How to Leverage the Student Budget Worksheet Answers to Maximize Financial Savings

The Student Budget Worksheet is a powerful tool for students to maximize their financial savings. By carefully analyzing their income and expenses, they can identify areas where they can reduce or eliminate spending, or where they can find ways to increase their income.

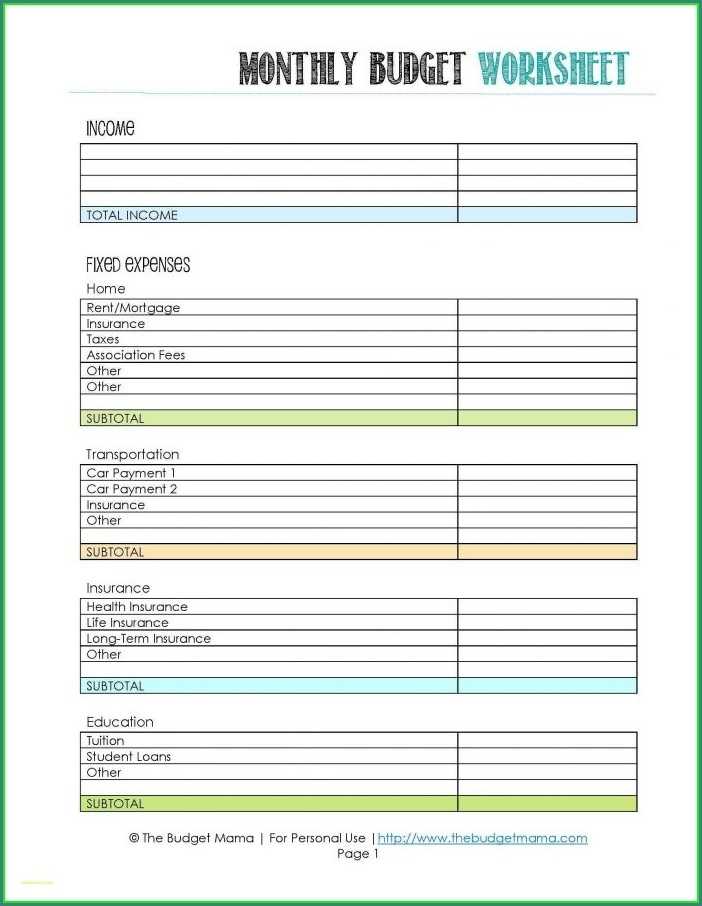

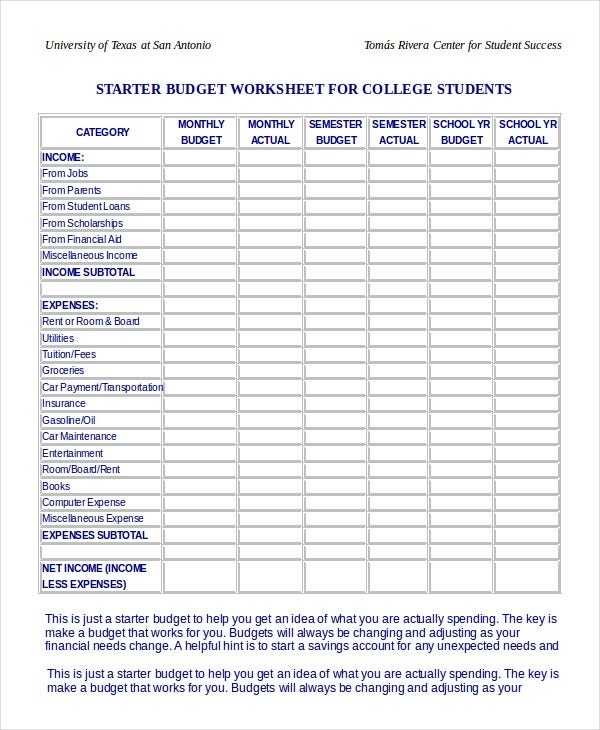

