How to Use an Assets and Liabilities Worksheet to Manage Your Finances

An assets and liabilities worksheet is an important tool for managing your finances. It can help you understand your overall financial picture and provide a roadmap for making smart decisions about your money.

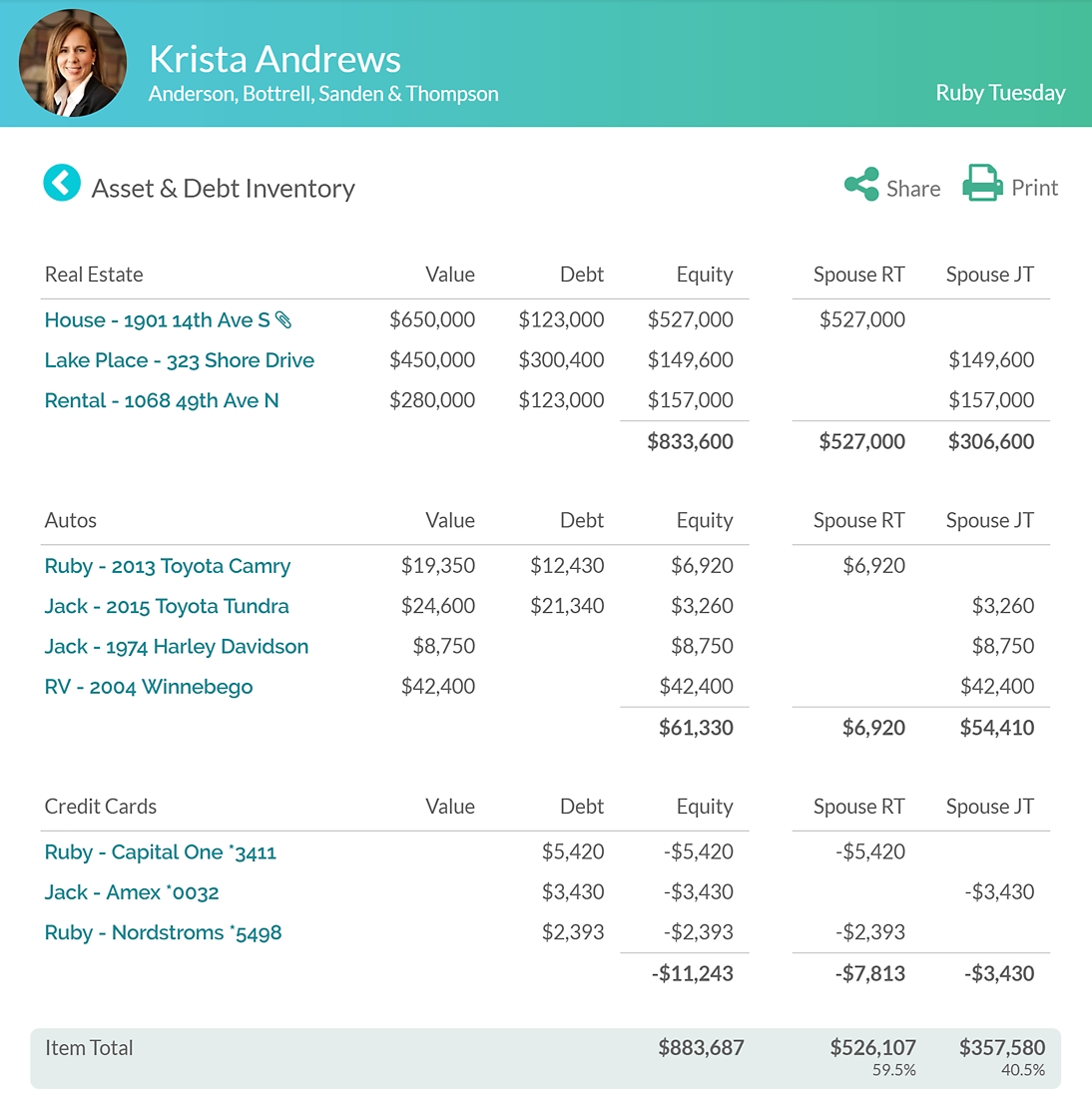

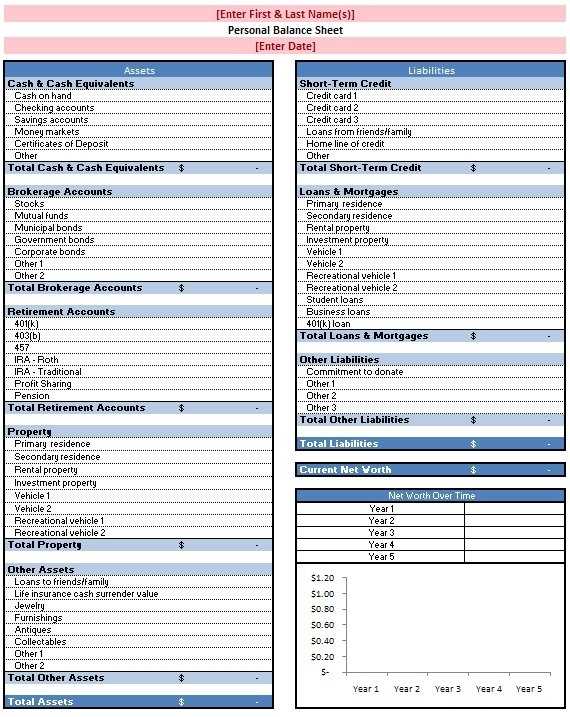

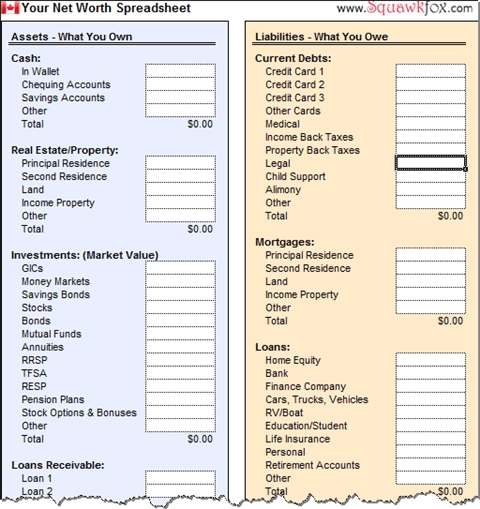

The first step in using an assets and liabilities worksheet is to record all of your assets and liabilities. Assets include any form of property that you own such as real estate, cars, stocks, bonds, and cash. Liabilities include money owed to creditors such as loans or credit card debt. Record the value or amount of each asset and liability on the worksheet.

Once all of your assets and liabilities are recorded, calculate the net worth of your finances. This is done by subtracting the total amount of liabilities from the total amount of assets. The resulting number is your net worth.

[toc]

