Exploring the Impact of Monetary Policy on Inflation: A Worksheet Analysis

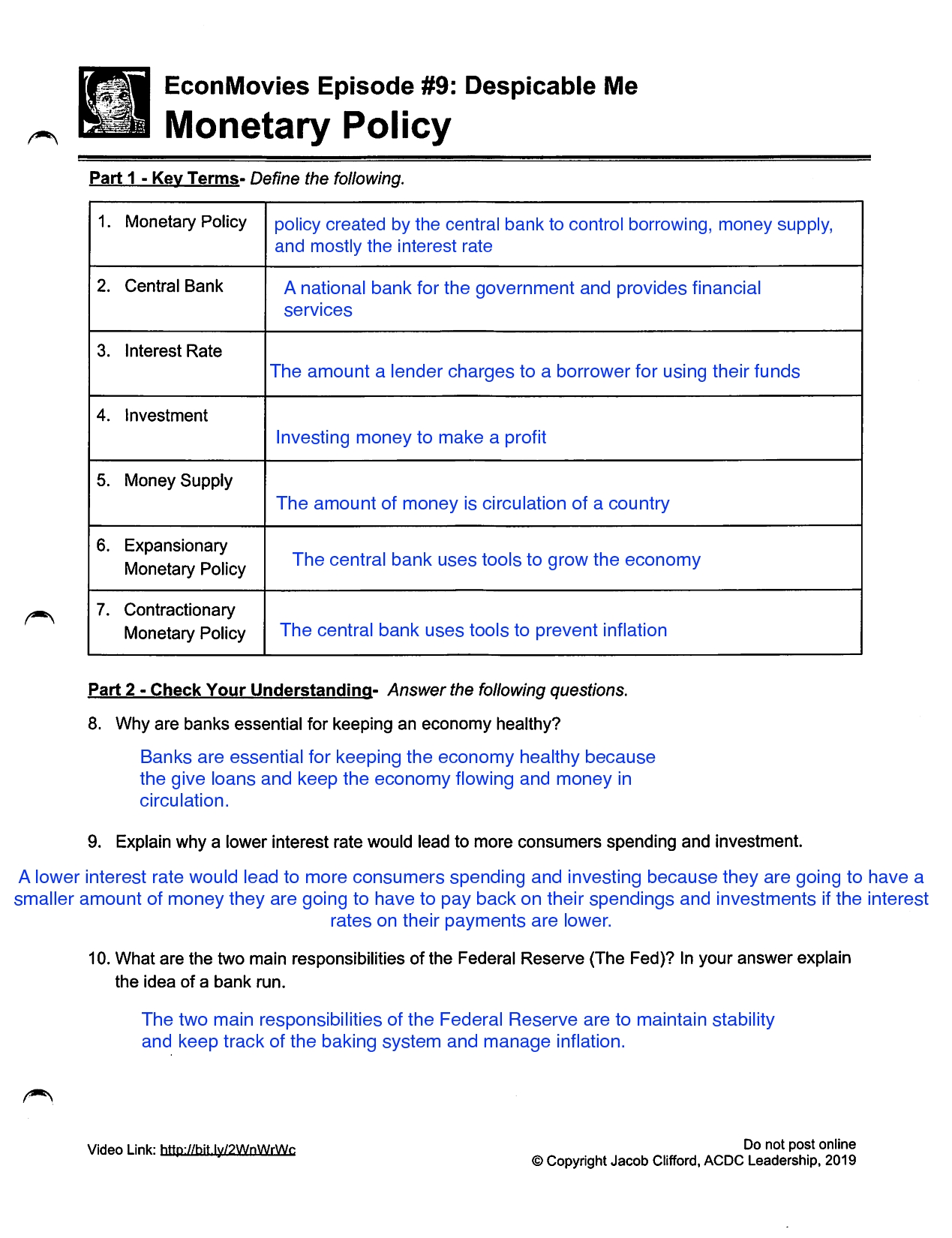

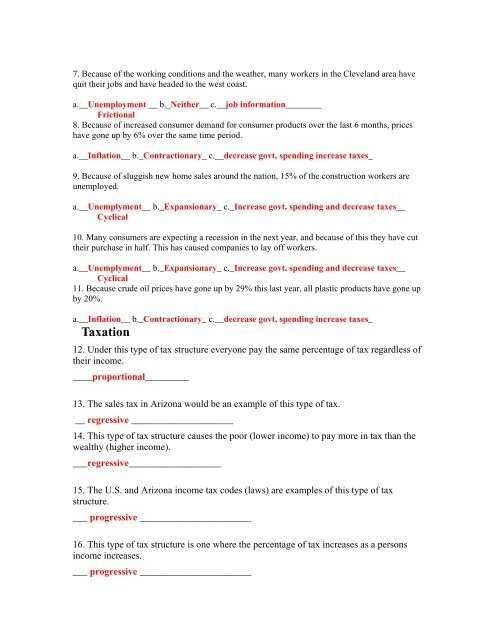

This worksheet is designed to provide an analysis of the impact of monetary policy on inflation. Inflation is a key economic indicator used by central banks to help assess the health of the economy. By examining the effect of monetary policy on inflation, central banks can make better decisions on how to adjust the money supply and interest rates in order to achieve their desired goals.

The worksheet begins by examining the effects of changes in the money supply and interest rates on prices. Specifically, as the money supply increases, prices tend to rise as well. This is due to an increase in the demand for goods and services, which leads to higher prices. Alternatively, when interest rates increase, prices tend to fall as people save money rather than spend it. This decrease in spending leads to lower prices.

Next, the worksheet examines the impact of changes in the money supply and interest rates on economic output. An increase in the money supply generally leads to an increase in economic output, as more money is available for businesses to invest and expand. Conversely, an increase in interest rates often leads to a decrease in economic output, as businesses find it more expensive to borrow money.

[toc]

Finally, the worksheet explores the impact of changes in the money supply and interest rates on inflation. An increase in the money supply generally increases the rate of inflation, as there is more money available to purchase goods and services. Conversely, an increase in interest rates typically decreases the rate of inflation, as people save money rather than spend it.

This worksheet provides an insightful analysis of the impact of monetary policy on inflation. By examining the effects of changes in the money supply and interest rates on prices, economic output, and inflation, central banks can make better decisions on how to adjust the money supply and interest rates in order to achieve their desired goals.

A Comprehensive Guide to Understanding the Effects of Monetary Policy on Interest Rates

Monetary policy is an important factor in determining interest rates in an economy. It is the policy implemented by a central bank or other regulatory authority in order to influence the availability and cost of money and credit in an economy. This policy can have a significant effect on interest rates, which in turn can have a major impact on both the short-term and long-term economic health of a nation.