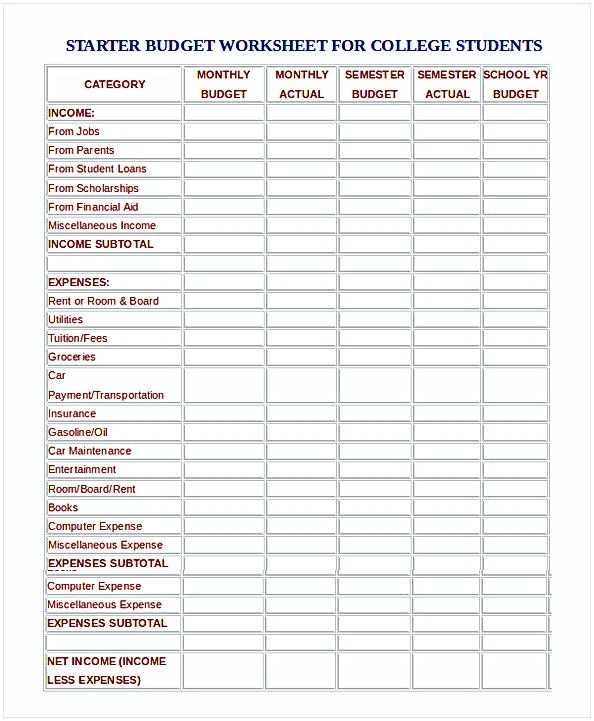

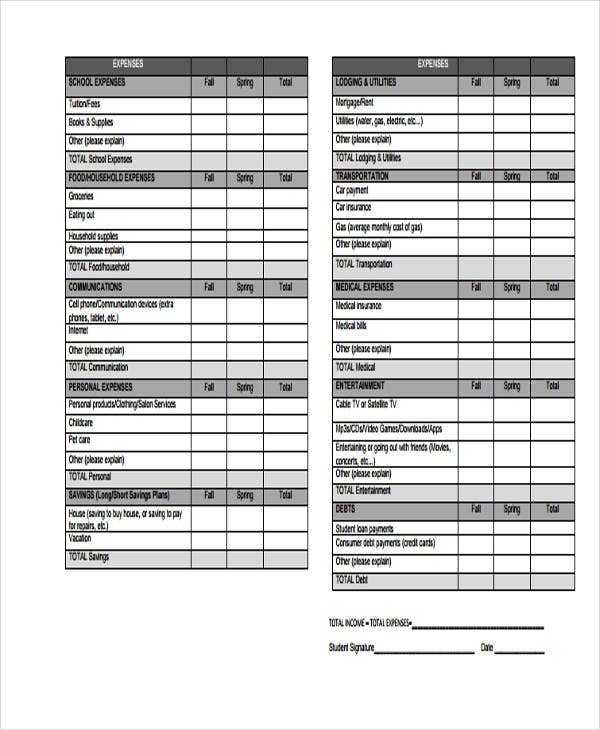

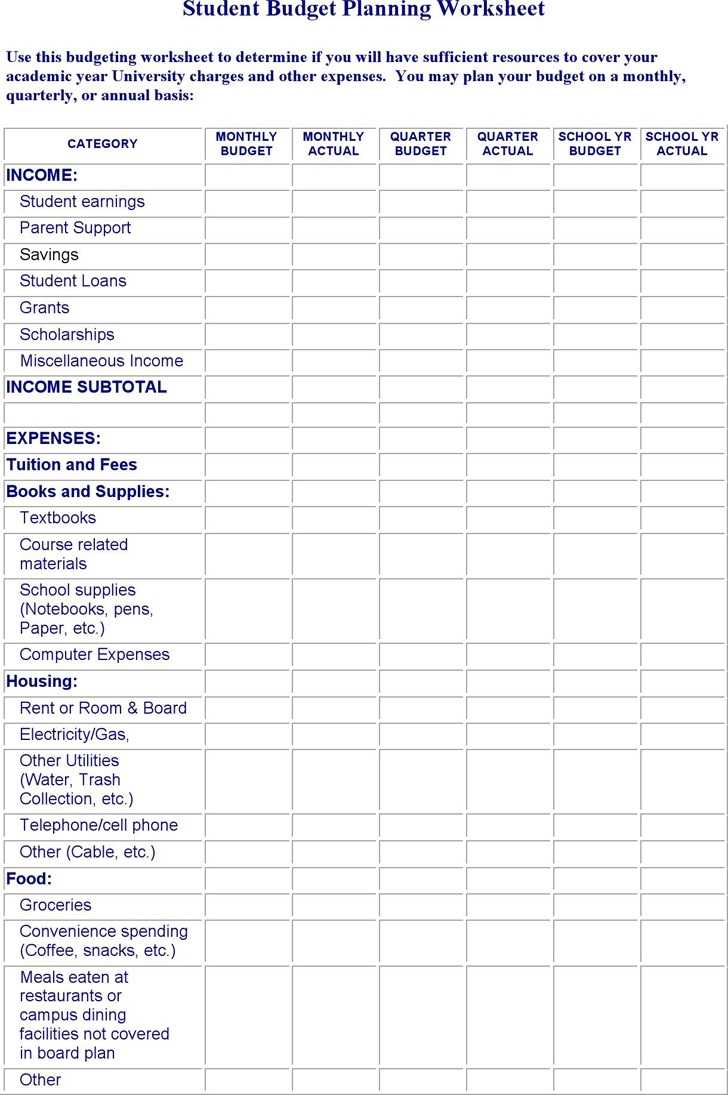

The worksheet starts by having the student list all of their sources of income. This may include income from part-time jobs, scholarships, grants, and other sources. Once the student has identified their sources of income, they can estimate their monthly income and determine their monthly budget.

