How to Use a Checkbook Register Worksheet to Track Your Finances

Using a checkbook register worksheet is an excellent way to stay on top of your finances. This tool helps you track your expenses and ensure that you are keeping an accurate record of your income and spending. It also helps to identify any discrepancies in your financial records and can help you identify any areas where you may need to make changes.

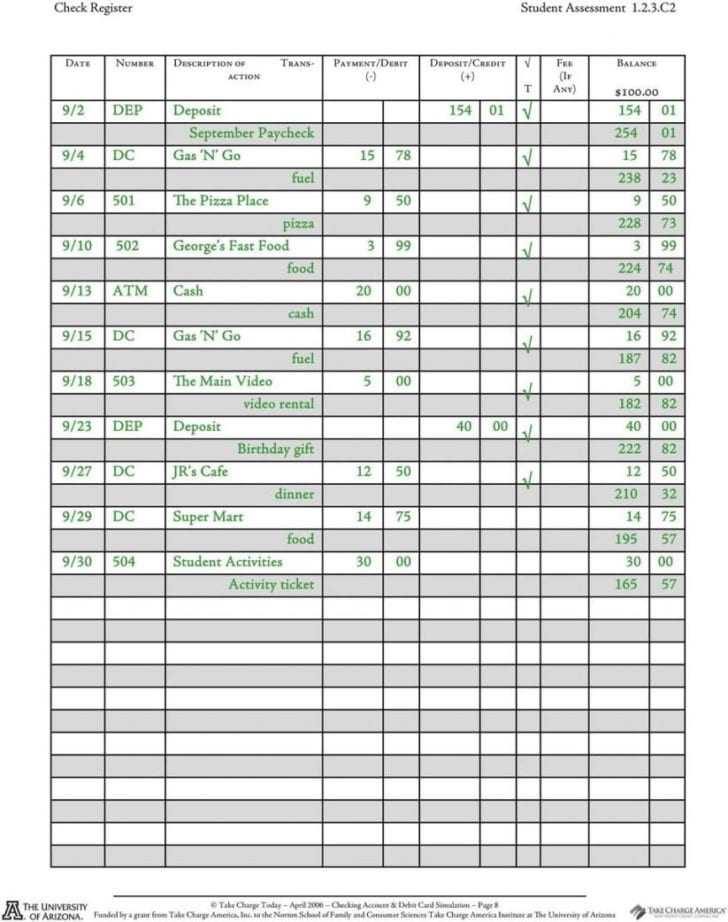

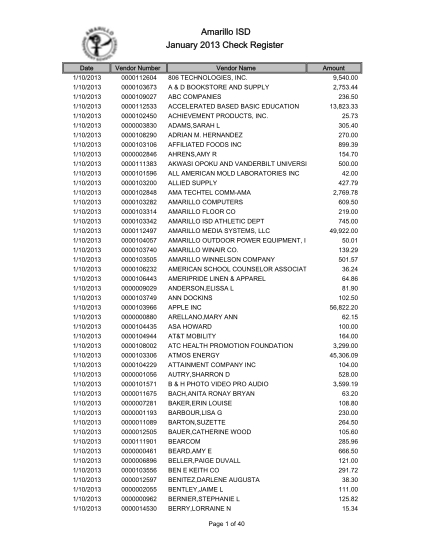

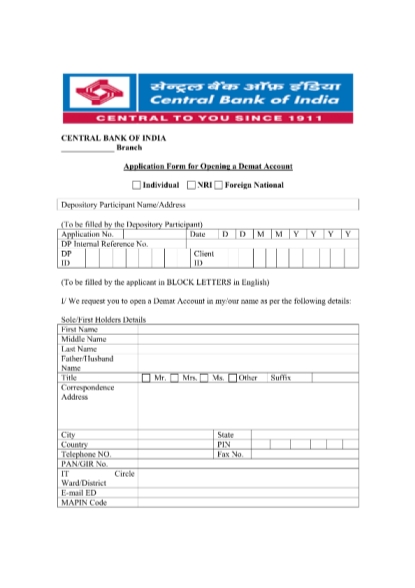

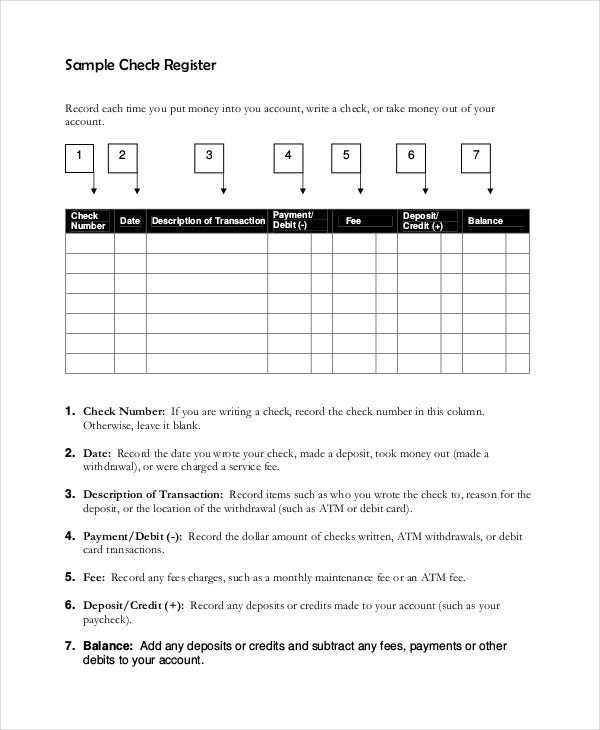

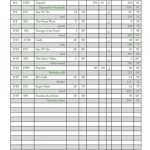

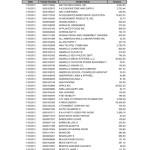

To use a checkbook register worksheet, begin by gathering all of your financial documents, including bank statements and credit card statements. Then, identify all of your transactions, including deposits, withdrawals, and payments. Once you have this information, enter each transaction into the worksheet. Include the date and amount of the transaction, as well as any additional information that may be necessary, such as the payee’s name, address, or account number.

After you have entered all of your transactions, take the time to review and compare your entries to the information in your financial documents. This will help you identify any discrepancies, such as a missing payment or an incorrect amount. If you identify any discrepancies, make the necessary corrections and update your worksheet.

[toc]

Finally, use the worksheet to track your spending and income in order to create a budget. This will help you ensure that you are spending within your means and that you are not overspending.

Using a checkbook register worksheet is a simple yet effective way to track your finances. By taking the time to review your information and update the worksheet regularly, you can ensure that you are staying on top of your finances and making the best financial decisions for yourself and your family.

