How to Use an Excel Checkbook Register Budget Worksheet to Track Your Finances

Tracking your finances is essential in managing your money and ensuring that you stay within your budget. An Excel checkbook register budget worksheet can provide an efficient and effective way to track your finances.

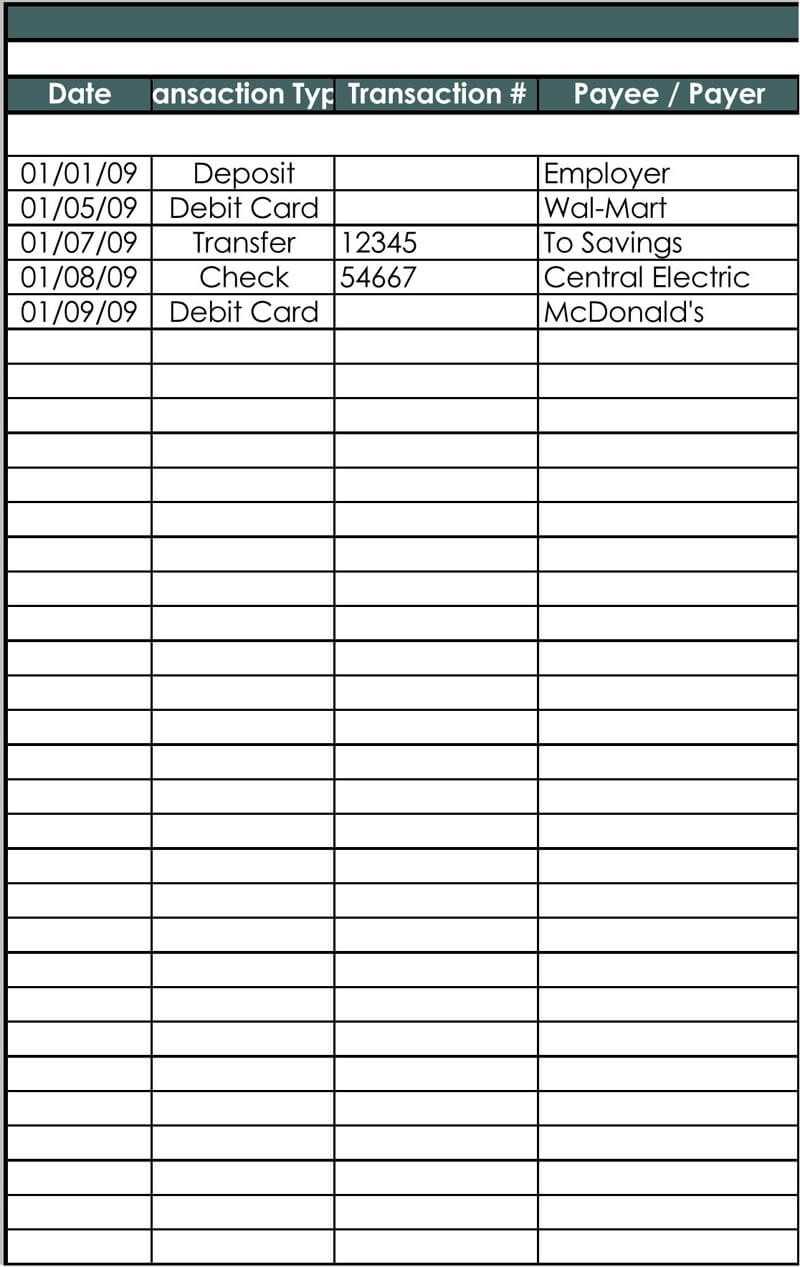