In order to understand the effects of monetary policy on interest rates, it is important to understand the underlying mechanisms of the policy. Monetary policy is generally conducted by the central bank or other regulatory authority in order to achieve a specific economic goal. This goal could be to stimulate economic growth, reduce inflation, or maintain a specific level of economic activity. By using various tools, such as changing the interest rate, adjusting the money supply, or manipulating exchange rates, the central bank can attempt to achieve this goal.

When the central bank increases the interest rate, it is generally done in an effort to reduce inflation and stimulate economic growth. This increase in the interest rate can have a number of effects on interest rates. First, it can cause the cost of borrowing to increase, leading to higher interest rates for both consumers and businesses. This can make it more difficult for people to purchase items on credit and may lead to a decrease in consumer spending. Second, it can lead to higher investment returns, as investors may be willing to take on more risk in order to receive higher returns. Finally, it can lead to higher yields on bonds, as investors may be willing to take on more risk in order to receive higher returns.

On the other hand, when the central bank lowers the interest rate, it is generally done in an effort to stimulate economic growth and reduce unemployment. This decrease in the interest rate can have a number of effects on interest rates. First, it can cause the cost of borrowing to decrease, leading to lower interest rates for both consumers and businesses. This can make it easier for people to purchase items on credit and may lead to an increase in consumer spending. Second, it can lead to lower investment returns, as investors may be less willing to take on more risk in order to receive higher returns. Finally, it can lead to lower yields on bonds, as investors may be less willing to take on more risk in order to receive higher returns.

Overall, monetary policy is an important tool for controlling interest rates in an economy. By changing the interest rate, the central bank can attempt to achieve certain economic goals, such as stimulating economic growth or reducing inflation. These changes can have significant effects on both short-term and long-term interest rates. It is therefore important for individuals and businesses to understand the underlying mechanisms of monetary policy in order to better prepare for potential changes in interest rates.