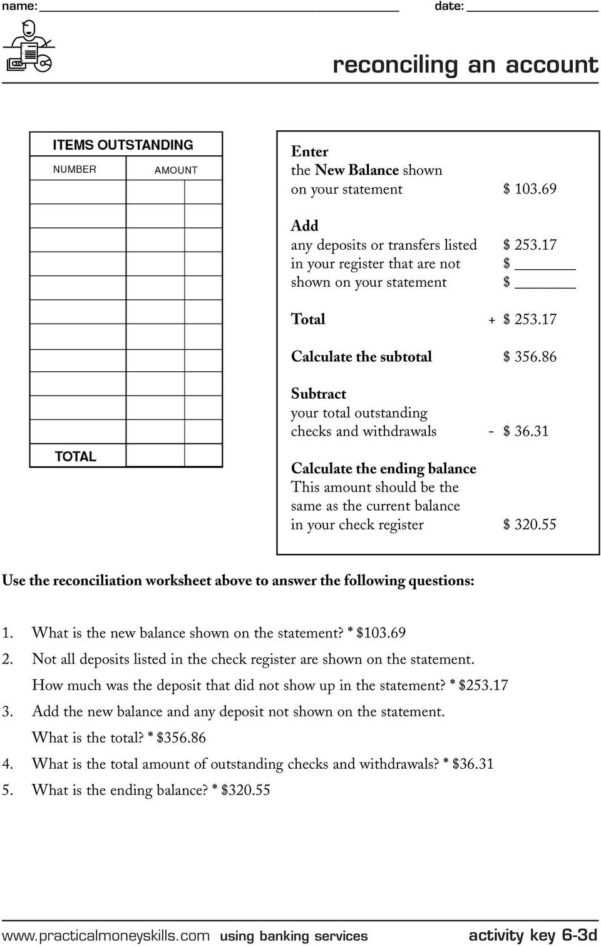

All You Need to Know About Reconciling Your Checkbook Register Worksheet

Checkbook reconciliation is essential to managing your finances. It helps you stay on top of your financial situation and helps to ensure that your bank account is accurate. Reconciling your checkbook register worksheet is a straightforward process that should be done regularly to ensure your financial records are accurate.

The first step in reconciling your checkbook register worksheet is to start with your most recent bank statement. Make sure that all of the checks, deposits, and other transactions that are listed in the statement match up with the information in your checkbook register. If there are any discrepancies, make sure to take note of them.

Once you have compared the information from your bank statement to your checkbook register, you can then begin to enter any transactions that are missing from your checkbook register into the appropriate columns. Any additional information that is needed to complete the reconciliation should be entered into the empty columns.

The next step is to total the deposits and withdrawals in your checkbook register and compare that amount to the balance listed on your bank statement. If the bank statement balance is greater than the amount listed on your checkbook register, then you need to make a deposit to your account to bring the balance back in line. If the balance is less than the amount listed on your checkbook register, then you need to make a withdrawal to bring the balance back in line.

Once you have made the necessary adjustments, you can then compare the ending balance on your bank statement to the ending balance on your checkbook register. If the ending balances are not the same, then you need to adjust the amount in your checkbook register to match the amount on your bank statement.

Finally, you need to sign off on the reconciliation. This is done by signing the reconciliation form and recording the date of completion. This will ensure that all of the information entered into the checkbook register is accurate and up-to-date. This will also help to ensure that you have a complete and accurate record of your financial history.

Reconciling your checkbook register worksheet is a simple but important process that should be done regularly. By following these steps, you can make sure that your financial records are accurate and that you are staying on top of your finances.

Tips for Making the Most of Your Checkbook Register Worksheet Answers

1. Read the instructions carefully: Before working on the checkbook register worksheet, it is important to read the instructions carefully to ensure that you understand what you are being asked to do. Pay close attention to information regarding formatting, calculations, and other details.

2. Double-check your work: After you have filled out the checkbook register worksheet, it is important to double-check your work. Make sure that all calculations are correct and that all entries are accurate. This will help you avoid any costly mistakes.

3. Track your spending: When using the checkbook register worksheet, it is important to track your spending. This will help you to monitor your budget and to see where your money is being spent.

4. Use budgeting tools: Use budgeting tools, such as a budget calculator, to help you stay on track with your finances. A budget calculator can help you figure out how much money you can afford to spend each month and help you determine how much you should be saving each month.

5. Organize your information: Keeping your information organized will help you stay on top of your finances. Organize your information by categories, such as bills, groceries, entertainment, and any other spending you may have. This will help you easily find the information you need when you need it.

6. Update regularly: Make sure to update your checkbook register worksheet on a regular basis. This will help you keep track of your financial activity and will allow you to see where you are spending your money.

Conclusion

The Checkbook Register Worksheet 1 Answers provide a great way to keep track of your finances. It is easy to use and understand, and can help you stay on top of your budget and avoid costly mistakes. By using this worksheet regularly, you can ensure that you are always aware of your financial situation and can make the best decisions for your finances.

[addtoany]