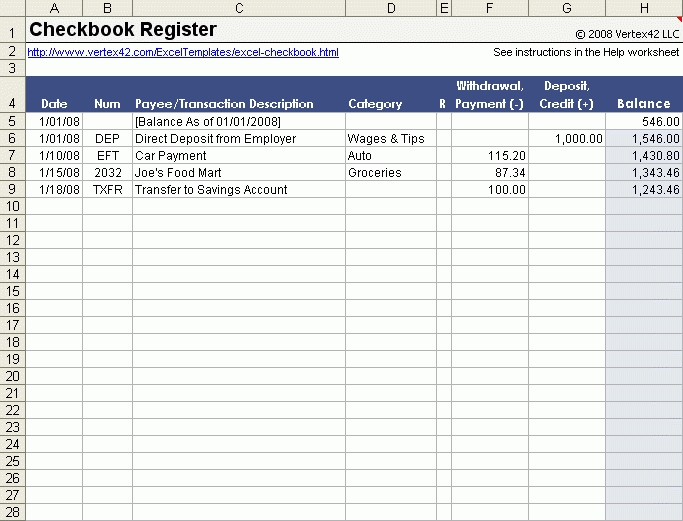

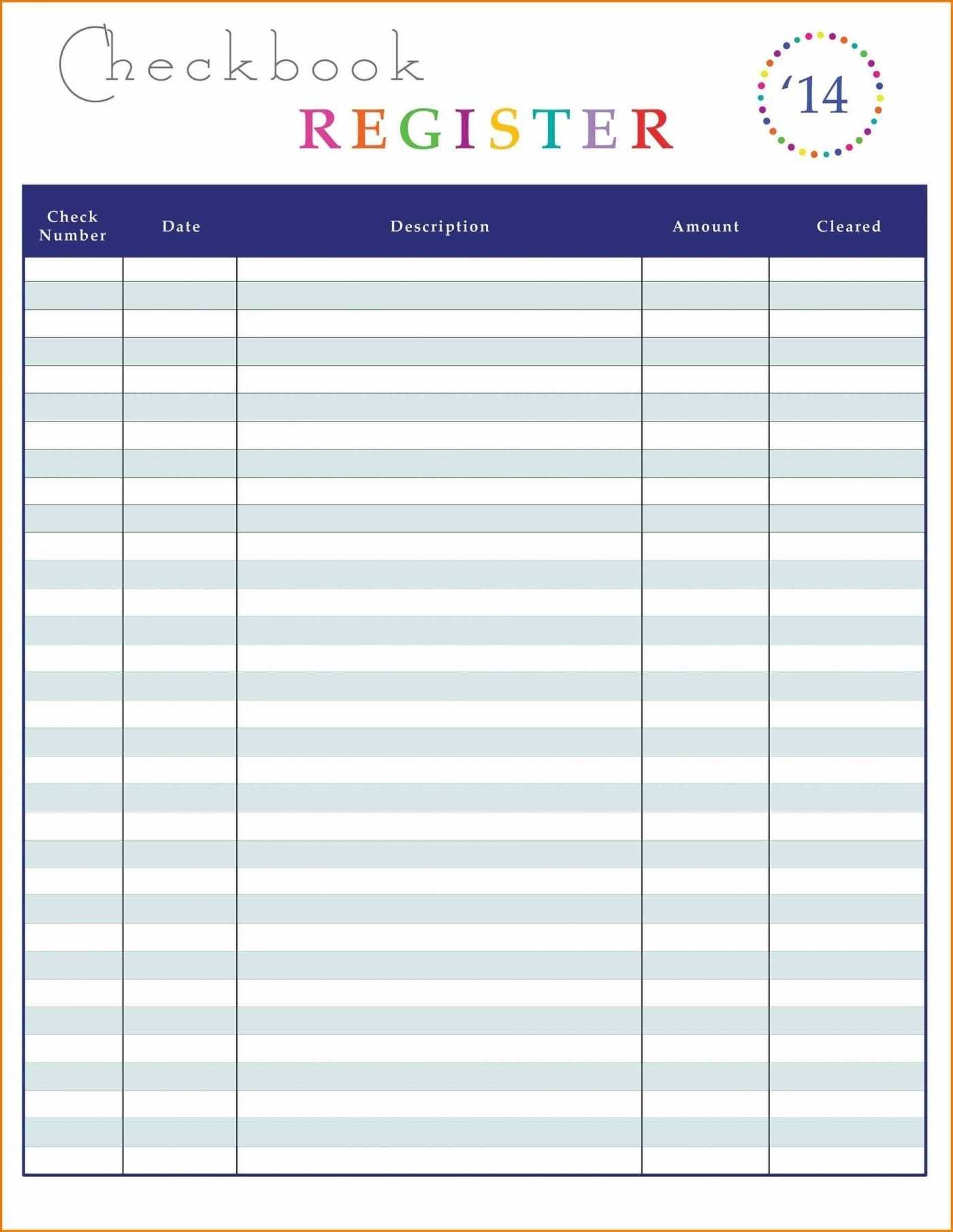

This type of spreadsheet is easy to use and set up. To get started, open a blank spreadsheet in Excel. Once the spreadsheet is open, you will need to create columns for each of the following categories: Date, Description, Check Number, Debit, Credit, and Balance.