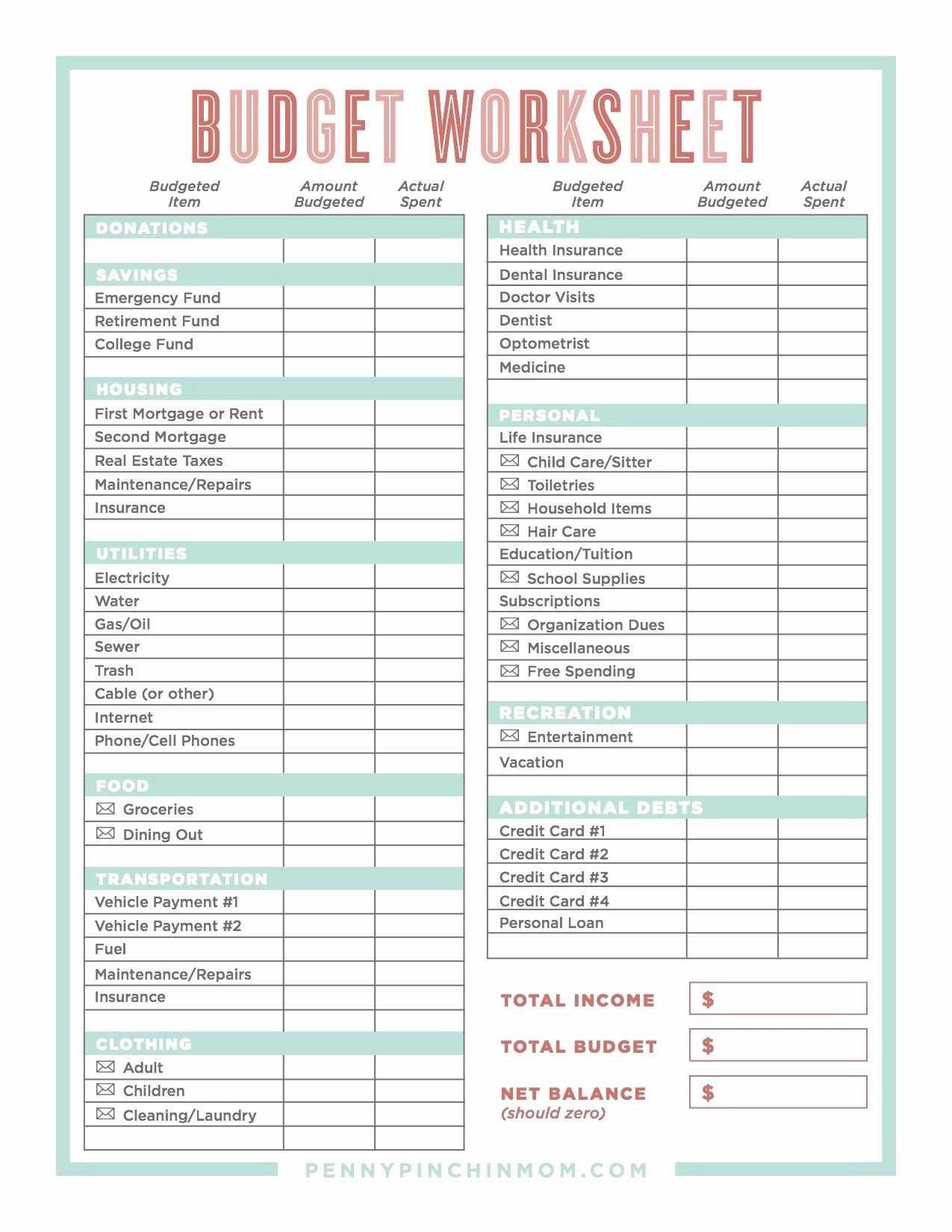

The next step is to review your finances and create a budget. This includes setting a spending limit and tracking your income and expenses. Make sure to include money that is saved for retirement, emergencies, or other long-term financial goals.

Finally, use the assets and liabilities worksheet to track your progress. Each month, compare your current net worth to the previous month’s. If it is higher, you are making progress. If it is lower, you may need to adjust your budget or look for ways to increase your income.

By using an assets and liabilities worksheet to manage your finances, you can get an accurate picture of your financial situation and make informed decisions about your money. It can also help you stay on track with your financial goals and ensure that you are doing everything you can to build your wealth.

Tips for Maximizing the Benefits of an Assets and Liabilities Worksheet

1. Start by gathering all of the necessary information. Gather up all of your bank statements, bills, and other financial documents that will provide a comprehensive picture of your assets and liabilities.

2. Create a comprehensive list. Take the time to list out all of your assets and liabilities in detail. This will help you get a better understanding of your financial situation.

3. Assign a value to each asset and liability. This will help you to determine the net value of your assets and liabilities.

4. Use a spreadsheet program to organize your data. Spreadsheet programs make it easy to organize and analyze your data.

5. Regularly update the worksheet. Make sure to update your worksheet whenever new information becomes available. This will help you to stay on top of your financial situation.

6. Consider consulting a financial advisor. If you’re feeling overwhelmed by the task of creating and managing an assets and liabilities worksheet, consider consulting a financial advisor. They can help you to make sense of your finances and provide advice on how to improve your financial situation.

7. Review your worksheet regularly. Take the time to periodically review your worksheet and ensure that the information is up-to-date. This will help you to stay on top of your financial situation and make sure that you’re making wise financial decisions.

Strategies for Understanding the Difference Between Assets and Liabilities on an Assets and Liabilities Worksheet