Examining the Impact of Quantitative Easing on Money Supply: A Worksheet Exercise

This worksheet exercise will examine the impact of quantitative easing on money supply. Quantitative easing (QE) is a monetary policy employed by central banks to increase money supply in the economy by purchasing financial assets from commercial banks and other financial institutions.

The objective of this exercise is to understand the impact of quantitative easing on money supply and analyze the implications of this policy for the economy.

The first step in the exercise is to define money supply, which is the total amount of money available in an economy. Money supply is measured using different metrics, such as M1, M2, and M3. M1 refers to the amount of currency and coins in circulation, while M2 and M3 include different types of deposits such as saving accounts and certificates of deposits.

The next step is to understand how QE affects money supply. QE works by increasing the money supply through the purchase of financial assets from commercial banks and other financial institutions. This increases the amount of money available in the economy and causes interest rates to fall. Lower interest rates encourage people and businesses to borrow and spend more, which can stimulate economic growth.

The last step in the exercise is to analyze the implications of quantitative easing on money supply. QE can lead to higher inflation because it increases the amount of money in circulation. This can lead to higher prices for goods and services, which can reduce the purchasing power of consumers. Additionally, QE can lead to an increase in asset prices, which can create an asset bubble and lead to market instability.

In conclusion, this worksheet exercise has examined the impact of quantitative easing on money supply and analyzed the implications of this policy for the economy. It is important to note that quantitative easing can have both positive and negative effects on the economy. Therefore, it is important to exercise caution when employing this policy.

Analyzing the Impact of Central Bank Intervention on Exchange Rates: A Worksheet Exercise

The purpose of this worksheet exercise is to analyze the impact of central bank intervention on exchange rates. Central bank intervention is a tool used by governments and central banks to influence the foreign exchange rates of their respective currencies. It involves the buying and selling of foreign currency in order to influence the exchange rate.

When central banks intervene in the foreign exchange market, they typically do so in an attempt to stabilize their currency’s value or to prevent their currency from depreciating against other currencies. In some cases, central banks may also intervene in order to encourage a revaluation of their currency.

The first step in analyzing the impact of central bank intervention on exchange rates is to consider the impact of central bank buying and selling of foreign currency. When a central bank buys foreign currency, it increases the demand for that currency and thus causes its exchange rate to appreciate. Conversely, when a central bank sells foreign currency, it decreases the demand for that currency and thus causes its exchange rate to depreciate.

The second step in analyzing the impact of central bank intervention on exchange rates is to consider the impact of the central bank’s monetary policy. Central banks typically use their monetary policy tools to influence the exchange rate of their currency. For example, a central bank may increase its interest rates to encourage foreign investors to purchase its currency, which in turn will cause the exchange rate of its currency to appreciate. Conversely, a central bank may reduce its interest rates to discourage foreign investors from purchasing its currency, which in turn will cause the exchange rate of its currency to depreciate.

The third step in analyzing the impact of central bank intervention on exchange rates is to consider the impact of the central bank’s foreign exchange reserves. Foreign exchange reserves are the foreign currencies that a central bank holds in its reserves. When a central bank increases its reserves of foreign currencies, it increases the demand for those currencies, which in turn causes their exchange rates to appreciate. Conversely, when a central bank decreases its reserves of foreign currencies, it decreases the demand for those currencies, which in turn causes their exchange rates to depreciate.

Finally, it is important to consider the impact of the central bank’s political objectives on its exchange rate intervention. Central banks are often influenced by political considerations when deciding to intervene in the foreign exchange market. For example, a central bank may intervene in the foreign exchange market to support its currency’s value if it is under pressure from its citizens or political parties to do so.

By considering the impact of central bank intervention on exchange rates from these four perspectives, it is possible to gain a better understanding of the effects of central bank intervention on exchange rates.

Conclusion

The Monetary Policy Worksheet Answers demonstrate that monetary policy is an important tool in influencing the economy. It can be used to help increase economic growth, reduce inflation, and control unemployment. Additionally, the answers show that the Federal Reserve has the ability to adjust the money supply to help control the economy, and that it can do this through the use of open market operations, direct lending, and changes in reserve requirements. Ultimately, monetary policy is an effective tool for managing the economy and is an important part of the overall economic picture.

[addtoany]