The Date column should include the date of the transaction. The Description column should include a description of the transaction. The Check Number column should include the check number if applicable. The Debit column should include the amount spent from your account, and the Credit column should include the amount received into your account. The Balance column should show the remaining balance in your account.

[toc]

Once the columns are set up, the next step is to enter your financial transactions in the spreadsheet. Begin by entering the date, description, check number, debit, credit, and balance for each transaction. Be sure to enter the information in the correct columns.

As you enter each transaction, you will need to calculate the balance in your account. To do this, start by entering the opening balance at the top of the spreadsheet. Then, as you enter each transaction, subtract the amount of any debit entries and add the amount of any credit entries to the previous balance to calculate the new balance.

Once all of your transactions have been entered and the balances calculated, you can easily review your spending and income patterns over time. You can also view the balance in your account at any point in time by referring to the spreadsheet.

By using an Excel checkbook register budget worksheet to track your finances, you can easily manage your money and stay on top of your budget. This type of spreadsheet is simple to use and provides a convenient way to view and track your financial activities.

Tips to Create a Comprehensive and Accurate Excel Checkbook Register Budget Worksheet

1. Ensure that the Excel worksheet is properly formatted: Before creating a checkbook register budget worksheet in excel, it is important to ensure that the worksheet is properly formatted. This includes setting up the column headers, adding a title, and adjusting the column widths, font size, and text alignment.

2. Input all of your account information: When creating a checkbook register budget worksheet, it is important to include all of your account information. This includes inputting the name of the account, the account number, and the balance. Additionally, it is important to include the details of each transaction, such as the date, the amount, and any notes associated with the transaction.

3. Calculate your budget totals: Once all of your account information has been entered, it is necessary to calculate the total budget for each account. This can be done by adding up all of the transactions for each account and subtracting any fees or other costs that may have been incurred. Additionally, it is important to calculate the total budget across all accounts.

4. Create formulas to automate the process: To make the budgeting process easier, it is important to create formulas to automate certain calculations. This includes creating formulas to calculate the total budget for each account as well as for the total budget across all accounts. This will save time and ensure that the budgeting process is accurate.

5. Double-check your work: Before saving the checkbook register budget worksheet, it is important to double-check all of the information and calculations to ensure accuracy. This includes reviewing the totals for each account as well as the total budget across all accounts. Additionally, it is important to review all of the transactions to ensure that they are accurate and up-to-date.

Understanding the Benefits of an Excel Checkbook Register Budget Worksheet for Money Management

An Excel checkbook register budget worksheet is a useful tool for managing finances and tracking spending. The worksheet is designed to help individuals and businesses maintain a budget, monitor cash flow, and track spending. It can be used to create a budget and keep track of expenses, income, and savings.

The Excel checkbook register budget worksheet is easy to set up and use. It consists of a series of columns and rows that can be customized to fit the user’s specific needs. The columns include date, description, income, expenses, balance, and savings. The rows can be used to enter information such as purchase prices, payment amounts, and other relevant data.

The Excel checkbook register budget worksheet helps to keep track of money that is spent and received. It also helps to track expenses and income over a period of time. This can be helpful for budgeting and managing finances. The worksheet can be used to create a budget for the month and monitor spending and savings.

The Excel checkbook register budget worksheet can be used to track spending and income from multiple accounts. This allows users to easily compare and contrast expenses and income from different sources. Additionally, the worksheet can be used to set up budget goals and track progress.

The Excel checkbook register budget worksheet is an effective tool for money management. It provides an organized and easy way to track income and expenses and monitor cash flow over time. It can be used to create a budget, monitor spending, and track savings. It is an invaluable resource for individuals and businesses looking to manage their finances and stay on top of their finances.

Conclusion

The Excel Checkbook Register Budget Worksheet is an invaluable tool for anyone looking to stay on top of their finances. It provides a simple and easy to use way to track your expenses and income, budget for the future, and monitor your spending. With its simple, user-friendly interface, the Excel Checkbook Register Budget Worksheet is an invaluable resource for anyone looking to stay on top of their finances and plan for the future.

[addtoany]