How to Use a Wants and Needs Worksheet to Help Parents Teach Kids about Financial Planning

As parents, it is important to teach children about financial planning from an early age. A wants and needs worksheet can be a valuable tool in helping parents instill healthy money management habits in their children.

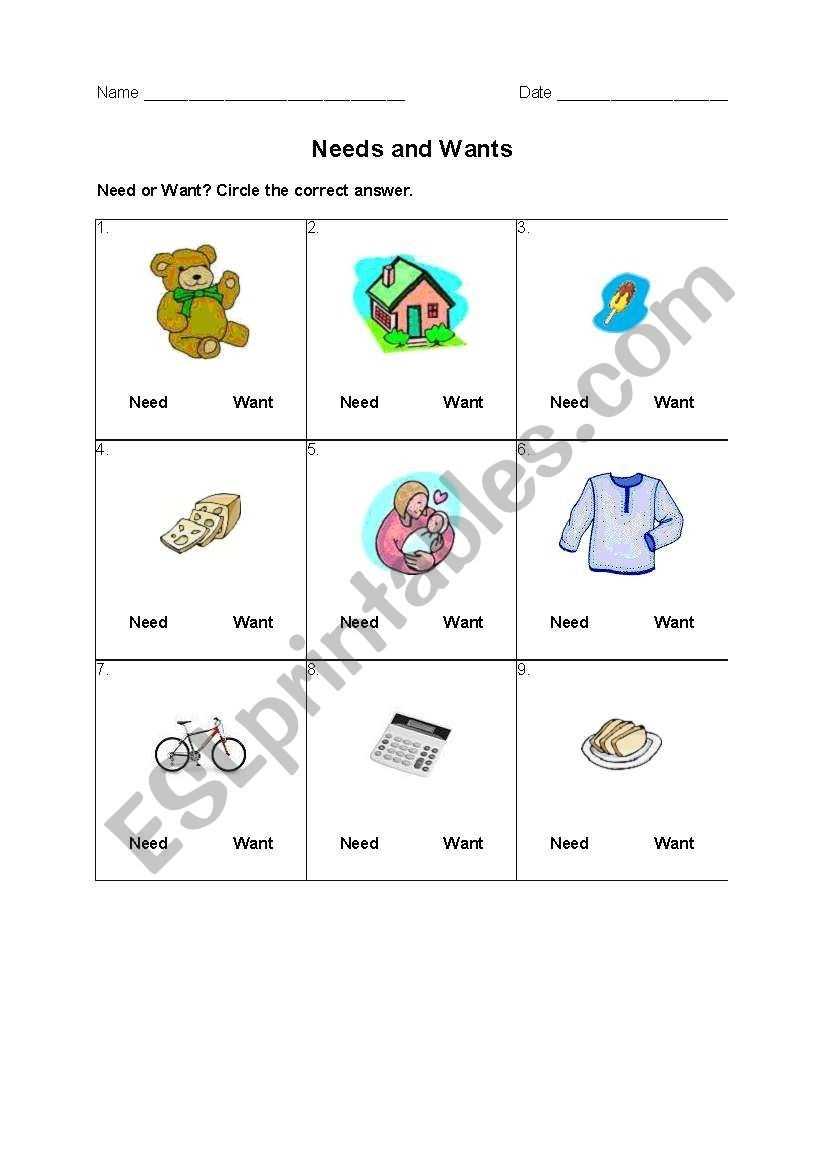

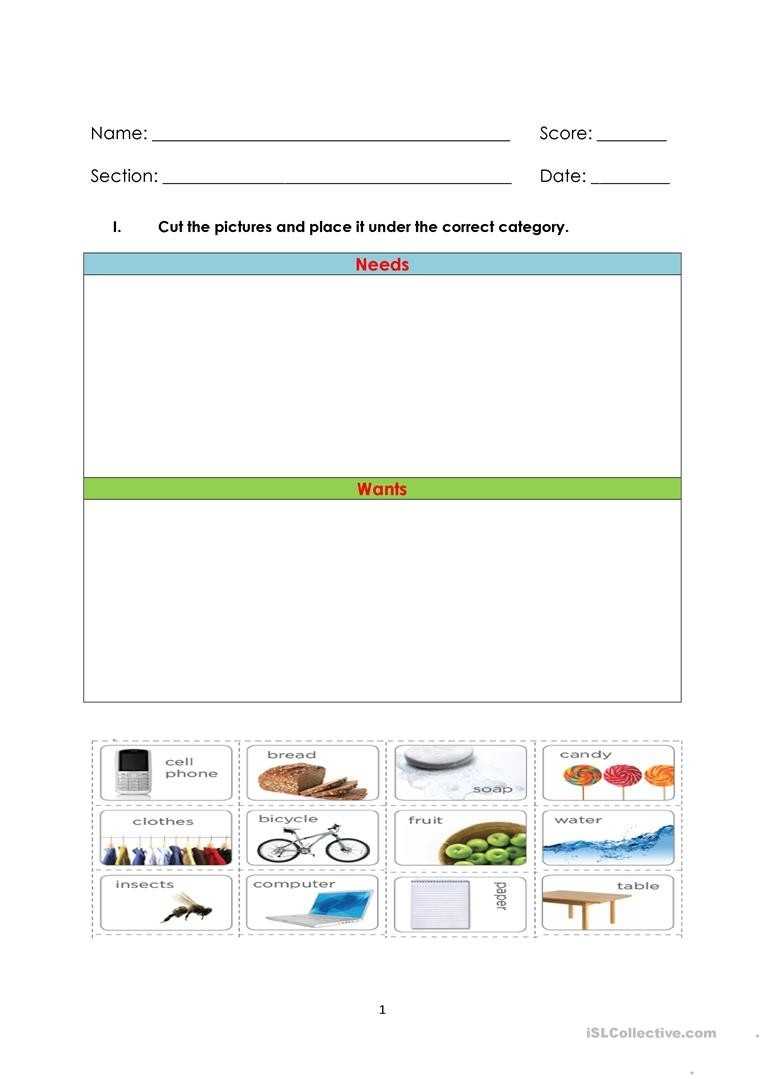

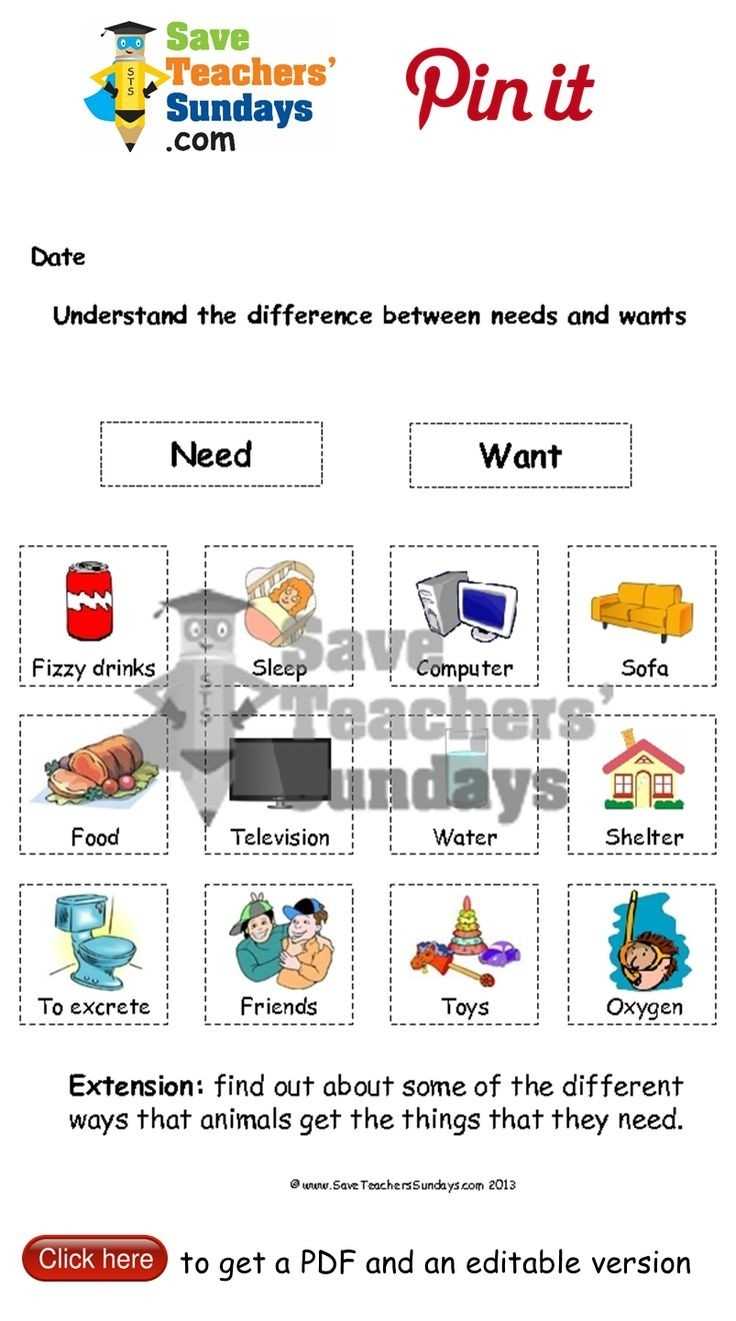

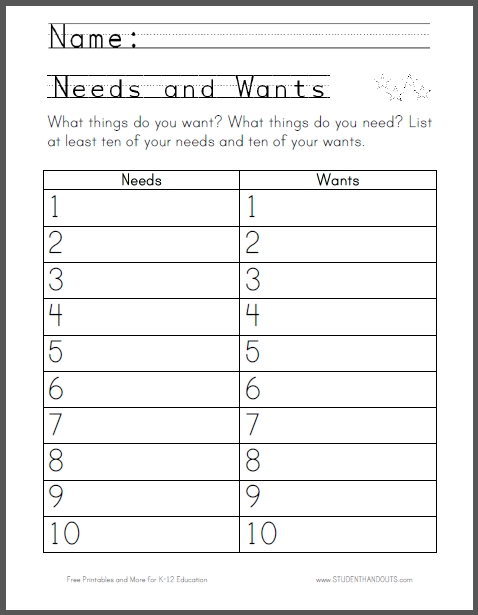

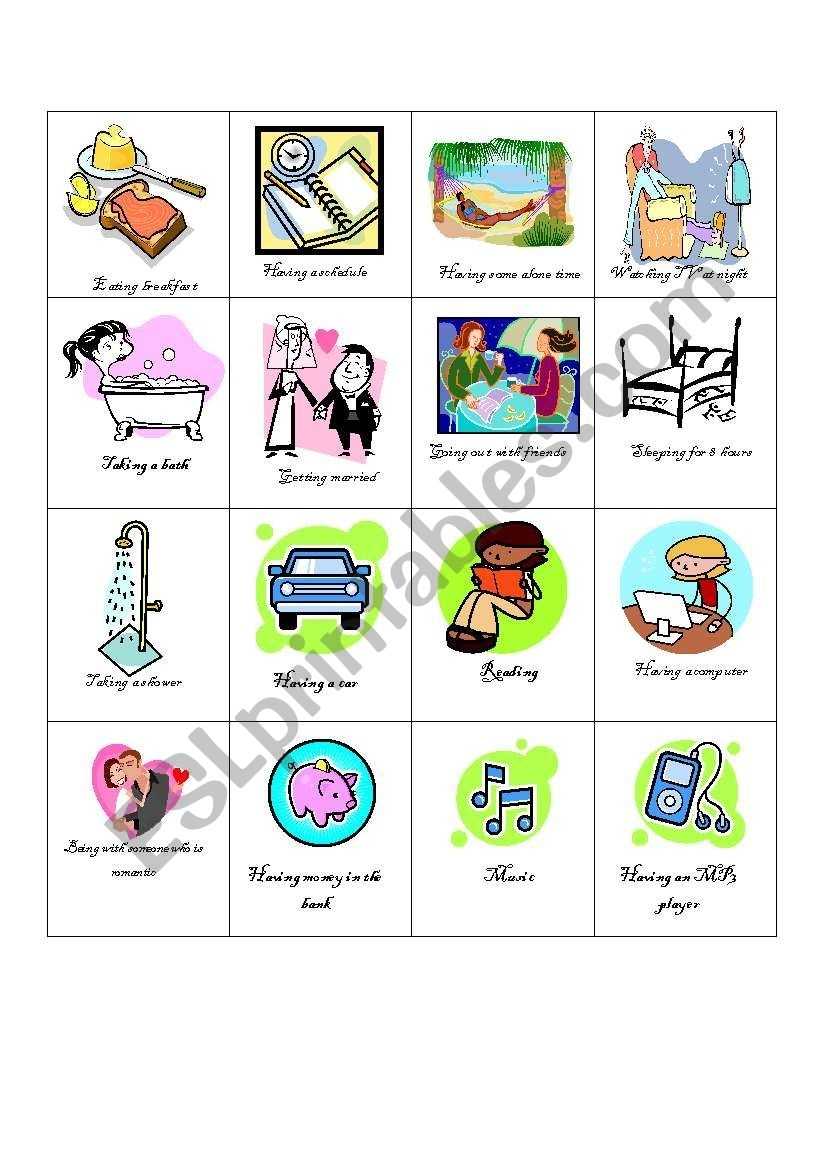

A wants and needs worksheet is a simple document that lists out items that a person may need or want. It typically includes a column for “needs” and a column for “wants”. The worksheet can be used to help explain the differences between needs and wants to children. By having them identify the items in each category, the worksheet can help children understand the concept of financial planning.

