How to Use a Needs And Wants Worksheet to Teach Kids About Financial Literacy

Financial literacy is a vital part of everyday life, and it’s important to teach children the basics of budgeting and making responsible decisions with money. One effective way to introduce the concept of financial literacy to children is to use a needs and wants worksheet. This worksheet helps children to differentiate between items they need and items they want, and it can provide a great opportunity for children to learn about budgeting and making responsible financial decisions.

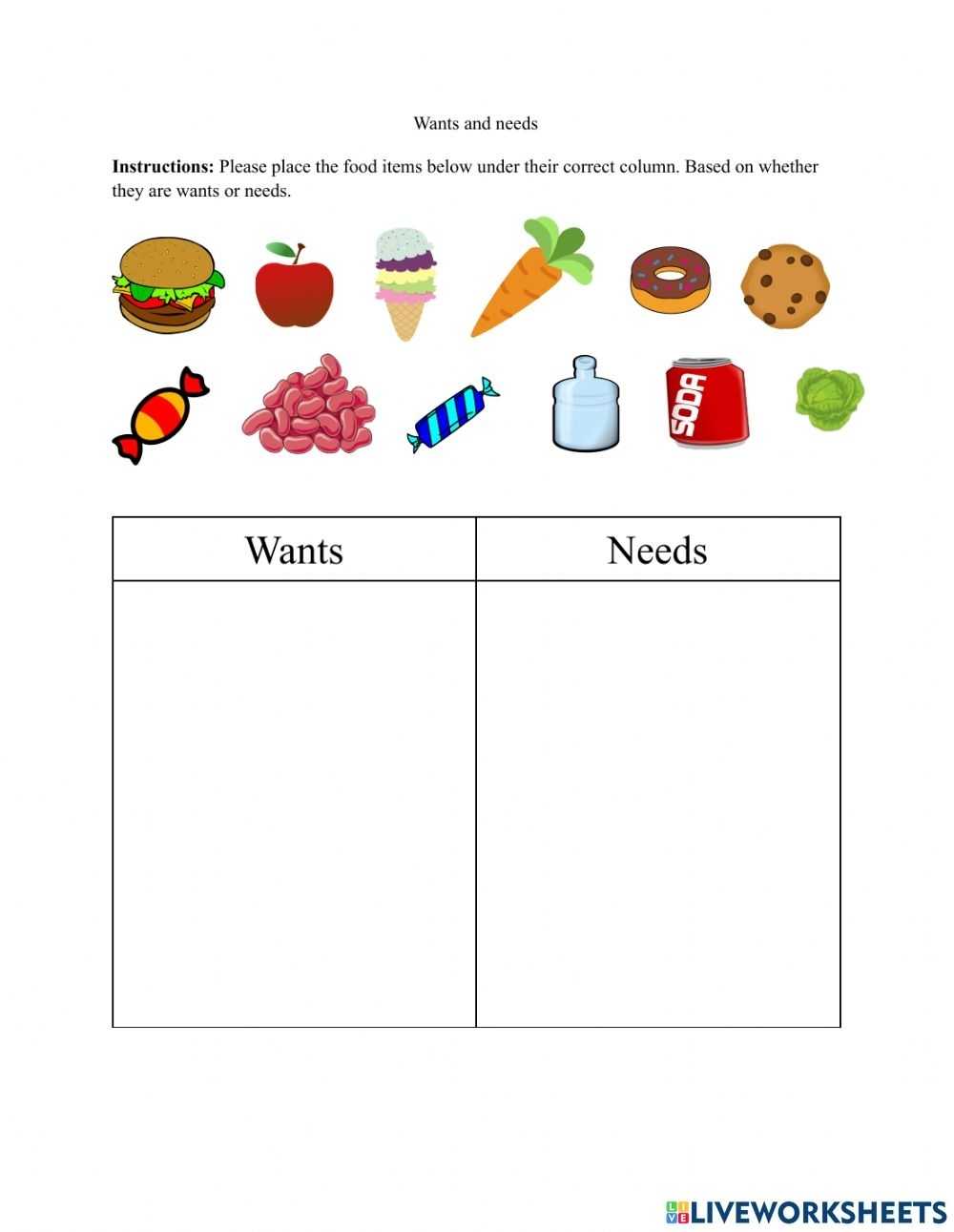

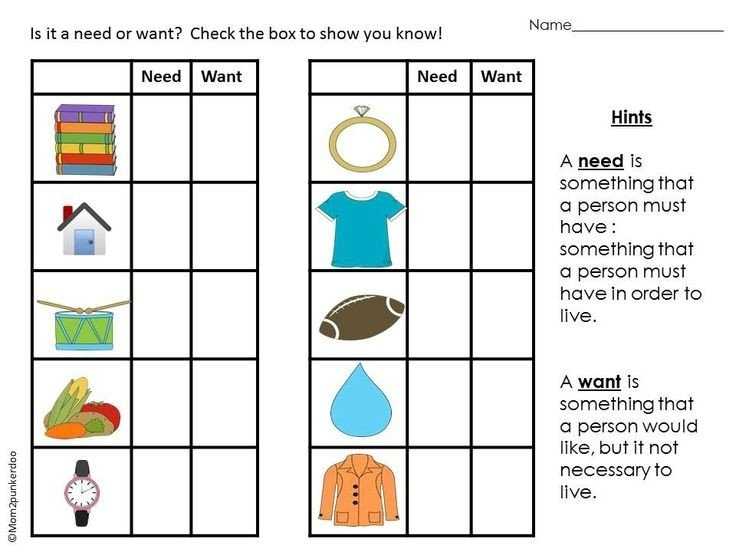

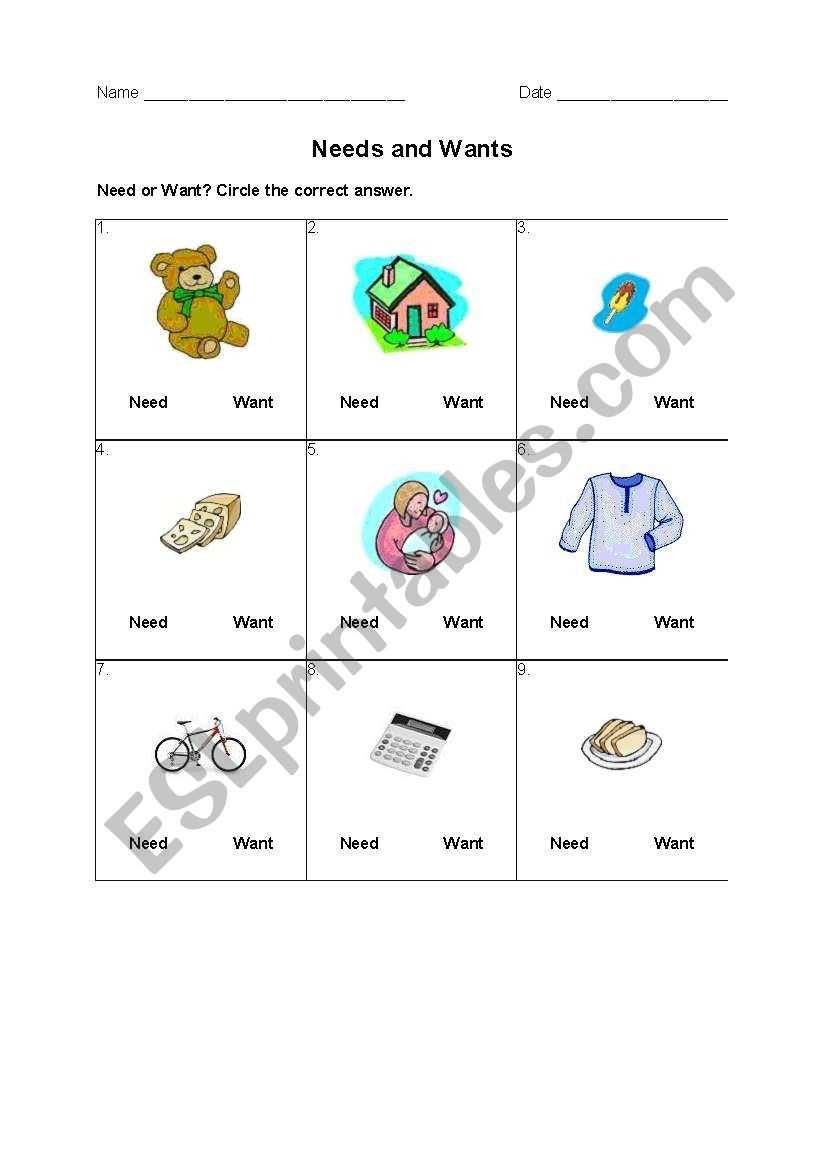

To use a needs and wants worksheet, first start by writing down a list of items that children may need in their daily lives. This list can include items such as food, clothing, shelter, and medical care. Each item should be classified as either a need or a want. This will help children to understand the difference between items they really need, such as food and shelter, and items they simply want, such as a new toy or video game.