The next step is to list all of their expenses. This includes rent, food, transportation, entertainment, and other miscellaneous expenses. After listing all of the expenses, the student can compare their income and expenses to determine if they are living within their means. If the expenses exceed the income, the student must find ways to reduce their expenses or increase their income.

[toc]

Once the student has identified where their money is going, they can look for ways to reduce their expenses. This may include finding ways to reduce their rent, finding cheaper transportation options, or finding cheaper entertainment options. The student can also look for ways to increase their income, such as taking on a part-time job or finding scholarships and grants.

By utilizing the Student Budget Worksheet and analyzing their income and expenses, the student can maximize their financial savings. By reducing their expenses and increasing their income, the student can ensure that their money is being spent wisely and that they are living within their means.

Understanding the Potential Benefits of Using the Student Budget Worksheet Answers

The Student Budget Worksheet can be an invaluable tool for students to use in order to get a better grasp of their financial situation. It is a simple yet effective way of taking stock of what money is coming in, what money is going out, and where it is all going. The worksheet helps students to better understand the flow of their money, and can help them to plan for the future.

The worksheet serves to provide a comprehensive look at a student’s finances. It can help them to identify potential areas of financial need, as well as areas where they may have surplus funds. This insight can be used to plan budgeting strategies, and to determine where they should prioritize their spending.

It can also help a student to better understand the details of their financial situation. By breaking down their income and expenses into categories, they can gain a better understanding of their overall financial picture. This insight can help them to make more informed decisions when it comes to budgeting and spending.

Finally, the Student Budget Worksheet can be used to help track and monitor a student’s progress over time. By tracking changes in their income and expenses, they may be able to identify areas where they are making positive strides or areas that could use improvement. This information can be invaluable for creating a plan for future financial success.

In sum, the Student Budget Worksheet provides a comprehensive look at a student’s finances and can be an invaluable tool for helping them to stay on top of their financial situation. By breaking down their income and expenses, tracking their progress, and identifying areas of need, the worksheet can help students to better understand their finances and make more informed decisions.

Exploring Creative Ways to Use the Student Budget Worksheet Answers to Stay Financially Fit

1. Stick to Your Budget: It is essential to create and stick to a budget. The Student Budget Worksheet helps to break down your income and expenses into manageable sections. Use the worksheet to determine how much you can realistically allocate for each category and then stick to it.

2. Utilize Automated Savings: Automated savings provide an easy way to save money each month. Allocate a certain amount of your monthly income to an automated savings account. This will help you to save money without taking any extra steps.

3. Track Your Expenses: Tracking your expenses will help you to ensure that you are staying within your budget. Use the Student Budget Worksheet to help you monitor your spending. This will allow you to make adjustments to your budget when necessary.

4. Seek Professional Advice: If you find yourself struggling with your finances, seek professional advice. Financial advisors can help you to create an effective budget and provide guidance to help you stay on track.

5. Make a Spending Plan: Making a spending plan is a great way to stay financially fit. Utilize the Student Budget Worksheet to help you create a spending plan that fits your financial goals. Look for areas where you can make cuts, such as ordering takeout less often, and make adjustments to your budget accordingly.

6. Make Investments: Investing your money is a great way to build your financial portfolio. Consider investing in stocks, bonds, and other investments. The Student Budget Worksheet can help you to calculate your risk tolerance and decide which investments are best for you.

7. Set Long-Term Financial Goals: Setting long-term financial goals will help you stay motivated to stay on track. Utilize the Student Budget Worksheet to help you set realistic financial goals and then track your progress.

By utilizing the Student Budget Worksheet, you can stay financially fit and on track with your financial goals. By sticking to your budget, tracking expenses, seeking professional advice, making a spending plan, investing, and setting long-term financial goals, you can stay on track and make the most of your budget.

Conclusion

The Student Budget Worksheet Answers can be a great tool for students to use to help them stay organized and on top of their finances. With this worksheet, students can easily see where their money is going and where they need to make adjustments if necessary. By knowing their financial situation, students can better plan for their future and make sure that they are in control of their finances.

[addtoany]