To use the worksheet, parents should first explain to their children the difference between needs and wants. Needs are items that are essential for survival and include items such as food, shelter, and clothing. Wants, on the other hand, are items that are not essential but may bring pleasure to the person. These can include items such as video games, toys, and electronics.

[toc]

After explaining the difference between needs and wants, parents can use the worksheet to help their children identify items that fit into each category. Parents should provide examples of each to help their children understand the concept. Once the items have been identified, parents can then discuss strategies for managing financial resources. This can include budgeting, saving, and investing.

By using a wants and needs worksheet, parents can help their children develop healthy financial habits from an early age. This will help equip them with the skills they need to make sound financial decisions as they grow older.

A Comprehensive Guide to Creating a Personal Wants and Needs Worksheet

Creating a personal wants and needs worksheet is an important step in gaining financial clarity and ensuring that you remain on track with your money-related goals. A wants and needs worksheet will help you to better understand your spending habits, prioritize your financial commitments, and create a budget that will help you achieve financial success. This comprehensive guide will provide step-by-step instructions on how to create and maintain an effective wants and needs worksheet.

Step One: Identify Your Short-Term and Long-Term Financial Goals

The first step in creating a wants and needs worksheet is to identify your short-term and long-term financial goals. This will help you prioritize your spending and ensure that all of your financial commitments are taken into consideration when creating your budget. Consider both your current and future goals and be sure to factor in any financial obligations you may have.

Step Two: List Your Needs

Once you have identified your financial goals, the next step is to list your needs. Needs are essential items or services that you require in order to maintain a healthy lifestyle. Examples of needs may include rent or mortgage payments, utilities, food, clothing, health insurance, transportation costs, and any other required monthly payments.

Step Three: List Your Wants

Once you have listed your needs, the next step is to list your wants. Wants are non-essential items or services that you may desire but are not necessary to maintain a healthy lifestyle. Examples of wants may include dining out, entertainment, vacations, luxury items, and any other non-essential purchases.

Step Four: Prioritize Your Needs and Wants

Once you have listed your needs and wants, the next step is to prioritize them. Consider which items are most important to you and be sure to factor in your financial goals when determining their priority. This will help you create a budget that will help you stay on track and achieve your financial goals.