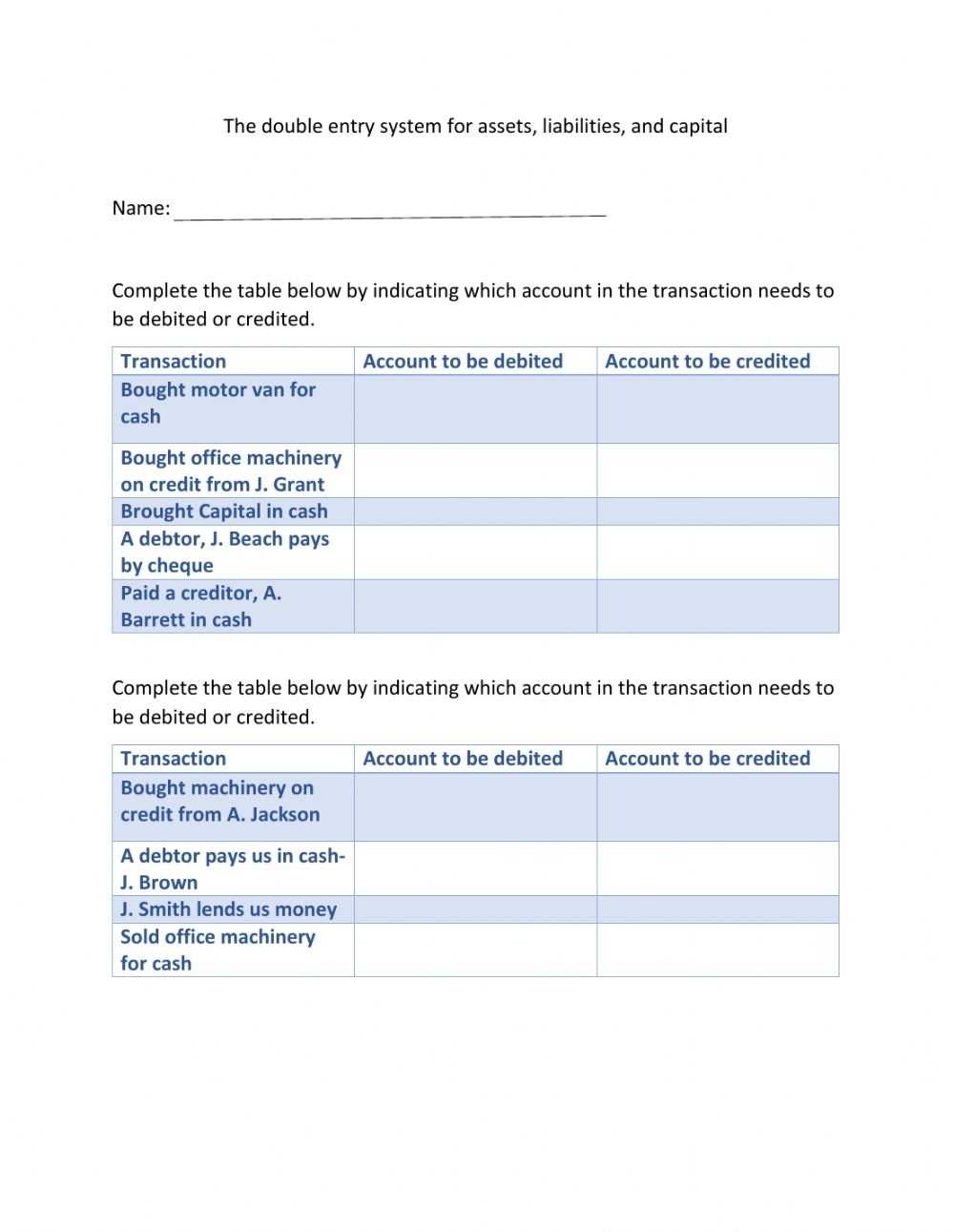

1. Understand the Definition of Each: Assets are items of value owned by an individual or company, while liabilities are debts or financial obligations owed by an individual or company.

2. Consider the Impact on Equity: Assets increase the equity of an individual or company, while liabilities reduce the equity.

3. Analyze the Flow of Funds: Assets represent the potential sources of funding, while liabilities represent the claims on those funds.

4. Identify the Source of Each: Assets are usually acquired through the receipt of money or other assets, while liabilities are usually created through the payment of money or other assets.

5. Consider the Risk Involved: Assets may increase or decrease in value, while liabilities remain the same except for the interest that accrues.

6. Reflect on the Cash Flow Impact: Assets generate cash flow, while liabilities consume cash flow.

7. Acknowledge the Time Value of Money: Assets may gain value over time, while liabilities must be paid off within a certain period of time.

Conclusion

The Assets and Liabilities Worksheet is a powerful tool for tracking and managing your financial situation. By taking the time to accurately enter your assets and liabilities, you will have a better understanding of your financial position and can make informed decisions moving forward. By using this worksheet, you can easily identify areas of improvement and opportunities for growth. With the right tools and dedication, you can take the necessary steps to improve your financial health.

[addtoany]