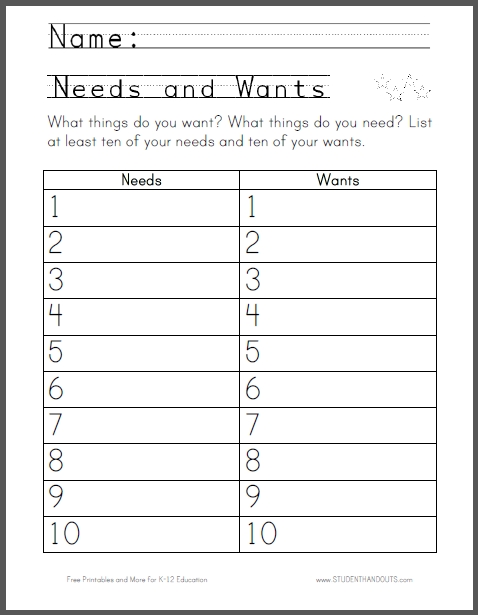

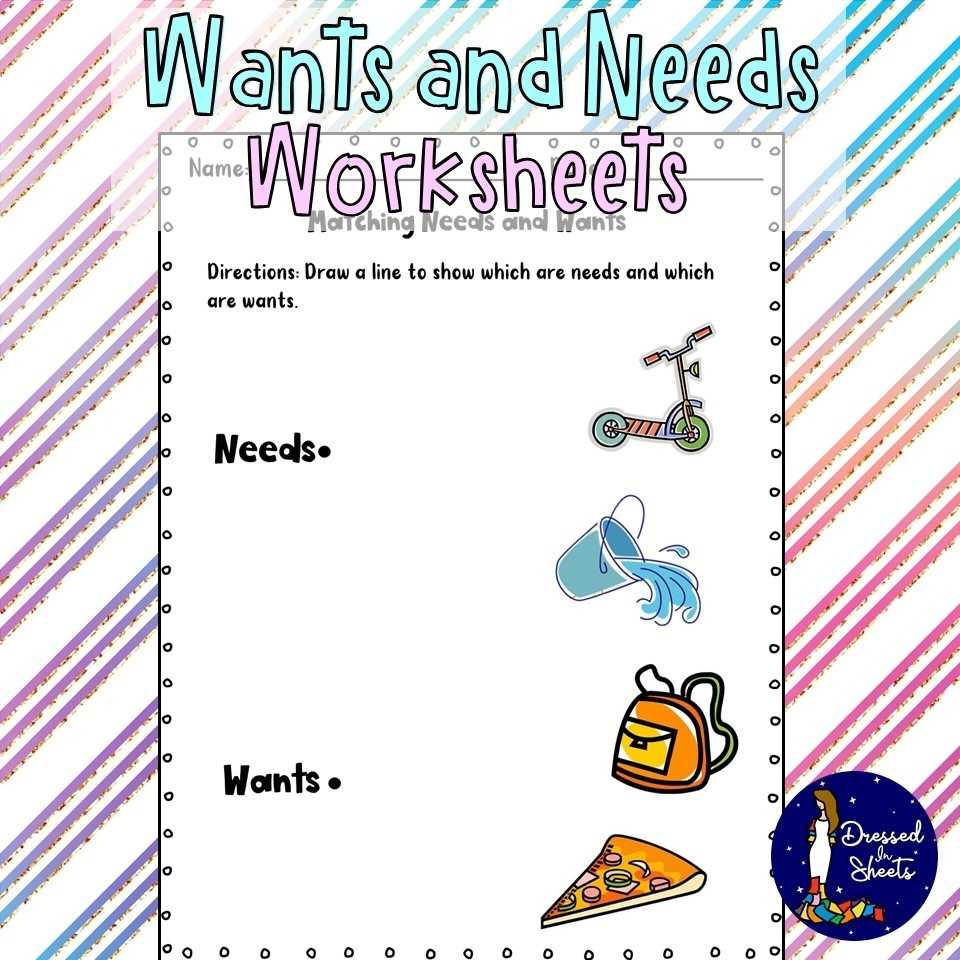

Next, have the children draw a line down the middle of the page and label one side “needs” and the other “wants.” Then, have them place the items they listed on the right side of the page, under the appropriate category. This will help them to visually differentiate between needs and wants, and it will also give them the opportunity to prioritize items.