Step Five: Create a Budget

Once you have identified your needs and wants and prioritized them, the next step is to create a budget. Consider your income and expenses and allocate each item into its respective category (needs or wants). This will help you stay on track and ensure that all of your financial commitments are taken into consideration.

Step Six: Track Your Spending

The final step in creating a wants and needs worksheet is to track your spending. Once you have created a budget and allocated your income and expenses, you should track your spending to ensure that you are staying on track and not exceeding your budget. This will help you to remain accountable and make any necessary adjustments to your budget as needed.

Creating a personal wants and needs worksheet is an important step in gaining financial clarity and staying on track with your money-related goals. Following the steps outlined above will help you to better understand your spending habits, prioritize your financial commitments, and create a budget that will help you achieve financial success.

How to Use a Wants and Needs Worksheet to Evaluate Your Financial Situation

A wants and needs worksheet is an excellent tool for evaluating your financial situation and planning for your future. By defining what you want and need, the worksheet helps you to assess your current financial position and determine what steps you should take to achieve your financial objectives.

To use a wants and needs worksheet effectively, you should begin by listing your current monthly income. This will help you to determine how much money you have available to spend each month. You should also list all of your current monthly expenditures, including bills, rent, and other expenses.

Next, you should identify what you want and need from your finances. Start by making a list of items that you would like to purchase in the future. Include both short-term and long-term goals. Make sure to include the cost of these items.

Once you have identified your wants and needs, you can begin to compare them to your income and expenses. This will help you to determine if you have enough money available to meet your financial objectives. You may find that you need to make changes to your spending habits or look for ways to increase your income.

Finally, you can use the information that you have gathered to create a budget. This will allow you to track your spending and make sure that you are not overspending.

By using a wants and needs worksheet, you can evaluate your financial situation and take steps to ensure that you are on the right path to achieving your financial goals. With careful planning and discipline, you can achieve financial security and peace of mind.

Exploring the Benefits of a Wants and Needs Worksheet for Financial Literacy Education

Financial literacy is an important life skill, yet many individuals lack the knowledge and skills they need to make informed financial decisions. A wants and needs worksheet can be a valuable tool in promoting financial literacy education. This worksheet can help individuals gain a better understanding of the differences between their wants and their needs.

A wants and needs worksheet is a simple but effective tool for financial literacy education. It provides a visual representation of how people can prioritize and manage their finances. The worksheet can be used to track spending, create a budget, and identify areas where money can be saved. It can also be used as a tool for planning for future purchases and investments.

The worksheet starts by asking the user to list their wants and needs. This is an important first step in understanding the difference between the two. It helps individuals recognize that wants are not essential for survival and that some of their spending may be unnecessary. It can also help them appreciate the importance of budgeting and making smart financial choices.

The worksheet then prompts individuals to consider the cost of their wants and needs. This can help them understand the financial implications of their choices and make better decisions. They can compare the costs of different items to determine which are most important and which can be sacrificed. This can also help them plan for future purchases and investments, as they will have a better understanding of the cost implications.

The worksheet then encourages the user to plan for their future. They can consider how their current wants and needs will impact their future financial situation and make plans accordingly. This can help them understand the importance of saving and investing in their future.

Overall, a wants and needs worksheet is an effective tool for financial literacy education. It helps individuals gain a better understanding of their wants and needs and how their choices can impact their future financial situation. It can also help them prioritize their spending, create a budget, and plan for the future. This worksheet can be an invaluable tool for those looking to improve their financial literacy.

Conclusion

The Wants and Needs Worksheet is a great tool for helping individuals assess their current financial situation, identify their financial goals, and create a plan for achieving them. By understanding their wants and needs, individuals can make better decisions about how to budget their money to achieve financial freedom. The worksheet also encourages individuals to think critically about their financial goals and decide which are the most important to them. Ultimately, the worksheet helps individuals create a budget that is tailored to their individual goals and needs.

[addtoany]