing a wants vs needs worksheet, individuals can easily identify their wants and needs, prioritize their spending, and maximize their savings in the process. This simple tool can help individuals achieve their financial goals and reach their desired level of financial security.

Tips for Using a Wants Vs Needs Worksheet to Create a Budget

Creating a budget can be an overwhelming and stressful process, but with a Wants vs Needs worksheet, it can be easier to manage. Here are some tips for using a Wants vs Needs worksheet to create a budget:

1. Start by creating a list of your expenses. Make sure to list all your bills and any other expenses you pay each month.

2. Next, separate your expenses into two categories: wants and needs. Needs are those items that you cannot do without, such as rent, groceries, and utilities. Wants are those items that you can live without, such as dining out, entertainment, and clothing.

3. Once you have separated your expenses into two categories, it is time to create your budget. Start by assigning a certain amount to each need. Make sure to prioritize your needs, as some may be more important than others.

4. After you have allocated funds for your needs, you can begin to budget for your wants. Start by setting a realistic limit for your wants. For example, you may decide to set a limit of $50 for dining out each month.

5. Finally, review your budget and make sure it is balanced. You should have enough money for all of your needs, as well as a little bit of money for your wants.

By following these steps, you can create a budget using a Wants vs Needs worksheet. This will help you manage your finances and ensure that you are able to meet all of your financial obligations.

Understanding Your Needs Vs Wants: A Guide to Help You Make Smart Financial Decisions

Making smart financial decisions can be a challenge. It’s easy to get confused between our needs and our wants and end up spending money on things we don’t necessarily need. It’s important to understand the difference between our needs and our wants so that we can make sound financial decisions.

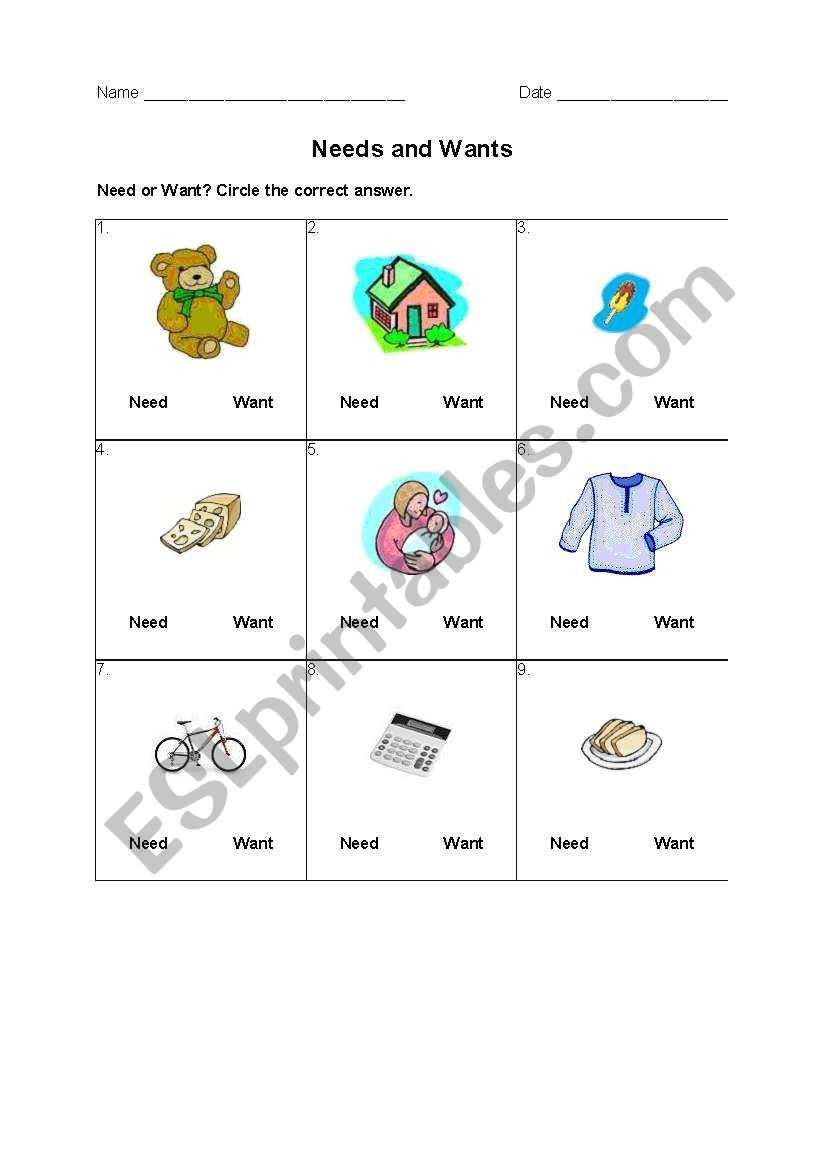

A need is something that is essential or necessary for survival or basic well-being. These are items that you must have in order to function properly on a day-to-day basis. Examples of needs include food, shelter, clothing, healthcare, and transportation. These items are necessary for your day-to-day life and should take priority when it comes to spending money.

On the other hand, a want is something that is desired but not essential. Wants are items that we may want to buy, but don’t necessarily need. Examples of wants include a new car, a designer handbag, or the latest smartphone. These types of items are not essential for basic functioning, and should be weighed against our needs when it comes to making financial decisions.

It’s important to remember that needs should always take priority over wants when it comes to spending money. When faced with a financial decision, ask yourself if the item is a need or a want. If it’s a need, it’s likely a wise decision to spend the money. However, if it’s a want, it’s important to consider whether or not the item is worth the expense.

By understanding the difference between needs and wants, you’ll be able to make smart financial decisions. Knowing when to splurge on a want and when to save money for a need can help you make the most of your finances.

Conclusion

The Wants Vs Needs Worksheet is a great tool for helping individuals to understand the difference between wants and needs. It can help us to make better decisions as to where we should allocate our money and resources. By taking the time to create a Wants Vs Needs Worksheet and using it regularly, we can become more mindful of our spending habits and make better choices with our money.

[addtoany]