[toc]

Once the children have completed the worksheet, talk to them about budgeting and financial responsibility. Explain that they should strive to meet their needs before they start thinking about wants. Explain that budgeting is a way of making sure that they have enough money to meet their needs, and that it’s important to make sure that wants don’t take precedence over needs.

By using a needs and wants worksheet, children can gain valuable insight into budgeting and financial responsibility. This worksheet can be a great tool for teaching kids about financial literacy in an engaging and interactive way.

The Benefits of Using a Needs And Wants Worksheet in the Classroom

Using a needs and wants worksheet in the classroom can be an effective way to teach students about budgeting, decision-making, and financial literacy. It is a simple, yet powerful tool that can help students to understand the concept of balancing their needs and wants. Through careful consideration, the worksheet can help them learn to prioritize their spending and make informed decisions about their money.

The worksheet can be used in a variety of ways in the classroom. It can be used as a class-wide activity or as a part of an individual assignment. The worksheet asks students to list out both their needs and wants. This helps them to identify and prioritize what is important to them and how they can best use their money. The worksheet can also be used as a tool to encourage students to think critically about their financial decisions.

Students can use the worksheet to analyze their current spending and identify areas where they can save money. This can be a powerful learning experience, as it allows them to understand why certain items are considered needs and others are considered wants. It also helps them to learn how to budget and how to make wise decisions when it comes to spending their money.

The worksheet can also be used as a way to track and monitor spending. By having students list out their needs and wants, teachers and parents can keep an eye on their spending habits. This can help to ensure that students are making wise choices with their money.

Overall, using a needs and wants worksheet in the classroom can be a great way to teach students about budgeting, decision-making, and financial literacy. It is a simple yet powerful tool that can help them to understand the concept of balancing their needs and wants. Through careful consideration, the worksheet can help them learn to prioritize their spending and make informed decisions about their money.

Tips for Helping Kids Differentiate Between Needs And Wants

1. Explain the Difference: Spend some time explaining the difference between needs and wants to your child. Needs are those things that are essential for survival, such as food, water, and shelter. Wants are things that are more of a luxury, such as a new toy or video game.

2. Role-Play: Role-play activities can be a great way to help kids understand the difference between needs and wants. Start with a few simple scenarios and let your child decide what is a need and what is a want.

3. Use Real-Life Examples: Use real-life examples to illustrate the differences between needs and wants. For example, your child needs new clothes for school, but they want the latest style.

4. Create a Visual: Create a visual representation of needs and wants, such as a chart or graph. Use images or words to represent each concept and use it as a reference point when discussing the difference between the two.

5. Make it Fun: Make learning about needs and wants fun by turning it into a game or inviting your child to come up with creative ways to differentiate between the two.

6. Reward Good Choices: When your child makes a good choice and can properly differentiate between needs and wants, reward them with positive reinforcement. This will help reinforce the idea that it is important to be able to make wise decisions.

Making a Budget with a Needs And Wants Worksheet: A Step-by-Step Guide

Creating a budget helps you gain control of your finances. It allows you to plan for the future and ensure that you are able to meet your financial obligations. One way to create an effective budget is to use a Needs and Wants Worksheet. This guide will walk you through the process of creating a budget with a Needs and Wants Worksheet.

First, list all of your fixed expenses. These are expenses that stay the same each month, such as rent, insurance payments, loan payments, and utility bills. Note how much each of these costs, as well as how much of your total income each expense takes up.

Next, list your variable expenses. These are expenses that change from month to month, such as grocery bills, clothing, and entertainment. Estimate how much you typically spend on these items each month.

Third, list your wants. These are items that you do not need, but would like to have. Examples of wants include vacations, new clothes, and entertainment. Estimate how much you typically spend on these items each month.

Once you have listed all of your needs, wants, and fixed expenses, add up the total amount of your expenses. This is the amount of money that you need to budget for each month.

Finally, subtract your total expenses from your total income. This is the amount of money that you have left over to use for savings, investments, or other discretionary spending.

By using a Needs and Wants Worksheet, you can create an effective budget that will help you manage your finances and plan for the future.

Conclusion

The Needs and Wants Worksheet is a great tool to help people identify their needs and wants and determine which are most important to them. By using this worksheet, individuals can prioritize their needs and wants, create a budget, and save money to reach their financial goals. Furthermore, this worksheet can help individuals manage their finances and live a financially secure life.

[addtoany]